Trending Assets

Top investors this month

Trending Assets

Top investors this month

Purchase #8: One many haven't heard of -- SemRush $SEMR

This week was @brianferoldi 's turn to pick a stock. He chose a small player that many haven't heard of, but that we both already own: Semrush.

Here are the details:

For starters, this is a TRUE small cap stock

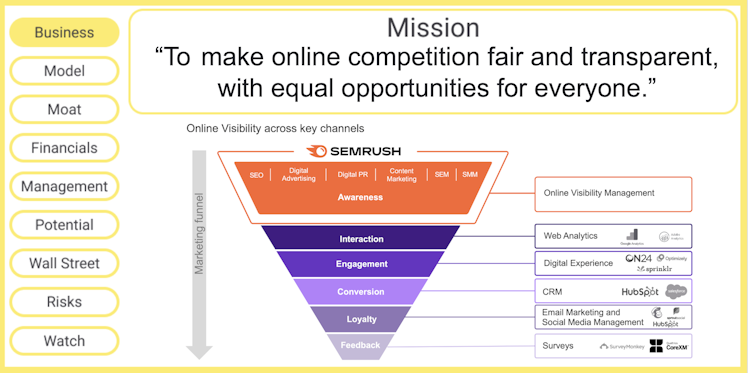

We love the mission for this SaaS company -- which aims to give functionality and observability to all aspects of a company's digital marketing strategy.

It combines first and third-party data to help companies reach the customers they need/want to reach

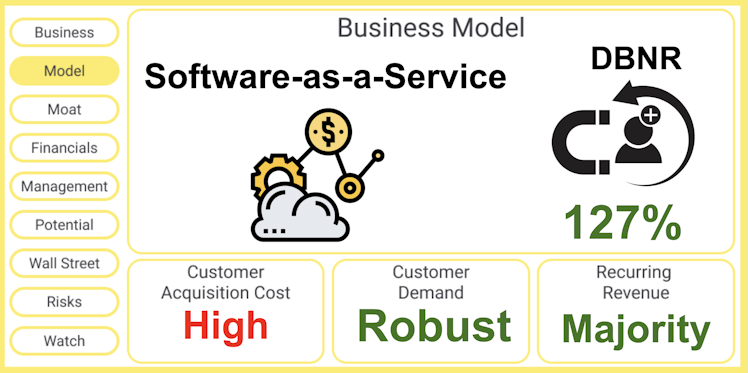

While customers are expensive to acquire, they tend to be recession-resistant and create predictable streams of revenue

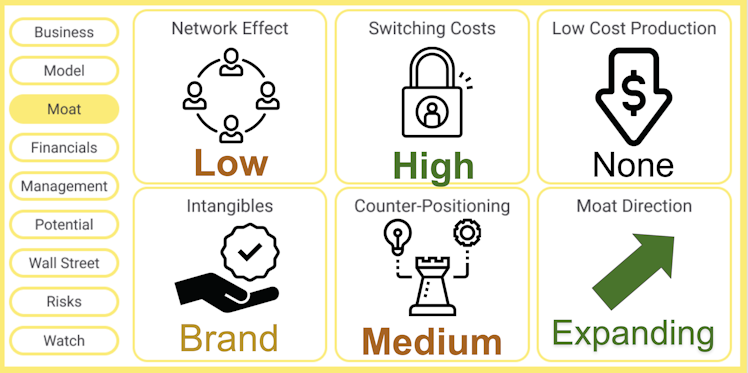

When it comes to the moat, we consider:

- Network effect: weak, from gathering data

- Switching costs: stronger, thanks to multiple tool usage

- Brand value: weak, but we hear it's the go-to

- Counter-positioning: Specifically, this is against Facebook and Google, who obviously have more data, but do so in walled gardens.

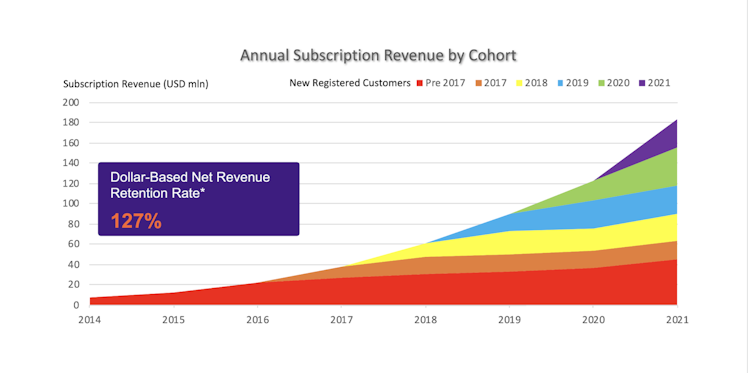

This graph helps add credence to those switching costs. Very healthy 127% dollar-based net retention

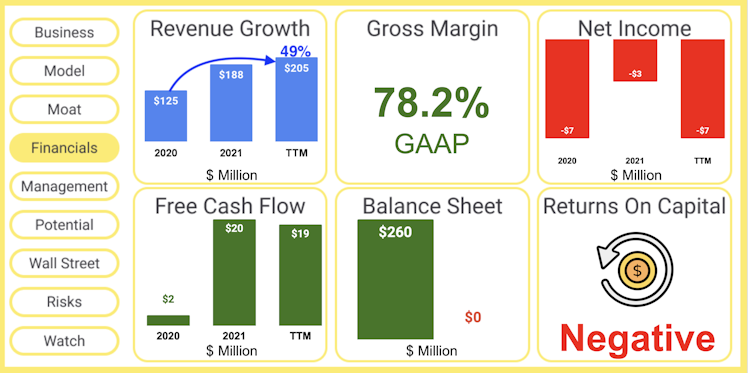

When it comes to results, there's a lot to like. Growth has been brisk, net income losses are very minor, and the company is free cash flow positive!

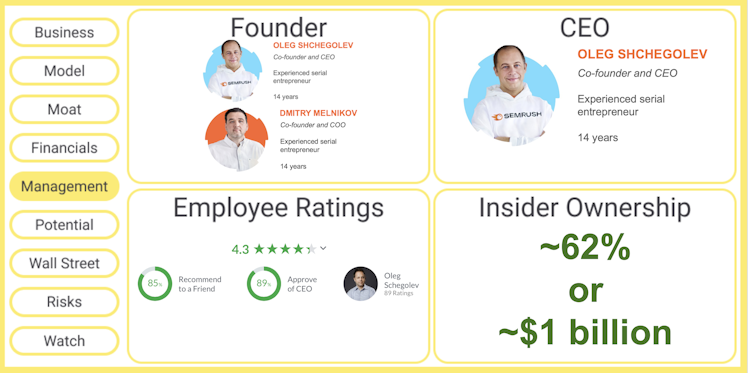

We also appreciate leadership: this is a founder-led team that gets great reviews and has TONS of skin in the game.

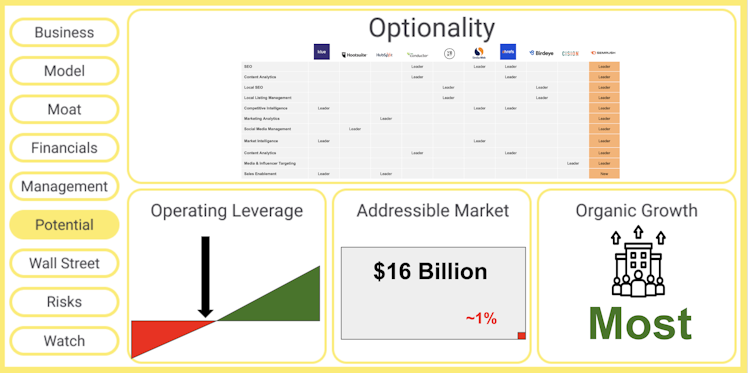

We also think the past serves as proof that there's lots of room for optionality. While the total market Semrush is after isn't all that big, it still has a very tiny part. We'd never invest in hopes of an acquisition, but we wouldn't be surprised to see this rolled into a bigger player at a later date.

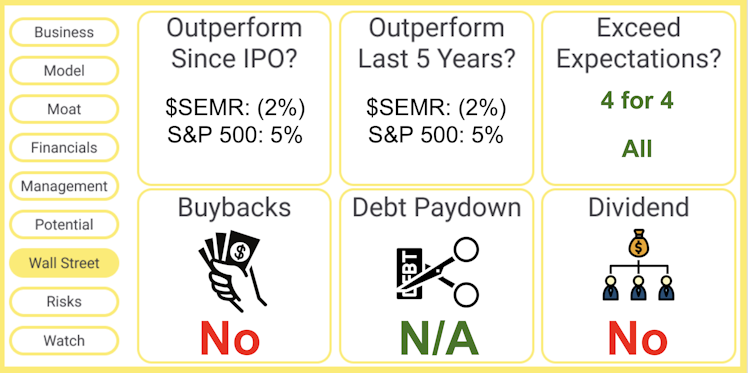

How has the company done as a stock? Surprisingly well given the fate of most 2020/2021 IPOs

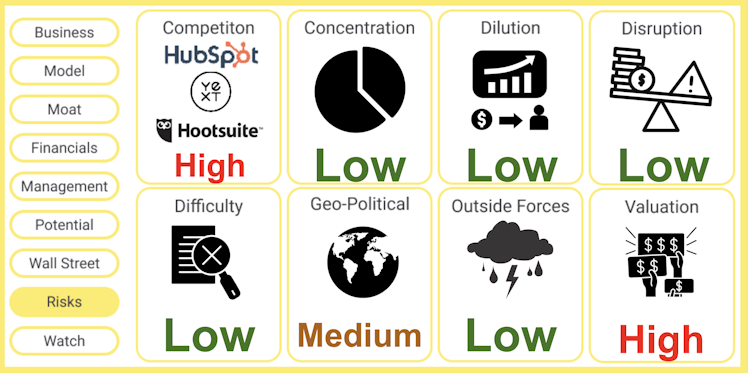

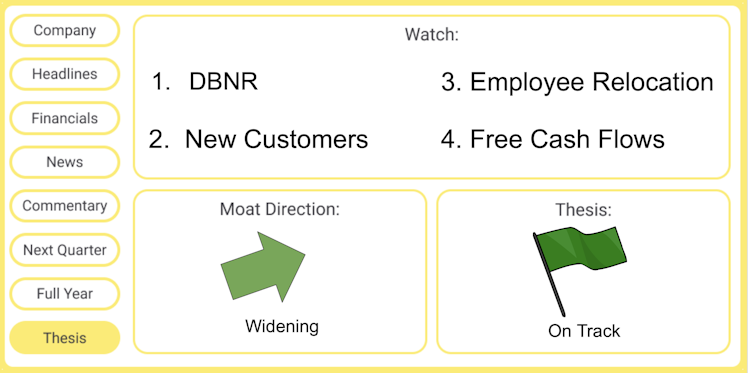

What about risks? Of course, there's competition. And despite being well of its highs, the stock is still expensive. But the real risk is geo-political: the company was founded in Russia, by two Russians. And despite being headquartered in Boston, it had hundreds of key employees in St. Petersburg. Management recently decided to pay for them ALL to be relocated. There's 15 million in one-time costs, and about 15 million in recurring costs for higher salaries once they're relocated. That stings, but we definitely believe it's the right decision

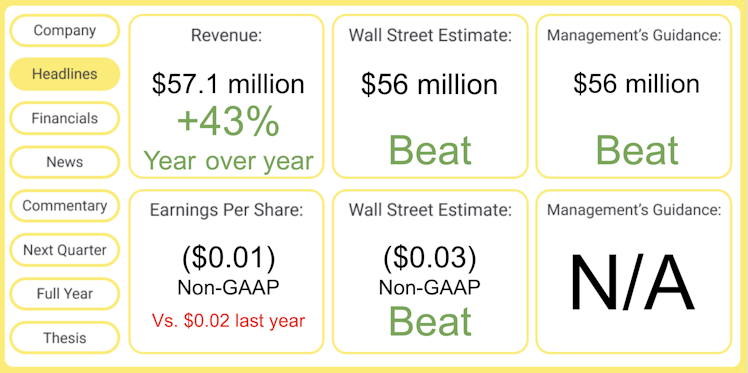

The most recent quarter showed the company beating across the board

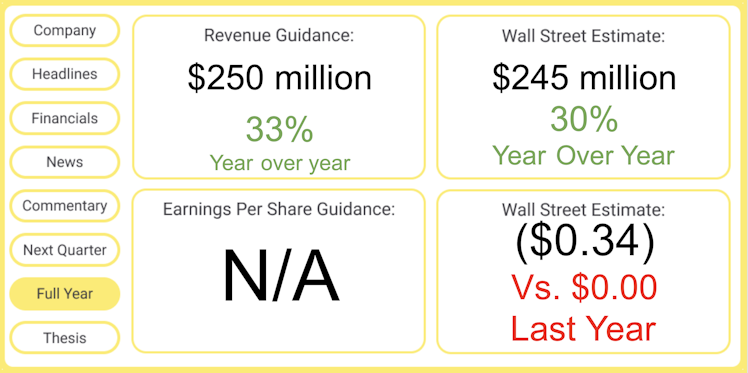

Not only that, it raised its outlook for the year, coming in ahead of estimates

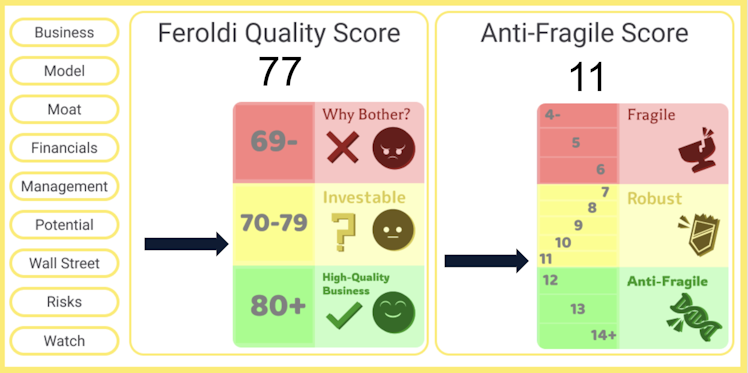

Overall, the company scored very well for both Brian and I.

Moving forward, we're going to keep our eyes on these four things

So what do you all think about this? We've gone pretty far outside our more well-known investments with this one. We'd love to hear feedback, especially if you have experience using Semrush tools -- or those of a competitor.

"When it comes to this week's pick, I think you guys have..."

46%"Found a diamond in the rough"

53%"Tried too hard - I'm passing"

43 VotesPoll ended on: 6/15/2022

Already have an account?