Trending Assets

Top investors this month

Trending Assets

Top investors this month

"The Coming War Over Taiwan"

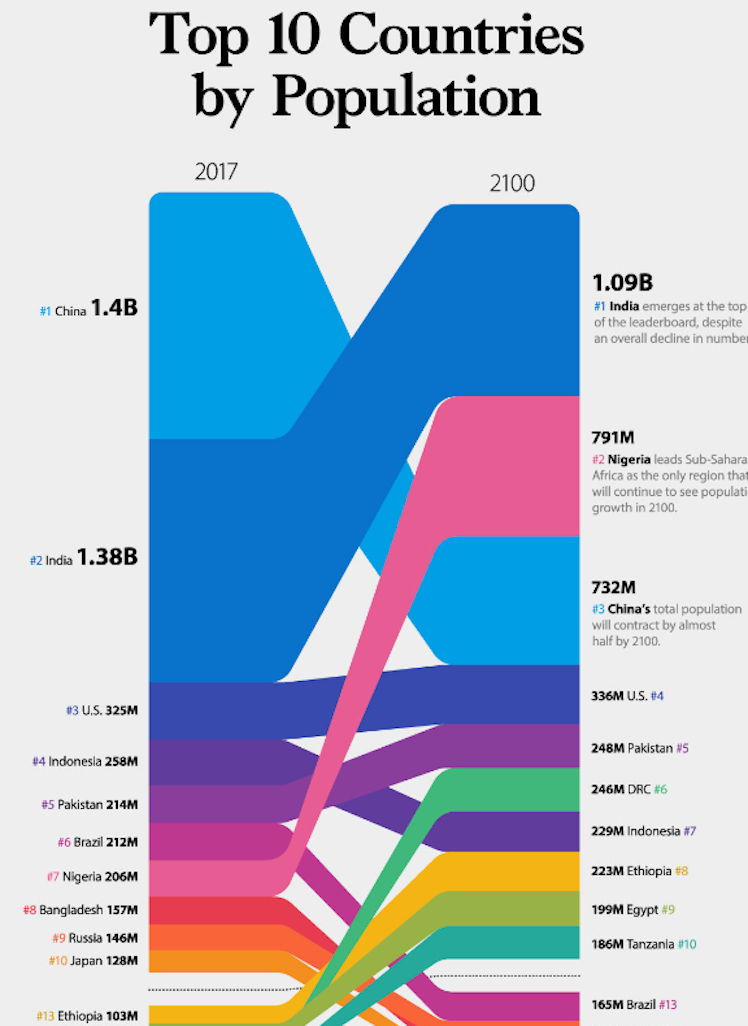

It's pretty incredible how rapidly China's demographics are shifting. Over the next decade 70 million people will leave the workforce and it will gain 120 million senior citizens. Found this image of population forecasts through 2100.

The WSJ article linked thinks that China has hit its peak power (most estimates I run across these days think China's population will start declining this year - 8 years sooner than previously thought). He points out that when countries begin to decline (hard not to lose power when your population is shrinking rapidly) that is often when they.

The author is clearly very pro a military build-up / assistance policy - he's basically lobbying for massive support for Taiwan and increased US military assets in the region.

He thinks the US would see a 5-10% GDP hit if we were cut off from China and lost access to semiconductors (90% of cutting edge logic comes out of Taiwan) - and China would shrink 25-35%. I don't think anyone can accurately predict GDP shrinkage from hypothetical wars in the future, but for perspective in 2008/2009 global GDP dropped less than 3%.

To me, what would be far worse than the initial recession hit - is the literal decade (or two?) plus it would take to rejig international supply chains. It truly would be a mutually assured destruction scenario, which I think everyone understands. Not only do we get semiconductors from Taiwan, I've seen estimates as high as 50% of products on Amazon come from China, and I've read that 90% of computers are assembled in China (including for Dell, HP, etc).

This makes me optimistic that this is sabre raddling by people interested in seeing military spending increase.

Link to WSJ article: https://www.wsj.com/articles/the-coming-war-over-taiwan-11659614417

WSJ

The Coming War Over Taiwan

With its global power at a peak and domestic problems mounting, China is likelier than ever before to make good on its threats.

Already have an account?