Trending Assets

Top investors this month

Trending Assets

Top investors this month

Copper Fundamentals vs Macro

Copper is facing headwinds in the second half of 2022, broker RBC suggests but the longer-term outlook remains solid.

“Investors should remember that Fed-induced slowdowns are simply a short-term abatement of the symptom -- inflation -- and not a cure for the problem -- underinvestment,” Goldman Sachs Group Inc. said in a note.

Slowing global growth as the world deal with high inflation and tightening monetary policy is the main hurdle suggests the broker, though stocks are low by historic standards, which will provide an offset.

Demand growth from electrification and expected deficits further will also provide some support as well as renewed stimulus measures in China, though here the challenges in the property market, one of the main users of copper, might limit the impact.

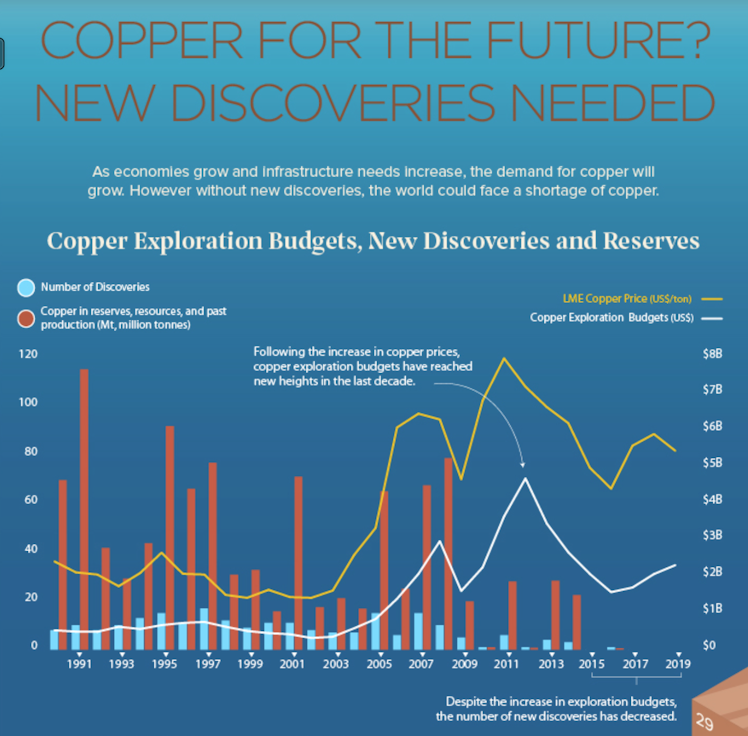

As economies grow and infrastructure needs increase, the demand for copper will grow. However, without new discoveries and sources of production, the world could face a shortage of the red metal.

According to data from S&P and the LME, the discovery of copper has not kept up with investment in copper exploration. If this trend persists, there will not be enough copper to replace current resources. On top of this, production from already producing copper mines face resource exhaustion and declining grades.

In order to maintain copper’s supply chain, the world needs new copper discoveries to ensure everyone has access to the materials and products that make modern life.

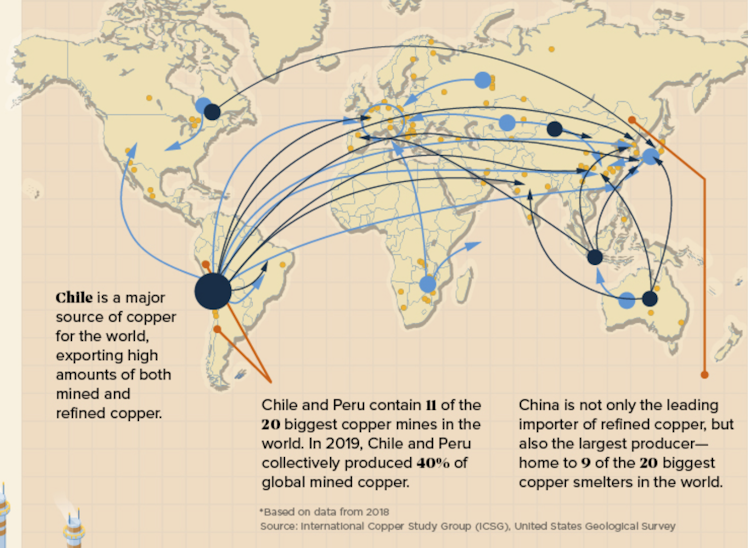

While Chile is one of the richest sources of copper in the world, the mining industry has exploited copper deposits to the point where the grade or quality of the copper ore is declining.

Chile copper workers begin nationwide strike over smelter closure

=================================================================

Chilean state-owned copper producer Codelco, the world’s largest, was hit on Wednesday by a nationwide strike against the miner’s decision to close permanently an allegedly polluting smelter in the country’s central zone.

About 50,000 copper workers, including Codelco’s employees as well as contractors, joined on Wednesday the indefinite strike.

Chilean President Gabriel Boric, who has been in power for a little over three months, has said he doesn’t want “more environmental sacrifice zones” in the country.

Last night on the SHFE:

Shanghai nonferrous metals closed mixed today, but the market was still dominated by the bears as US officials supported a 50bps or 75 bps rate hike in the following month. Shanghai copper slid 1.64%.

Macro vs fundamentals - a low inventory continues dropping:

The world’s copper consumption has climbed to 20 million tons today from 9 million in 1995. The development of more electric products such as electric vehicles coupled with the global appeal for a more sustainable energy mix to replace fossil fuels, will quickly shift demand to 35 million tons in 2030, while the maximum extraction capacity is currently 22 million tons. The existing copper mines simply cannot sustain the demand.

The establishment of new copper mines currently takes eight years from the beginning of the permitting process to the go-live of the mine, and the backlog for copper dependent products will only grow.

Already have an account?