Trending Assets

Top investors this month

Trending Assets

Top investors this month

Global stocktake

Valuing regional and global stock markets to help us find the best ponds in which to fish for value.

•••

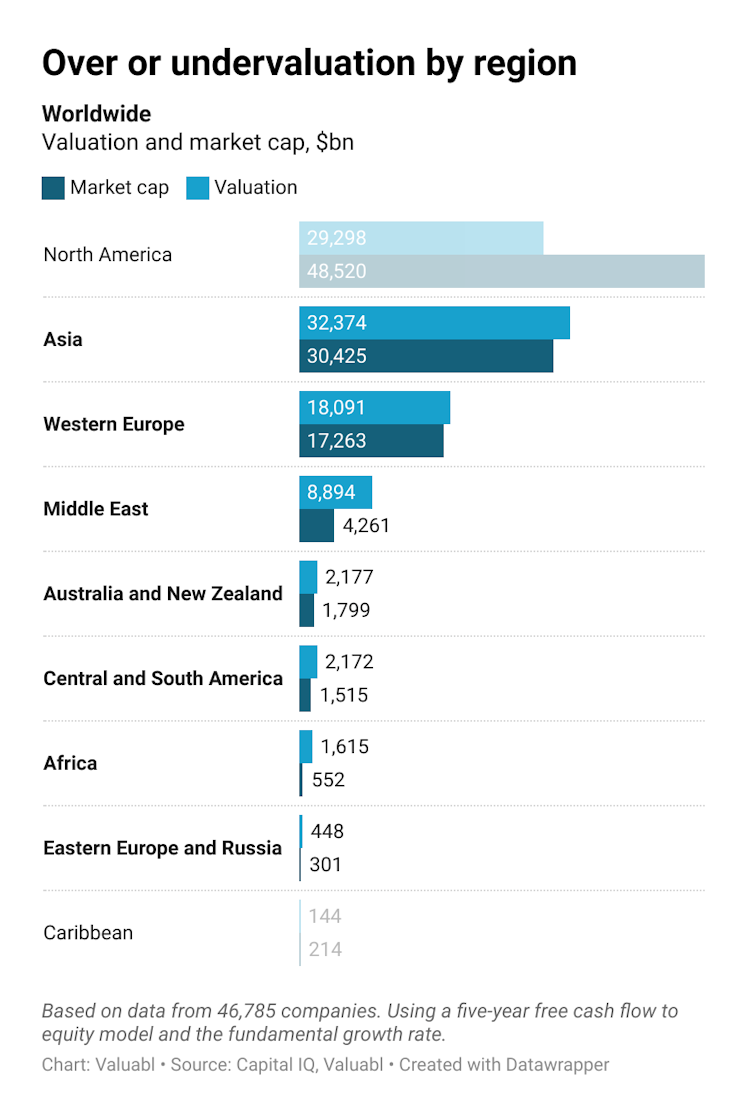

I used a five-year free cash flow to equity (FCFE) model and the fundamental growth rate, the growth in earnings predicted by the return on equity and retention ratios, to value stocks at $95.2trn globally. But given the $105trn price tag, global share markets, on average, still look slightly overvalued.

Valuations by region

African and Middle Eastern stocks look like the best value, while North American and Caribbean stocks are overvalued.

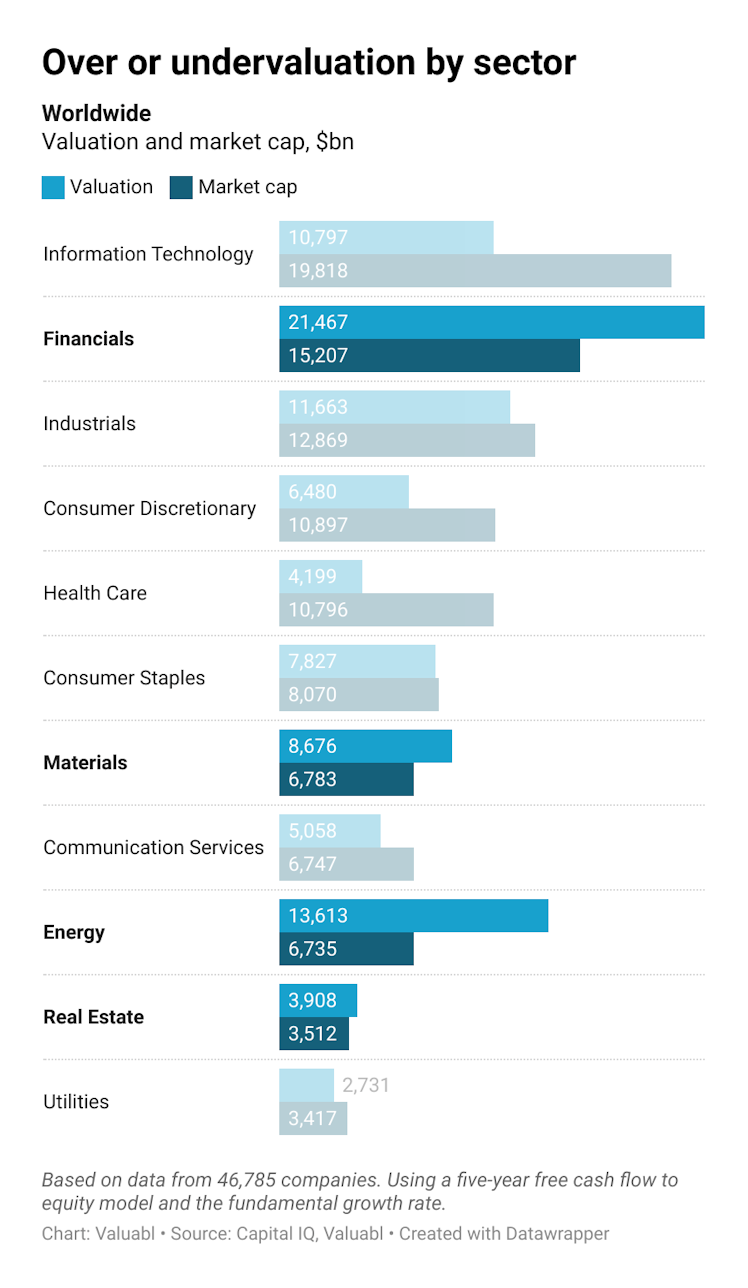

Valuations by sector

Energy, Financials, and Materials companies look the most undervalued. While Consumer Discretionary, Information Technology, and Health Care firms look the most overvalued.

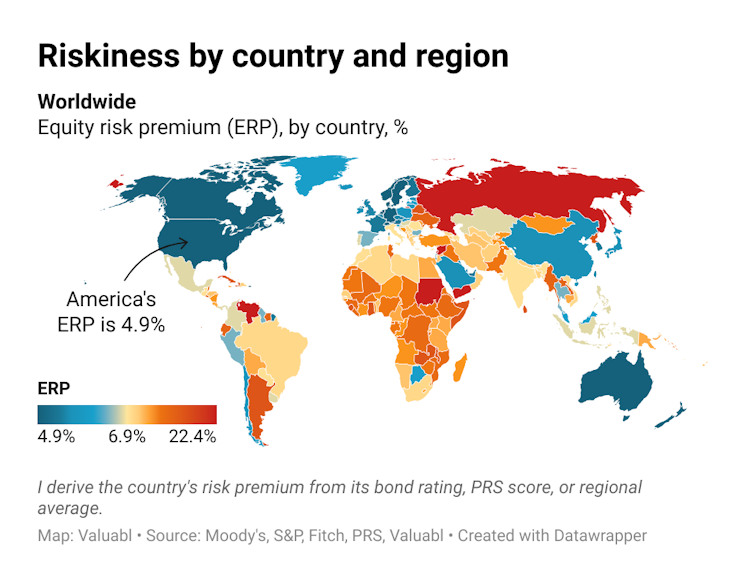

Country and regional risks

The global equity risk premium, the extra return investors demand to buy global shares instead of bonds, dropped by 50bp to 6.4%.

Moody’s, a rating agency, downgraded Nigeria’s credit rating from B3 to Caa1, saying they expect the country’s fiscal position to continue deteriorating. They also downgraded Tunisia from Caa1 to Caa2 as they reckon the government will likely default. In contrast, they upgraded Uzbekistan from B1 to Ba3, saying the country’s reform program is going well and will continue.

Regional and sectoral data

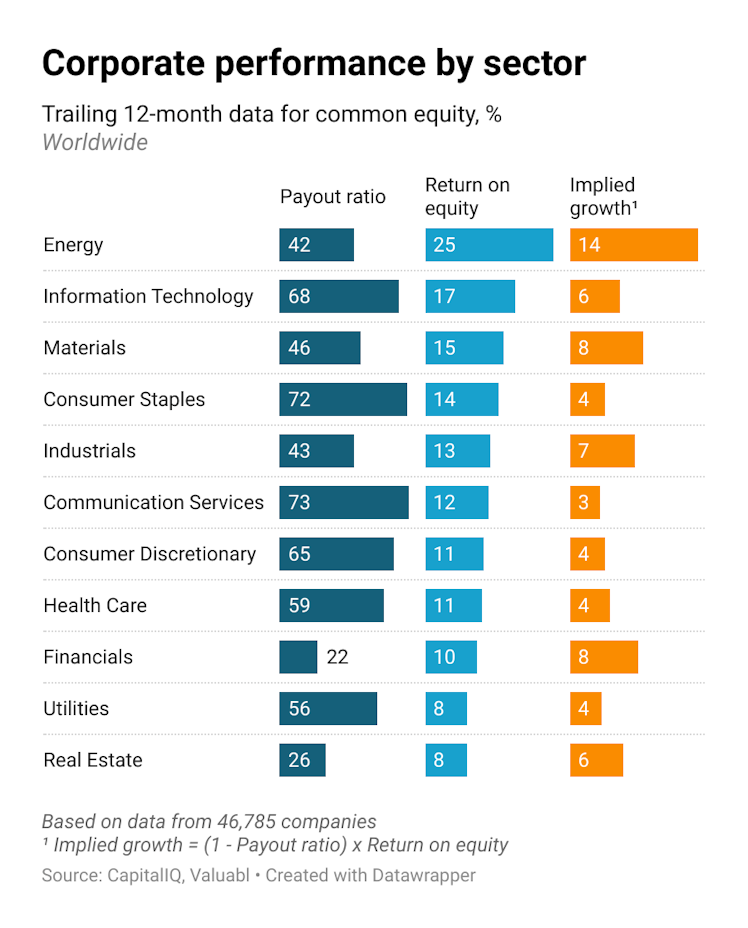

Public companies have $44trn of common equity invested in them, and that equity earned a 13% after-tax return in the past year. Middle Eastern, African, and South American companies generated the most profit per dollar of shareholder funds. But Caribbean and Asian companies are still lousy.

Based on reinvestment, Middle Eastern, Eastern European, and African firms are likely to grow the fastest, while North American and Caribbean ones the slowest. North American firms are only reinvesting one in every four dollars of profit, while Caribbean companies earn a crummy 7% return on equity.

Based on growth rates suggested by the money companies have retained and what they earn on that capital, energy businesses are likely to expand the fastest. Their implied fundamental growth rate is 14%.

While this measure isn’t perfect—and given that inflation was pushed up by energy, material, and industrial prices—if these companies expand production, this will help reduce input prices for other companies and continue to pull inflation down. This disinflation has already started to feed into lower producer prices. The producer price index (PPI) dropped 0.5% in December.

great charts! thank you! Would be great if possible to have Switzerland isolated :). Thank you!

Already have an account?