Trending Assets

Top investors this month

Trending Assets

Top investors this month

SentinelOne ($S) Earnings Recap

Highlights:

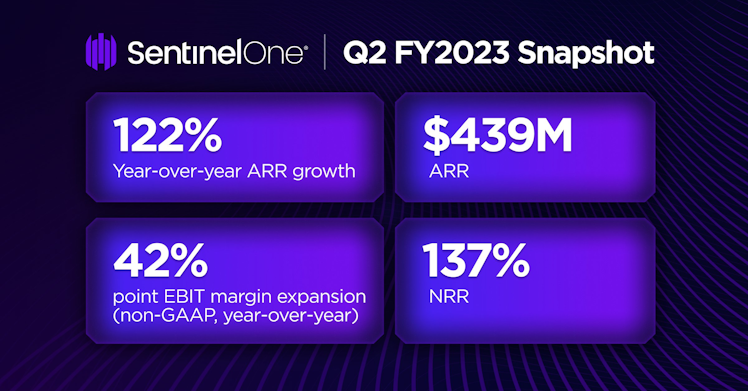

• Annualized Recurring Revenue (ARR) grew 122% year-over-year to $439 million at

the end of the fiscal second quarter. Revenue in the quarter grew 124% year-over-year

to $103 million.

• Added a record number of customers in the second fiscal quarter, over 1,100

customers sequentially. Total customer count grew by about 60% year-over-year to over

8,600 at quarter-end. Customers with ARR over $100K grew 117% year-over-year to 755.

Dollar-based net revenue retention rate was 137%.

• Fiscal second quarter GAAP gross margin was 65%, up 6 percentage points year-over-year. Non-GAAP gross margin was 72%, up 10 percentage points year-over-year.

• Fiscal second quarter GAAP operating margin was (106)%, up 41 percentage points

year-over-year. Non-GAAP operating margin was (57)%, up 42 percentage points

year-over-year.

Takeaways:

Just like for $SNOW, going into earnings there was investor hesitancy that $S could maintain their best-in-class, YoY historical growth rate (100+%) in the current macro environment.

Not only did SentinelOne prove that enterprise cybersecurity spend is recession-proof, $S proved that they are the disruptor I thought they were and re-accelerated both ARR and NRR in Q2 to record highs of 122% and 137% respectively.

SentinelOne continues to execute their unique go-to-market strategy of becoming the partner of choice for MSPs (managed service providers), MSSPs (managed security service providers), and resellers; where $CRWD loses out by competing with these potential channel partners.

They also continue to work their way upmarket from SMB, winning their largest contract ever, and prove the demand and resiliency of a differentiated, AI-driven product that reduces customer overhead.

As management reiterated repeatedly in the Q&A, XDR is in extremely early innings, and SentinelOne is set up the best out of any (yes, any) cybersecurity company out there to take advantage of the opportunity.

If you're interested in the company that's disrupting the disruptors, or you're a CrowdStrike investor who wants to learn more about the competition, let me know and I'm happy to answer any questions about one of my favorite companies (and top 3 position).

PS, I would be remiss to not include the following Twitter thread, which convinced me to double down nearly a year ago: https://twitter.com/InvestiAnalyst/status/1468796820788629506?s=20&t=bO6tZgFWqc5Hj0I8kS3_Xg.

X (formerly Twitter)

Francis (@InvestiAnalyst) on X

The Rising Challenge of SentinelOne:

$CRWD is the undoubted leader of the endpoint cybersecurity market. However, there is a very compelling thesis for $S - SentinelOne.

I'll outline my research notes in this full thread (and an upcoming Spaces!):

Already have an account?