Trending Assets

Top investors this month

Trending Assets

Top investors this month

General M&A and Specifically how it Relates to $MITK

Yesterday, I asked about M&A, and @eggplant and https://twitter.com/inglouriouscap were both nice enough to send me really informative papers. The full papers are https://t.co/Tp5d0FF2oH and https://t.co/9qXVR43GUc but I wanted to share some things that I learned.

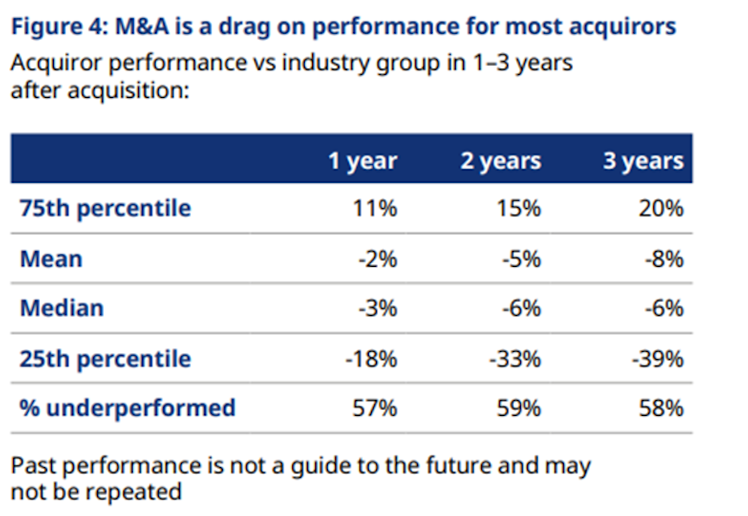

M&A is normally bad for the buyer as many buyers overpay. The average buyer has negative share returns after the acquisition. However, some buyers do extremely well, and I want to

dive into those.

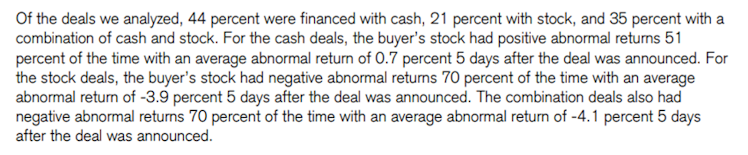

Cash deals do better than other types of deals and there are two main theories for this. 1. Management has a good idea of the value of their shares and don’t want to dilute themselves when undervalued 2. Cash deals are riskier and the buyer shows confidence in their acquisition.

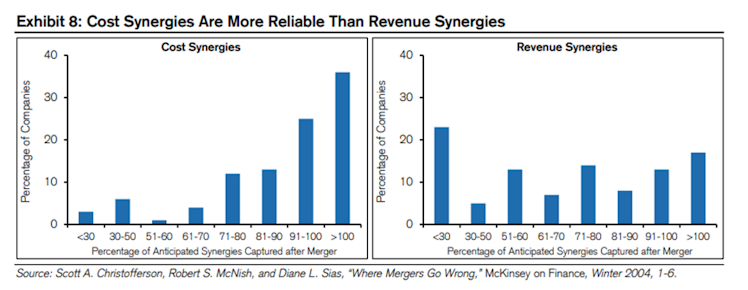

There are three other factors I found interesting. 1. cost synergies are more reliable than revenue. 2. Serial acquirers do better than one-time acquirers. 3. Small bolt-on deals, do better than large transformative acquisitions

The market also usually has a general idea if the acquisition is smart. Buyers whose stock goes up on the day of acquisition do significantly better on average than those who don’t.

I did this research because one of my companies $MITK made an acquisition yesterday. The positives were it was an all-cash deal, Mitek is a serial acquirer, and their stock was up 2.39% (although almost everything was up today). Some neutral factors were Mitek should receive revenue and cost synergies from the deal and the deal was medium-sized (about 1/6th of Mitek’s market cap). I look forward to learning more about HooYu (the company Mitek acquired)

Already have an account?