Trending Assets

Top investors this month

Trending Assets

Top investors this month

Philip Morris International Q3 Results + Thoughts

PMI $PM put up some impressive numbers, though it may not look that way at first glance.

Shipment volume increased on a reported and pro forma basis, .6% and 2.3%, respectively. Declines in combustible volumes more than offset by HTU shipments growing by 17.1%, or 21.9% on a pro forma basis. Net revenues saw +6.7% (CC) and +6.9% pro forma, led by higher HTU volume paired with combustible pricing against combustible declines and device pricing. Worth noting that Marlboro continues to show relative strength.

Q y/y Reported Operating Income was down 14.1%, up 4.4% on a pro forma adjusted basis. OI Margin decreased 5.5pp, or 1.0pp on a pro forma adjusted basis, primarily driven by input inflation, strong device sales growth plus ILUMA strength, supply chain disruptions, and notably due to the war in Ukraine. Reported diluted EPS was down 13.5% to $1.34 and up 8.3% on a pro forma adjusted basis.

The difference between reported and other numbers is extremely wide. Organic growth is adjusted to exclude currency, acquisition, and disposals. Additionally, the pro forma numbers exclude the company's operations in Russia and Ukraine. Undeniably, the loss of Russia is a major hit to the company, as the country has accounted for a HSD % of revenue in the past. This is nothing unknown. However, the continuing operations throughout the rest of the world look to be doing exceptionally well.

- Smoke-free products were 30.1% of net rev, 29.2% on a pro forma adjusted basis.

- Market share of HTUs is up 1.3 pts to 7.7% on a pro forma adjusted basis.

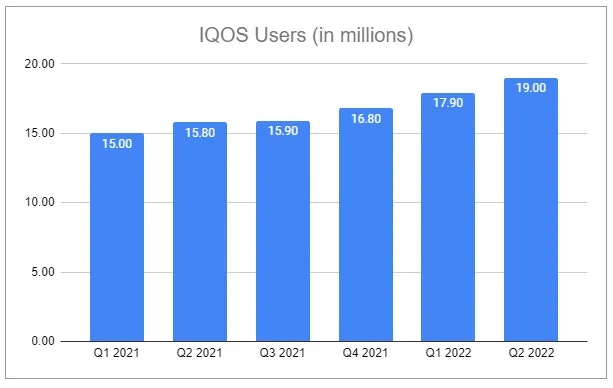

- Pro forma total IQOS users up to 19.5 mil. Continuing the trend shown the chart below:

Granted, PMI is still facing many pressures, but there are some glowing points to consider that I believe paint an easily understood favorable scenario:

- As a whole, PMI has captured an additional .6% market share YTD in 2022, and aggregate shipment volumes are positive. Sustained growth, even in low and middle-income markets, and volume guidance are particularly encouraging.

- Pricing continues to more than offset combustible volume declines.

- Moving forward, smoke-free products (IQOS, 30%+ of net revs) can continue to grow at a healthy double-digit clip.

- Accelerating growth, paired with a new device launch (ILUMA), further compresses margins on top of inflation and supply chain pressures, as devices have an unfavorable margin profile. However, this will accelerate related HTU volume growth over time, leading the segment to demonstrate significant operational leverage, and margins should incrementally expand over the long term.

Along with this, there are two notable developments:

- PMI has reached an agreement with Altria to end the companies' commercial relationship regarding IQOS in the U.S. as of April 30, 2024. For this, PMI will be paying a total cash consideration of $2.7 billion - $1 billion upfront and the remaining by July 2023 at the latest.

- PMI has increased its offer price for shares of Swedish match to SEK 116 from the initial SEK 106, representing a 52.5% premium over the closing price prior to the announcement of the initial deal. The revised price accounts for the value relating to SWMA's cash flows generated in USD and the recent strength of the USD. PMI has stated that given global economic uncertainty and recent weakness in markets that the offer price should be found attractive by SWMA shareholders. PMI has further stated that this is a best and final price, which in accordance with the Takeover Rules for Nasdaq Stockholm, means that the price can not be increased any further.

I remain very skeptical that PMI's SWMA offer will reach the required 90% acceptance threshold. Nonetheless, U.S. IQOS, without a legacy combustible business, represents purely incremental growth with no cannibalization. Even in a taxation environment that does not differentiate between combustible and HTP products, this could be a massive opportunity for PMI. The company has stated that even if the SWMA deal does not finalize, plans are in place to get IQOS into the United States.

Not much to say about Healthcare and Wellness. Net revs ~$275 million and adj. op loss of ~$100 million. My stance on the segment has remained unchanged since earlier in the year:

"But maybe this segment becomes a perpetual black-box money pit, or perhaps it will turn into an incredibly profitable new segment. Either way, I’ll wait to speculate further."

TLDR;

- Cash cow

- Currency headwinds ouch

- Stable core business

- IQOS continues to show very strong growth

I'll likely write a more in-depth analysis to update my prior and layout thoughts on future scenarios.

For a comprehensive analysis and valuation covering PMI, follow the link below:

open.substack.com

Philip Morris International $PM: Analysis, Valuation, and Pricing, Comprehensive, 2022

Philip Morris International has turned into a global behemoth, and now, the company is growing into something even more remarkable.

Already have an account?