Trending Assets

Top investors this month

Trending Assets

Top investors this month

SLT Core Portfolio: Arista Networks ($ANET) - Data Driven Cloud Computing Network Pioneer Poised For Growth

ANET is another idea sourced using our Quality-Growth screener and has been as interesting as challenging to analyze. As always, any comment on this post would be much appreciated.

Thesis

- Real disruptor with technological competitive advantage benefitting from massive Cloud TAM with more opportunity on adjacencies.

- Technological leader with obsession to provide customers with better products and support than competitors. ANET’s business model allows the company to invest heavily in R&D while maintaining peer leading margins, to stay ahead of the competition and continue to gain market share over Cisco.

- The above is likely to drive a double digit growth for a company with above than competitors profitability and strong financial condition.

- Founders still have key executive responsibilities (development and technology) and established a strong culture, the Arista Way, with the customer being the central point. Best-in-class CEO with extensive networks experience and capital allocation skills. The company is leading its peer group in ESG with strong commitment to corporate responsibility.

- ANET’s valuation compared to Cisco and accounting for growth perspectives may appear attractive but absolute valuation is currently fair or even a bit overvalued. We will initiate a position when/if ANET’s stock price trades in the $100-$110 range.

Company Description

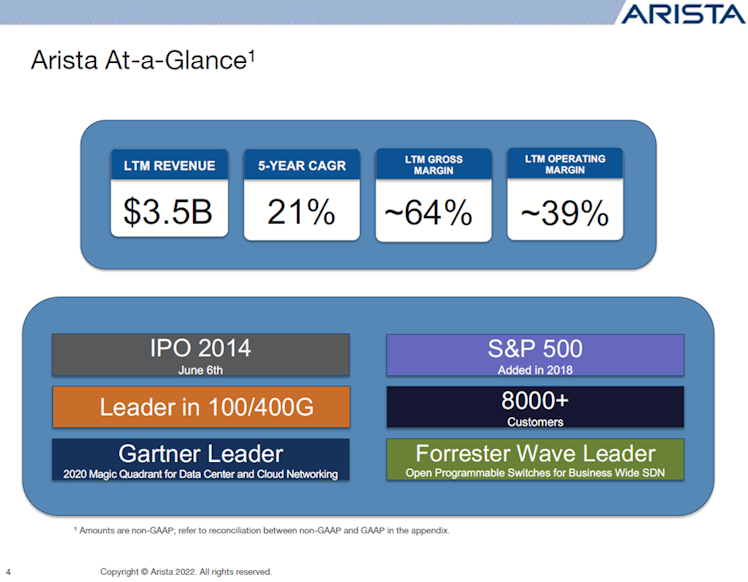

Arista Networks was founded in 2004 by industry luminaries Andy Bechtolsheim, Ken Duda and David Cheriton. The company is headquartered in Santa Clara, CA and has offices in Ireland, Canada, India, Australia, and the UK. It employs 3,000 people and has a market capitalization of $37bn.

ANET pioneered data-driven, cognitive cloud networking for large-scale data center and campus workspace environments. The company has developed a highly scalable cloud networking platform that uses software to address the needs of large-scale internet companies, cloud service providers, and large enterprises like financial services organizations, government agencies, media and entertainment companies, including virtualization, big data and low-latency applications.

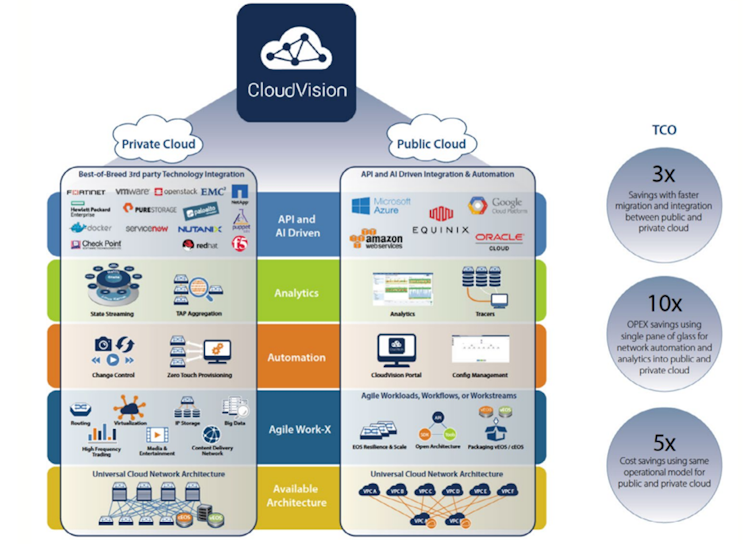

The core of the company's cloud networking platform is its Extensible Operating System (EOS) which runs on top of standard Linux and offers programmability at all layers of the stack. All of

ANET’s ethernet platforms run its EOS software and it supports such virtual networks as VMware NSX and Microsoft System Center.

Overall, around 80% of sales come from its products (hardware: switches, routers), while about 20% come from services (software). ANET’s offerings portfolio can be broken down into 3 main groups:

- Data Center and Cloud Networks (core): from 1G to 400G ethernet switches.

- Campus and Routing (cognitive adjacencies): PoE and spline switches, universal spine and leaf routing products.

- Network Software and Services: CloudVision (automation tool for configuration and management of networks), CloudEOS (virtualized/containerized version of EOS for hybrid multi-cloud networking), DMF (network monitoring, analytics, and recording, for capturing data inside the network), NDR Security (proactive network based ML technology to identify an attacker).

ANET contracts with US manufacturers Jabil Circuit, and Sanmina to make its routers and switches. Customers in the Americas account for nearly 75% of revenue. EAME region

accounts for over 15% and the Asia/Pacific region supplies some 10%. Products

are sold through a direct sales force and channel partners such as distributors, value-added resellers, system integrators, and OEMs. The company counts over 8,000 customers. ANET generates sales from Microsoft for over 10% of its revenue. ANET largest competitor is the giant Cisco.

Source: Arista Networks

Competitive Advantage

ANET is not simply a network company but rather an AI data-driven company that delivers its value through the network.

A True Disruptor: ANET has disrupted the market with two significant innovations. The company’s principle invention is an advanced network operating system, EOS, designed based on open standards to deliver high reliability and unique programmability at all system levels.

This approach is a large differentiator to legacy vendors who use multiple operating systems with numerous images to implement a siloed network. Managing these multiple software images with quality control testing or new features testing multiplies operational costs. ANET uses the same software version across all its network switches and routers, which improves reliability and reduces costs and complexity and makes software upgrades and maintenance simple, rapid, and automated.

ANET’s other key advantage resides in its ASIC (application-specific integrated circuit), a microchip designed for a special application, such as a particular kind of transmission protocols. While most of legacy providers spend lots of time and money making custom chips, ANET’s opted for the exclusive use of best-in-class merchant silicon ASICs. It refers to chips manufactured by providers like Intel or Broadcom for example. With this approach, the company eliminates the need to develop chips in-house which can be a long and costly process, and can allocate all of its resources to software development and extend its product differentiation. It also allows the company to bring new innovative products to the market faster in order to meet ever evolving client’s needs and demand.

More detail: https://www.youtube.com/watch?v=BSLK3Qi08gY

The company’s innovations mean real savings in total cost of ownership (TCO) for customers, who are trying to achieve cloud scale economics. The ANET product line offers dramatically lower datacenter CapEx compared to prior generation equipment. Leveraging merchant silicon, ANET switches offer high 10 GbE port density and power efficiency, with up to 96 ports per RU at under 2.5W per port. The two-tier, leaf-spine network architectures that ANET brought to market eliminate the cost and complexity of traditional three-tier designs. Reducing the footprint and power utilization of network switches means that every rack can support more servers and storage.

ANET’s competitive advantage is the result of its “Five A’s” architecture, as illustrated below.

Source: Arista Networks

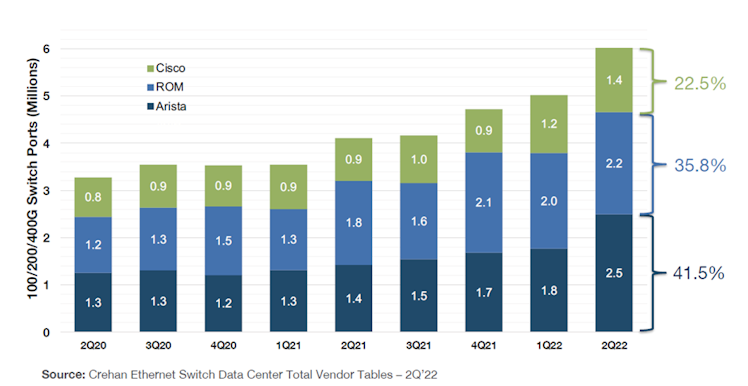

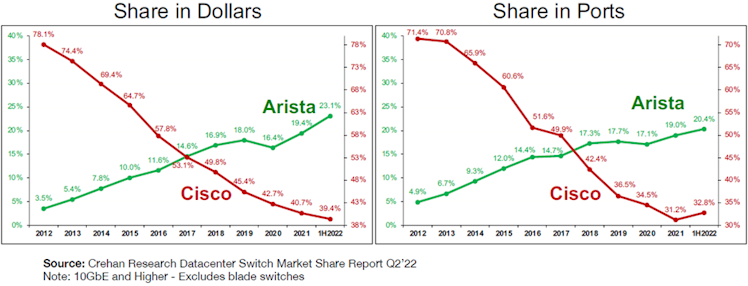

Based on all the above innovations, ANET became, over the years, a leader in high speed switches. As of Q2 2022, 41.5% of 100/200/400G switch ports installed in data centers are ANET’s products vs. 22.5% for Cisco.

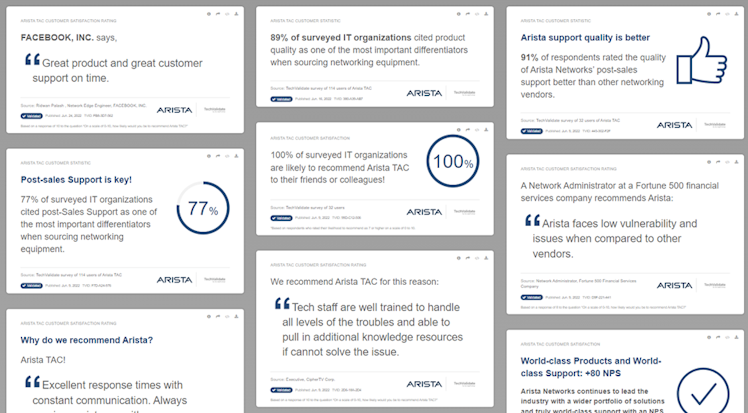

While performing some research on the company, we came along a lot of articles or comments on social network emphasizing and promoting the support quality compared to Cisco. We decided to dig a little bit deeper and it is effectively confirmed by the company’s TechFacts established by TechValidate.

ANET’s products and customer obsessions have resulted in rapid market share gain over the biggest competitor and giant Cisco.

For more information with regards to ANET's competitive advantage, especially regarding the

use of AI and the development of a full-stack solution, we’d recommend the following video of Zeus Kerravala, founder and network analyst at ZK Research: https://www.youtube.com/watch?v=4wYLcvVHei8&t=12s

Sustainable growth

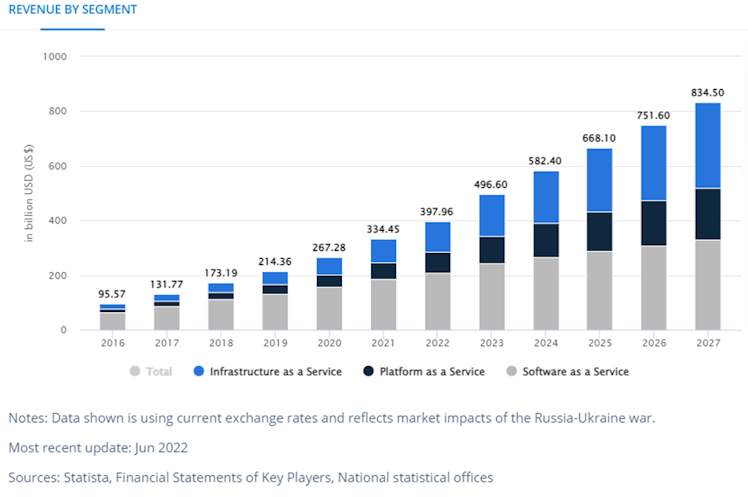

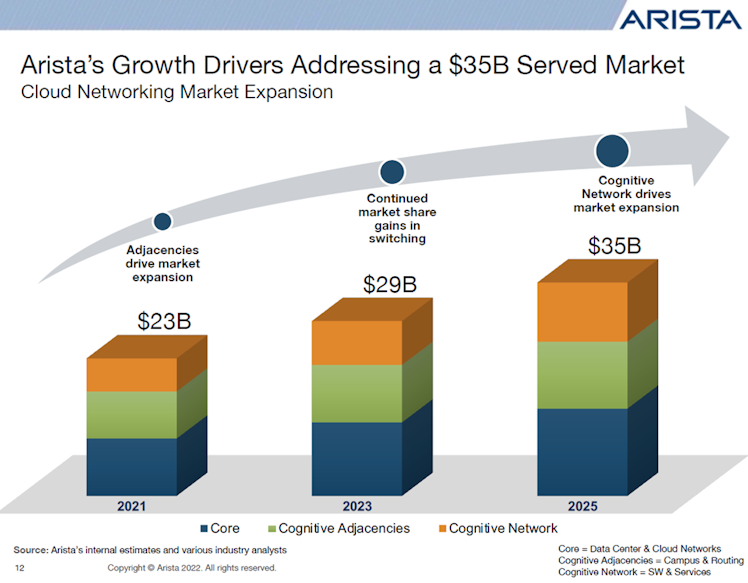

Cloud Data Center: ANET is ideally positioned to benefit from key secular trends driving the global cloud network market such as digital transformation, IoT, 5G and AI, among others. Below is a chart we found particularly interesting as it breaks down the cloud expected revenue into 3 different categories, especially with infrastructure and SaaS (where ANET

operates) representing the largest markets. Revenue is expected to show an annual growth rate (CAGR 2022-2027) of 15.97%, resulting in a total market of $834.60bn by 2027. It should be no surprise to investors now that public cloud TAM is set to grow at an accelerated rate over the next decade with the potential to reach $2tn in the long-term.

If we take a closer look at a sub-group, the datacenter switching market, the latter is expected to grow at an 8% CAGR until 2025. As seen previously, ANET is gaining market share in the higher speed switching segment (100G/200G/400G) and as per IDC/Bloomberg, this segment

is likely to significantly outpace the market, growing at 95% CAGR. By 2025, 200G/400G witches will make up about 40% of the total market (by revenue).

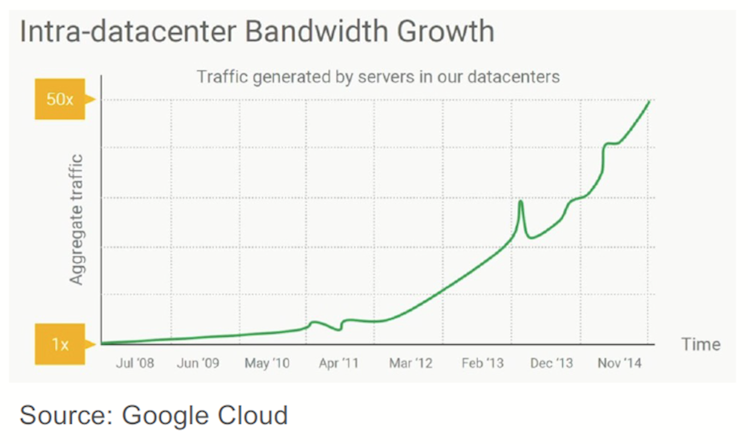

The digital transformation operated during and continued after the Covid-19 pandemic, combined with all the aforementioned key secular trends fueled intra-datacenter bandwidth growth. The below chart is a perfect example in Google Cloud datacenters.

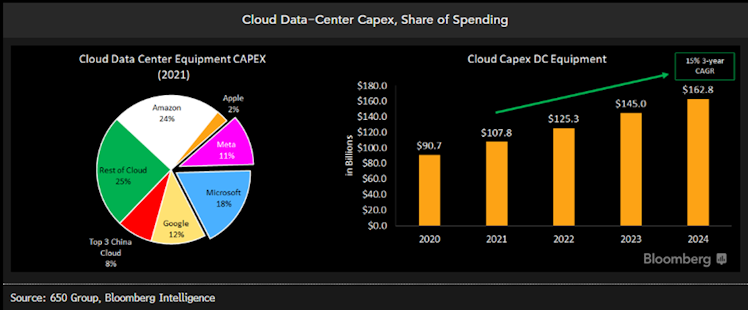

The top-five US cloud providers accounted for two-thirds of hyperscale data-center equipment spending in 2021, with Microsoft and Meta (both ANET clients) making up almost 30%.

To keep up with increasing demand, such expenditures are forecasted to expand at a 15% clip from 2021 to $163bn in 2024, according to 650 Group. ANET’s 100/200/400G switching products cycle align well with cloud's spending uptick.

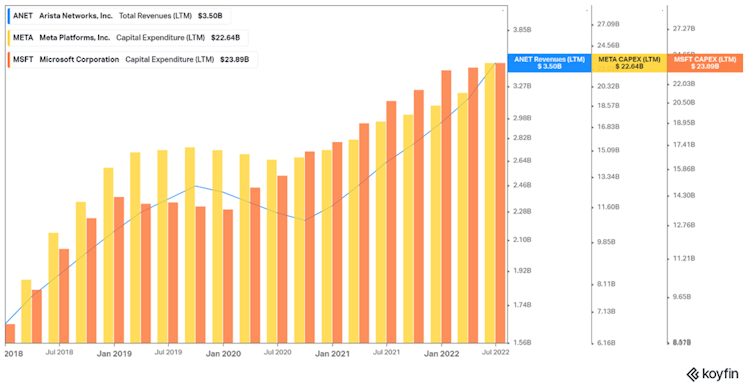

Why it matters? As explicitly showed in the below chart, ANET’s revenue is closely correlated with top cloud providers capital expenditure, taking clients like MSFT and META as an example.

Cognitive Adjacencies: ANET's campus opportunity offers another leg of growth and potential TAM expansion, especially given the company’s low estimated 2% share of the combined $22bn campus-switching and enterprise Wi-Fi markets.

To conclude, the company estimates it will serve a $35bn cloud networking market inside this massive global cloud TAM.

Financials

Source: ANET's filings, SLT Research

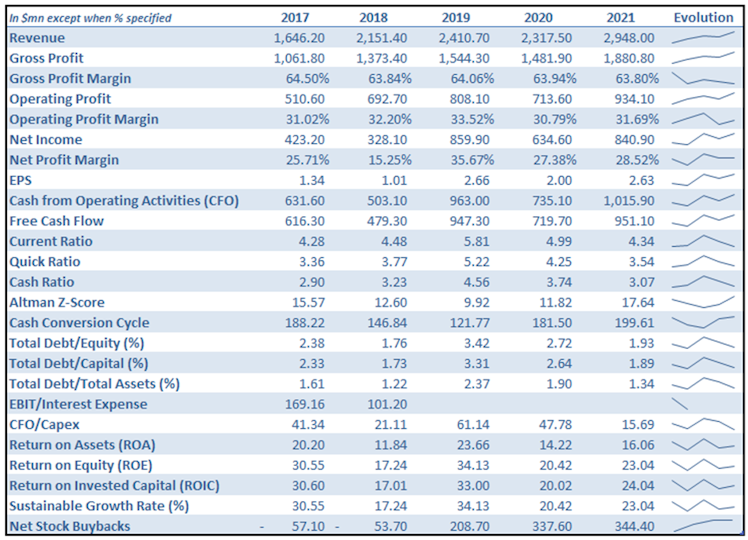

Income Statement: ANET's revenue has been rising in each of the last five years with an

exception in 2020, at an overall rate of 79% between 2017 and 2021. The company's revenue in 2021 was a little bit shy of $3bn, a 27% increase from the previous year's revenue of $2.3bn.

Total revenue is a combination of product (hardware) and services revenue. The former increased by $546.9mn (30%) in 2021 compared to 2020, to reach 2.38bn (80.7% of total revenue). It can be explained by stronger demand for ANET’s products from new and existing customers and broader market acceptance of enterprise and campus products.

Despite swift revenue increase, supply-chain disruptions, and inflationary pressure caused by the Covid-19 pandemic, both gross and operating profit margins remained stable around the mid-60s and 30% respectively. It is confirmed with a LTM gross margin of 62.8% and operating profit margin of 32.5%. Even if operating profit margin has been relatively stable, we are

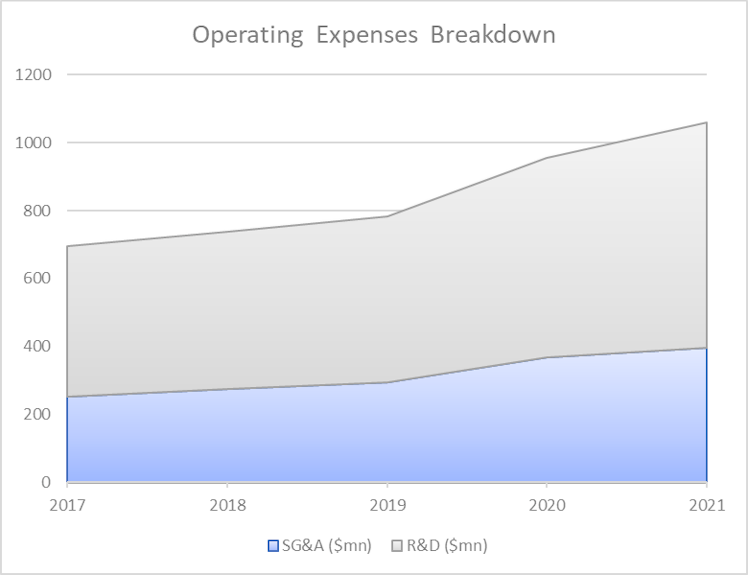

particularly interested in understanding what composes operating expenses and in seeing if each item also experienced low volatility as a percentage of total revenue.

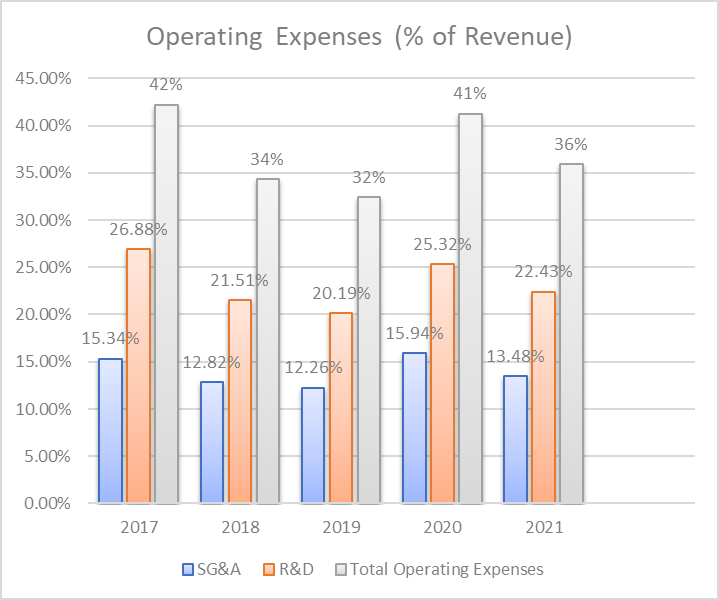

Source: ANET's filings, SLT Research

We can directly observe that R&D’s allocation of operating expenses is roughly twice as important as SG&A. Given ANET’s key secular trends opportunity and the exponential rate of adoption of these trends, R&D is key for ANET to compete and continue gaining market share.

Management comments about R&D (Annual Report 2021):

- “Our research and development efforts are focused on new product development and maintaining and developing additional functionality for our existing products, including new releases and upgrades to our EOS software and applications. We expect our R&D expenses to increase in absolute dollars as we continue to invest in software development in order to expand the capabilities of our cloud networking platform, introduce new products and features, and continue to invest in our technology.”

Source: ANET's filings, SLT Research

If we delve a little bit deeper, operating expenses oscillated within a range of 10% between 42% and 32%. Using information in the above chart we clearly see that SG&A expenses have been relatively stable over the period. R&D expenses have been as high as 26.88% of total revenue ($442.5mn) in 2017. Over the last 5 years, ANET constantly committed more than 20% of its revenue to R&D while maintaining an operating profit margin of more than 30%.

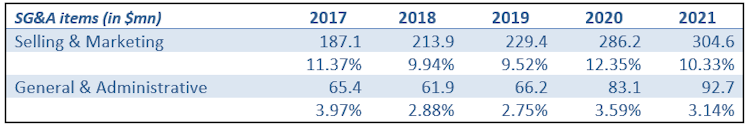

SG&A expenses can be broken down as follows:

Source: ANET's filings, SLT Research

Almost all the operating profit is transposed into the net profit due to the fact that ANET’s use of debt is close to 0. In 2021, the company posted a net income of $840.9mn, a c.100% increase from 2017. LTM net income breaches the $1bn milestone (29.55% net income margin).

Balance Sheet: ANET balance sheet is very sound. From a liquidity point of view, current assets represent 4.34x current liabilities. The company's cash and cash equivalents as of Q2 2022 was $2.9bn.

From a solvability perspective, ANET level of debt is almost not existent. Total debt represents less than 2% of total assets and total equity. Logically, the Altman’s Z-Score has been constantly above or around 10 over the covered period and implies a probability of bankruptcy of 0.

Cash Flow Statement: Operating activities generated more than $1bn in 2021. Non cash items

such as depreciation & amortization, and change in non-cash working capital did not significantly contributed to CFO. However, SBC added $186.9mn to CFO, representing c.20% of the later. Adjusted from SBC, CFO was $829mn, in line with net income ($840.9mn).

Investing activities used $925.6 million, mainly for purchases of marketable securities (LT investment). Financing activities used another $360.9 million, primarily for repurchase of common stock.

FCF was more than $950mn and given current stock price it represents a FCF yield slightly above 2.5%.

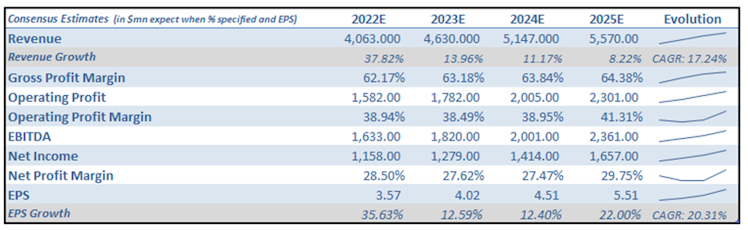

- Outlook

Looking forward now and based on consensus estimates, revenue is expected to grow at a 17.24% CAGR from 2021 to 2025E and exceed $5.5bn. Gross profit margin is set to remain stable during the period. However, while outsized growth in (lower margin) cloud titans revenue hasn’t allowed the company to improve margins, the company could start to see the

benefits from recent positive pricing actions and it could be fair to anticipate higher margins.

With continued share buyback programs, and slightly improving margins, consensus estimates

forecast EPS to grow at a faster pace than revenue. Given current share price, 2025E EPS represents a more than 5% earnings yield.

Source: Bloomberg, SLT Research

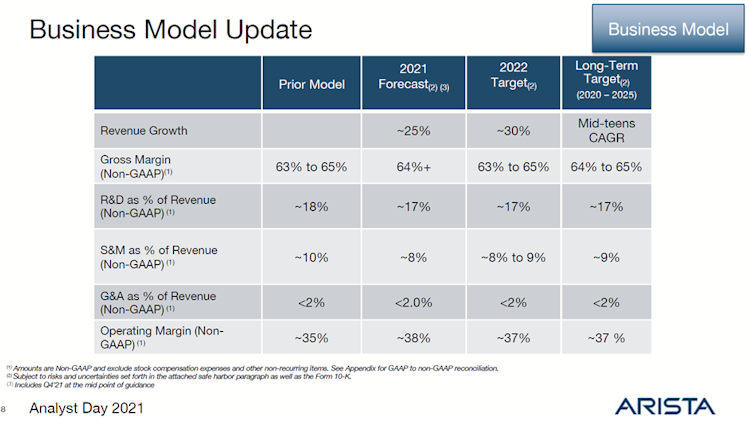

To complement consensus estimates, below is ANET’s long-term business model target.

Source: ANET's Analyst Day 2021.

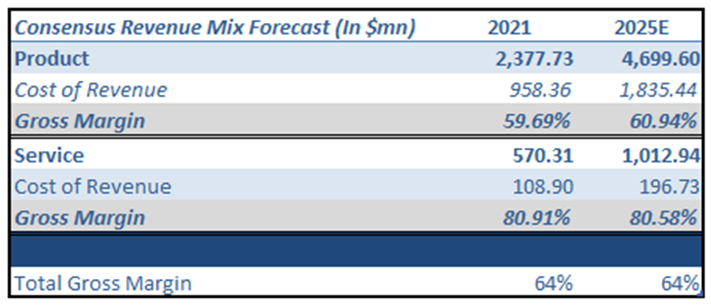

- Revenue Mix Forecast – 2021 vs. 2025E:

Source: Bloomberg, SLT Research

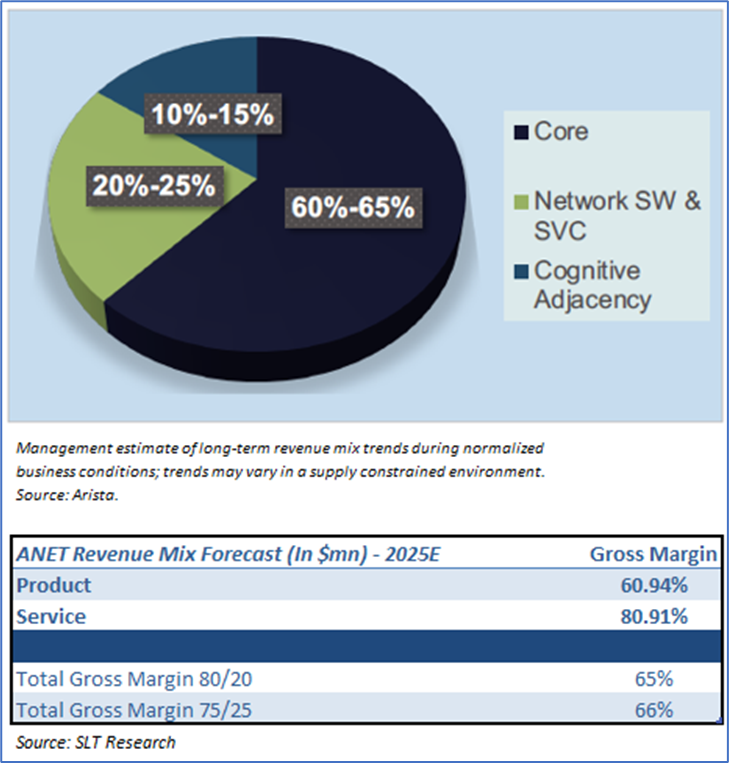

As implied by a constant forecasted gross margin, consensus expects ANET’s revenue mix to be relatively similar 4 years from now. However, and since the company provided us with its long-term revenue mix targets, we wanted to perform the same exercise using ANET’s targets.

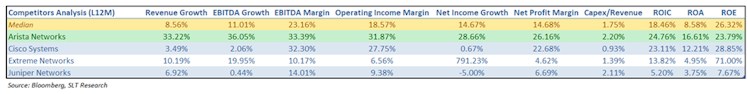

- Competitive Analysis

The list of main competitors has been directly taken from ANET’s 10K filing.

ANET enjoys a significantly higher than peer group growth and margin profile. We can clearly

observe ANET higher margins profile resulting in a better profitability. ROE is slightly lower but we need to recall that ANET uses a very low amount of debt (median total debt / total assets of 16.17% vs. only 1.34% for ANET) and hence has a low leverage ratio. With similar capital than competitors, the company would post an above median ROE. The last observation is directly demonstrated by a ROA 2x superior than median, which factors in competitors debt.

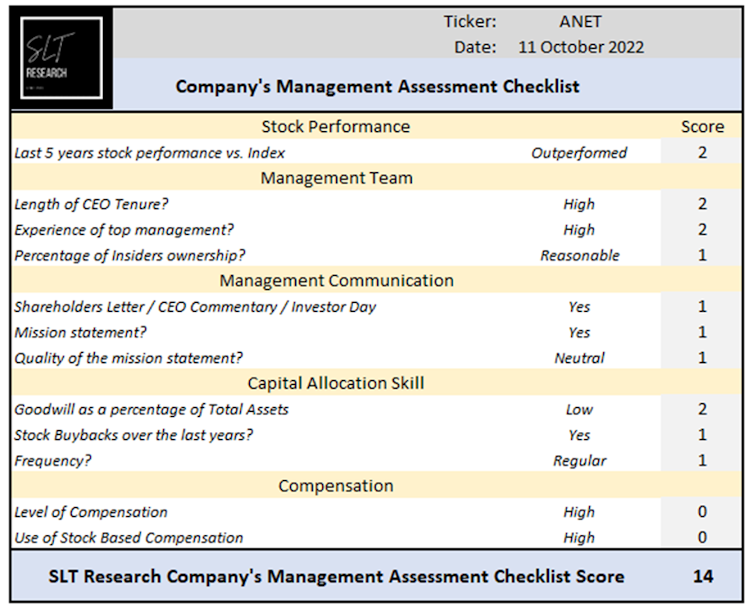

Management and ESG Considerations

Over the last 5 years, the stock returned 122% vs. 40% and 97% for the S&P500 and the S&P500 Information Technology Sector Index respectively.

ANET’s management and engineering team consists of networking veterans with extensive data center and campus networking expertise. Jayshree Ullal, CEO, has over 30 years of networking expertise from silicon to systems companies. Prior to joining ANET 14 years

ago, she was a senior VP in charge of data center at Cisco. Andy Bechtolsheim, co-founder

and CDO, was previously a founder and chief system architect at Sun Microsystems. He is also chairs the board of directors. Ken Duda, co-founder and CTO, led the software development effort of EOS.

We specifically appreciate that top executives are mainly composed of founders who are still involved in the technical and operational development of ANET. Almost 25% of the company is

held by insiders.

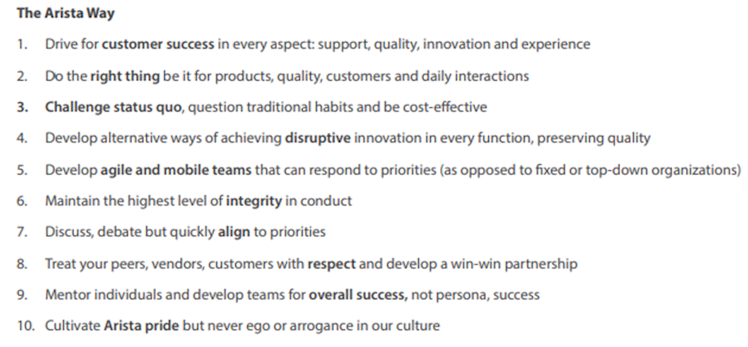

Management insured a strong and unique culture: The Arista Way.

Source: Arista Networks

We particurly like ANET’s focus on customer quality as demonstrated by the following quote from the co-founder Ken Duda:

- “Quality is THE most important attribute of our product. Not one-of-the-most-important, but the-most-import ant attribute. Because you know why, if networks ain’t working, ain’t nothing working”.

Source: Arista Networks

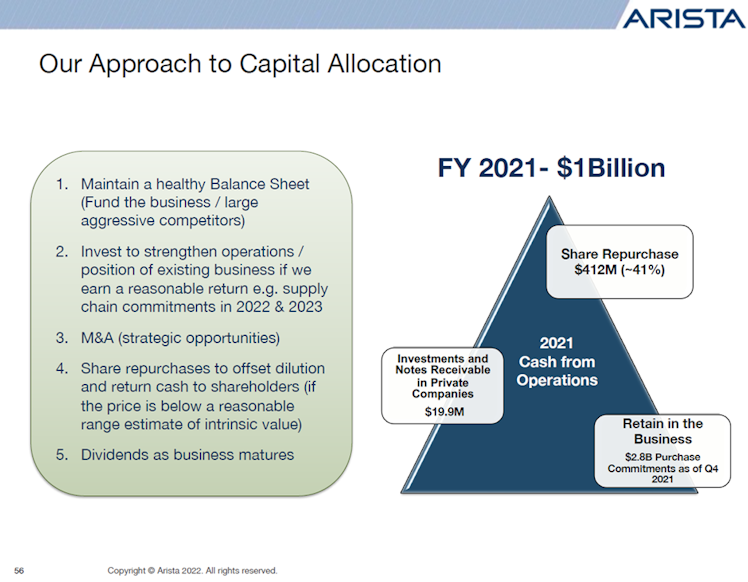

ANET’s approach to capital allocation is everything we look for in a company at SLT Research. The company acquired 5 companies over the last 5 years and despite being relatively active on the M&A front, goodwill represents a fairly small amount of total assets. Key acquisitions enabled ANET to develop the software segment and deliver a qualitative full-stack product. It includes Awake Security (acquired in October 2020), a network detection and response (NDR) platform, which combines AI with human expertise to autonomously hunt and respond to insider and external threats while providing triage digital forensics and incident responses cross campus, datacenter and IoT. ANET also acquired Big Switch Networks earlier in 2020.

This, along with the company's existing DANZ (Data ANalyZer) capabilities, led to the introduction of DMF (DANZ Monitoring Fabric), a network observability software across switching platforms that gives customers enterprise-wide traffic visibility and contextual insights.

Share repurchase is a significant use of cash from operations from the management and the favorite tool currently used to enhance shareholder’s return. The company repurchased close to $900mn worth of stock over the last three fiscal years and around the same amount solely in the LTM. Let’s now dig a bit deeper and analyze if the management delivered on the “if the price is below a reasonable range estimate of intrinsic value” statement mentioned in

the above slide.

Source: Bloomberg

The chart is telling us that despite announcing shares buyback programs at higher prices, the execution of the latter was good. The two observable spikes in red show that management repurchased shares mainly after stock price declines, especially in 2020 where the market price was still lower than 2019 highs and even more significantly in July 2022 after a -35% drop YTD.

ESG: the company is a leading its group and above media regarding Environmental and Social matters respectively (Bloomberg ESG Scores).

Source: Arista Networks

Valuation

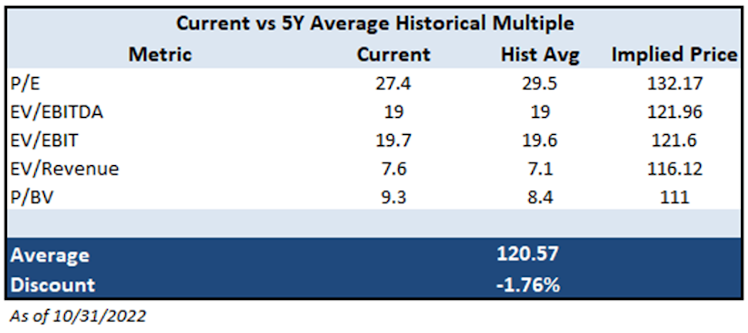

Source: SLT Research

The company is currently fairly priced compared to the above 5 years average multiples. The stock price dropped c.15% YTD and was trading at a multiple of 41.23x earnings at the end of 2022. The current valuation appears to be more reasonable but the company still not undervalued. Compared to Cisco, the company trades at a significant premium, slightly higher than the 5 years historical premium.

We decided to take a closer look at relative multiples after having accounted for earnings growth perspective, and to use the PEG ratio, simply the PE ratio divided by the growth rate of expected earnings for next 5 years. ANET’s PEG ratio is 1.21, significantly lower than Cisco’s

(1.91), meaning that if we take growth profile of both companies into consideration, ANET actually appears more attractive than its competitor.

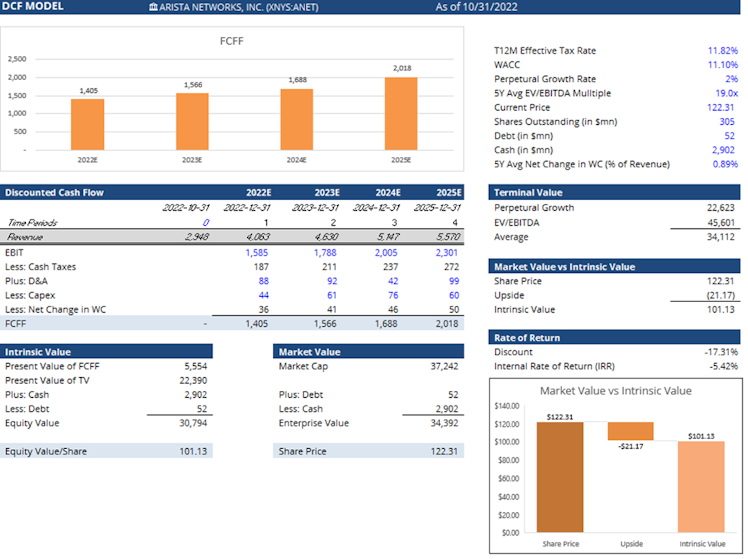

To supplement the multiples based valuation, we decided to run a DCF model to assess ANET’s intrinsic value, using consensus estimates to calculate the next 4 year FCFFs.

Source: SLT Research

Our calculation implies a c.17% premium to intrinsic value which is not consistent with the fair valuation assessment using historical multiples. It is important to mention that shares of the company surged 22% over the last 15 days.

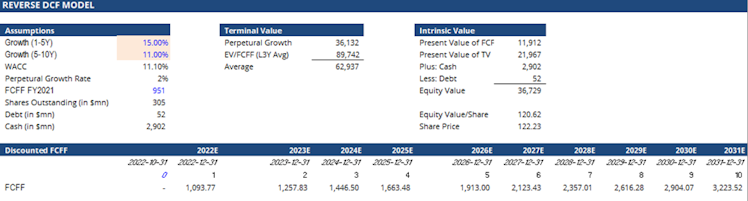

At SLT, we are following a disciplined investment process especially regarding the fundamental analysis part but we are constantly looking for improvement and this is why we decided to included the reverse DCF model valuation methodology as much as possible going forward.

Source: SLT Research

FCFF grew 34.46x over the last 10 years. While we are not expecting the same growth going forward, implied FCFF growth rates of 15% for the next 5 years, 11% for the following 5 years and 2% thereafter do not seem disproportionate to us especially given the numerous secular trends the company is likely to benefit from.

As an indication, consensus expects ANET’s FCF to grow by 15.66% CAGR until 2025E, and hence we can conclude that, using this method, shares are actually fairly valued.

Risks

Key risks for us include:

- Core business has a high correlation with the cloud titans hyperscale CapEx, any slowdown in datacenter expenses from big Cloud provider could hindered ANET revenue growth. Given current premium vs. peers, lower guidance could result in important stock price swings.

- Cisco: the giant has deep pockets and the ability to win business at seemingly irrational prices. Cisco has the financial strength to heavily pressure Arista and to aggressively defend its turf.

We hope you enjoyed reading our analysis, please don't hesitate to upvote and/or to give us your thoughts in a comment!

Disclaimer: The information provided in this post is for information only and solely on the basis that you will make your own investment decisions after having performed appropriate due diligence.

YouTube

Arista's Disruptive Innovation - 2021 Analyst Perspective

Already have an account?