Trending Assets

Top investors this month

Trending Assets

Top investors this month

Detaching the crowds

I published an article that was extremely interesting to produce. I believe the result was decent for what I tried to express, hope you enjoy it!

Throughout 2023, in numerous occasions we’ve touched the point of thinking probabilistically. As early as November of last year the concept was introduced to this newsletter and reiterated as I exposed myself to investors who thought of it as a valid approach to investing. I then came across Buffett letters. In them, Warren explains why the sole fact of thinking is a core part of his investing strategy. We expanded on this point in multiple times, but I always felt there was something missing.

In early April, I listened to a podcast Leandro did, in which he interviews Francois Rochon, founder of Giverny Capital. Their exchange of views and opinions really helped me continue placing pieces in this dark mental model we’ve been trying to build here. In the interview, Leandro asks about a particular idea/theory Francois has that really fascinated me, the tribal gene.

Francois has a long record in the investing business and, as decades went by, he had an interesting observation that then turned into this theory. He believes that in the genetic configuration of most (95%) humans there’s this particular gene, which he refers to as ‘tribal gene’.

The name derives from a very ancient form of society configuration, tribes. Within them, there was a strong incentive of following what your colleges said because, the price you could pay for not reacting rapidly and in accordance to them, was high. This means that, if they called something, you followed, if they ran, you ran.

After exposing himself to people’s thoughts, writings, ideas, etc, I suppose, Francois got to realize that the number of people that had this gene embedded in their very nature was extremely high. In any case, he believes that people who have this gene will very unlikely manage to beat the index. Then I remembered a particular chart.

I was completely amazed by the theory, but not because of the hypothesis itself, but because of something Francois pointed out after:

“So they're able to think differently”

And that triggered the connections. That was the fundamental stone that brought Buffett to my mind and allowed me to identify this same foundation in multiple ideas from thinkers I respect. I immediately remembered listening to a conference Peter Thiel gave in which he talked about this.

When asked why or how was he capable of being a contrarian thinker, Peter responded alluding to the following. He realized that human beings are wired for imitation. Since we are born, we are designed to copy everyone and everything around us. That’s how we learn our culture, our values, how to speak and almost everything. Even schools are made to enhance this pattern.

Then I had to go a few months back, to a university class I attended. In it, we covered the ideas Robert Cialdini, a psychology author whom Charly Munger highly recommends reading, shared in his book ‘Influence’. The book is about a series of principles that attempt to explain how human beings influence and persuade others. One of these principles is called ‘social proof’.

Social proof also refers to the idea that people are more likely to follow the actions of others when they are uncertain about what to do or how to behave in particular situations. This concept has been thoroughly researched by psychologists and there’s strong evidence to believe it’s true.

In conclusion, there are many people that have had ideas and theories alike. Each of these has been based on facts, research, observations, psychology and biology. It would be more than reasonable to assume that it takes a very peculiar mindset or biological configuration to escape a recursive pattern of behavior we’ve predicated since our birth.

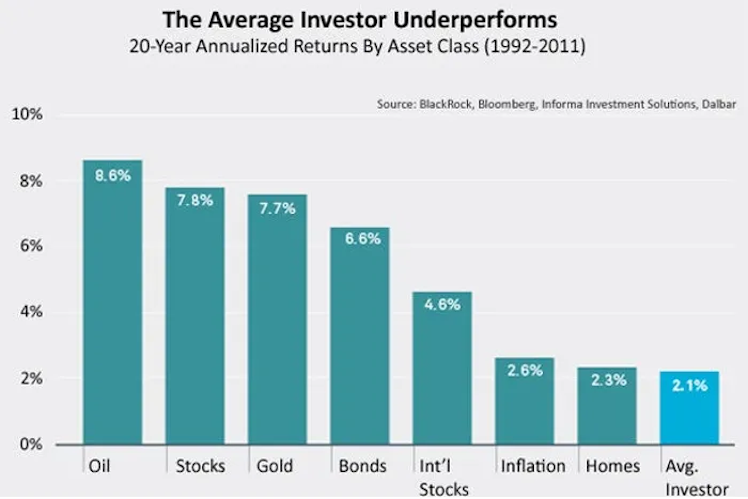

Data finds that over 85% of fund managers and over 90% of individual investors underperform the market, quite in line with what Francois and all these professionals have observed. It is not surprising after what we just discussed.

But, I wondered,

Is there a connection between actual thinking and overperformance?

I have no clue. I did get to observe the pattern myself when reading great investors. They not only thought for themselves, but their thinking process was widely different from what I see in ‘normal people’. I don’t know if it is something genetic and unchangeable, but there is one more person I’d like to bring to this article, Paul Graham, who offers some sort of hope.

I’ve been consuming Paul’s essays for a while now and, again, there’s one in which he goes through this theme, called ‘How to think for yourself’. In this essay, Paul concludes that independent mindedness may be largely inborn, but he thinks there’s a way for all of us to become more independent minded or at least not suppress thinking:

- “simply to be less aware what conventional beliefs are. It's hard to be a conformist if you don't know what you're supposed to conform to”

- “If you're surrounded by conventional-minded people, it will constrain which ideas you can express, and that in turn will constrain which ideas you have.”

I have been thinking on how to put this article together for a while now. I find it so curious to spot the same idea or behavior among very successful people who have arrived to the same conclusions by following different paths. To this, I remembered a quote from Michael Mauboussin, shared by Nick Sleep in one of his letters:

“Individuals who achieve the most satisfactory result across various probabilistic fields have more in common with one another than they do with participants in their own field”

Already have an account?