Trending Assets

Top investors this month

Trending Assets

Top investors this month

The 7 Qualities of a Great Investor

When starting out on your investment journey, it’s important to set yourself up for success as to minimize blunders and maximize wins. Reading The Intelligent Investor by Benjamin Graham with commentary by Jason Zweig, made me think about 7 qualities that I think great investors possess. They are:

Self-awareness: "To know thyself is the beginning of wisdom."—Socrates. If you’re the type of person whose emotions can get the best of them, you’re better off not checking the market every day. It’s important to know what kind of person you are and what your triggers are, to avoid making costly investment decisions. That may mean not having brokerage apps on your phone and only checking up on your portfolio on the computer, for example. When you know who you are, you will do what you must to ensure optimal outcomes.

Focus: what is your reasoning for investing? If you have no focal point, it’s going to be very easy for you to get off track and chase shiny objects. Make your future the shiny object and become extremely focused when it comes to what industries as well as what assets that you decide to invest your energy in.

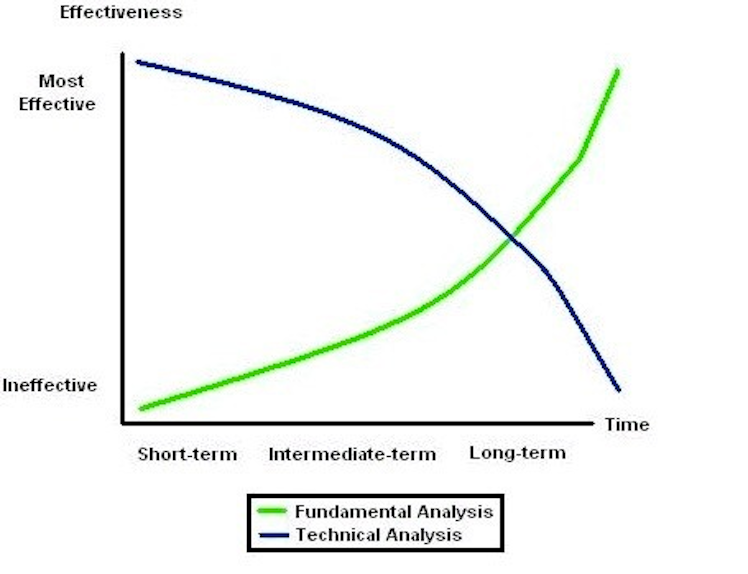

Patience: in order to make real money in the stock market, you have to be in it for the long haul. Investors tend to make a lot more money in the long term versus day traders. Day trading may make you some money in the short term, but it's been proven time and again that investing for the long-term is where real wealth is built. A perfect example of someone who’s been extremely patient when it comes to investing is Warren Buffet, who as a result, has made billions in the stock market.

- ‘“By the rule of opposites,” the more enthusiastic investors become about the stock market in the long run, the more certain they are to be proved wrong in the short run.’

Planning: “those who fail to plan, plan to fail.” Before you start anything, you should always have a plan as to what you’re going to do, even if it doesn’t follow that plan to a T. This includes things like knowing how much you want to invest, what types of industries (in the stock market), what types of assets (if you’re looking to diversify your asset classes), a time horizon, what you're willing to pay for a stock, etc. When you have a plan it makes you more confident as well as more disciplined in your investing. It's also important to be aware of the microeconomic factors that can influence the price of a stock.

- “…it is most essential that the enterprising investor start with a clear conception as to which courses of action offer reasonable chances of success and which do not.”

- “The value of any investment is, and always must be, a function of the price you pay for it.”

- “The stock market’s performance depends on three factors:

- (1) real growth (the rise of companies’ earnings and dividends

- (2) inflationary growth (the general rise of prices throughout the economy)

- (3) speculative growth—or decline (any increase or decrease in the investing public’s appetite for stocks)”

Research: it’s imperative that you ALWAYS do your own research and don’t outsource your investment plan to someone else—unless they are a trained financial advisor with a track record of making good financial decisions. Either way, you empower yourself when you educate yourself; make it a point to research the companies you invest in.

- ‘…everyone who buys a so-called “hot” common-stock issue, or makes a purchase in any way similar thereto, is either speculating or gambling.’

- “There is intelligent speculation as there is intelligent investing. But there are many ways in which speculation may be unintelligent. Of these the foremost are: (1) speculating when you think you are investing; (2) speculating seriously instead of as a pastime, when you lack proper knowledge and skill for it; and (3) risking more money in speculation than you can afford to lose.”

Persistence: don’t bank on your investments making a steady straight line upwards on a graph; prepare for a squiggly line which will likely cause you agita. When you have an investment thesis/plan that you’ve created beforehand, you must persist when things look shaky else you might let your emotions ruin your long-term investment goals.

Remaining humble: no one knows everything! While you may get some things right, you will surely get some things wrong as well. Don’t tie your ego to your investments and remain as level-headed as possible regarding them. And also, don’t be afraid to vent or ask for help! Sometimes all you need to do is ask a question of a more seasoned investor to get you back on track (which is what you can do here on Commonstock).

- “Since the profits that companies can earn are finite, the price that investors should be willing to pay for stocks must also be finite.”

- ‘Focusing on the market’s recent returns when they have been rosy, warns Graham, will lead to “a quite illogical and dangerous conclusion that equally marvelous results could be expected for common stocks in the future.”’

- “The heart of Graham’s argument is that the intelligent investor must never forecast the future exclusively by extrapolating the past.”

Ask yourself, WHY are you choosing to invest?

- It’s important to know WHY you are choosing to invest. Get clear on what your short and long-term goals are so that you have a north star to which you’re pointing.

- Be wary if you’re only investing because you want to make a quick buck; there is no such thing as getting rich quickly. Becoming rich and building wealth take time, and it’s important to know that before you get started else you’ll only be disappointed.

- You don’t want to end up like the Dogecoin Millionaire, who got too greedy and left losing a lot of money on the table because he didn’t lock in profits (I doubt he had a plan, too!). He held on in the hopes that $DOGE.X would hit $1, but instead, it started going the opposite way and sits at $0.067 as of writing. This is why it’s incredibly important to have a trading plan and to take profits once you’ve made a sizable ROI.

In thinking of another definition of a great or sophisticated investor, according to Investopedia, this is what they consider a Sophisticated Investor:

someone who has sufficient investing experience and directly relevant knowledge to weigh up the potential risks and benefits of an investment opportunity. In other words, the person genuinely understands what they need and want, and what they are getting from the seller.

At a minimum, such investors will ensure that their portfolios are sufficiently diversified, monitored regularly and that buying takes place when markets are relatively low and selling when they are high. Investors who fail to heed these three basic principles are not sophisticated.

With this in mind, take stock of yourself… where are you solid and where do you need to improve? If you have all of these qualities, great. If you do not, that’s great too because now you know what you need to work on. While I shared some quotes from The Intelligent Investor, I highly suggest you read it for yourself if you haven’t yet for the full effect!

Here’s to happy investing 🤗🤑

Investopedia

The Many Ways to Achieve Investment Portfolio Diversification

Achieving investment portfolio diversification is all about striking the right balance between risk and potential for financial reward.

Already have an account?