Trending Assets

Top investors this month

Trending Assets

Top investors this month

Logitech is my holding #55 🖱️

I decided to open a new position in my Dividend Portfolio;

Disclaimer ⚠️

I am a long-term dividend investor, and my decision to be Long on $LOGI is not to generate a 6month capital gain; if you are searching for an idea to invest your money and exit in the short term, then probably Logitech is not for you.

🏢 The Company

No matter your age, I believe any of you, between home, school, or office, used a mouse/keyboard/webcam branded Logitech; we are talking about one of the biggest hardware producers for these kinds of devices.

Logitech anyway evolved during the last ten years, and the company now owns different brands:

- Logitech - selling all devices we are familiar with

- Logitech G - premium gaming oriented decides

- Astro Gaming - professional gaming Headsets

- StreamLab - streaming software suite.

- Others - Blue Mic, Ultimate Ears, and Jaybird

🔢 The Numbers

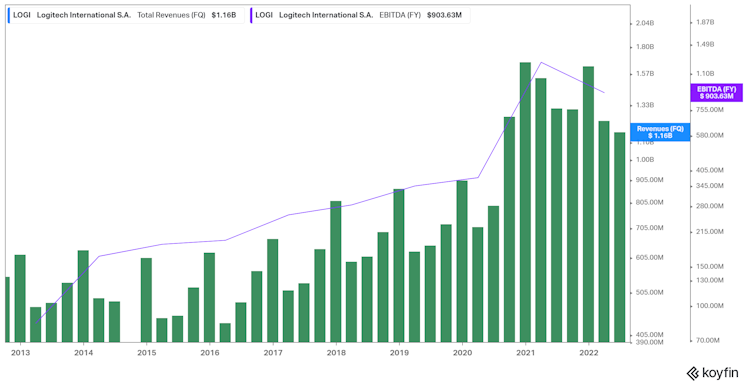

Sales were slightly disappointing in the last two quarters, after an approximately +66% increase in revenue in 2020-2021. We are talking about a company that took full advantage of the "work-from-home" movement and delivered an impressive return in terms of revenue and also earnings.

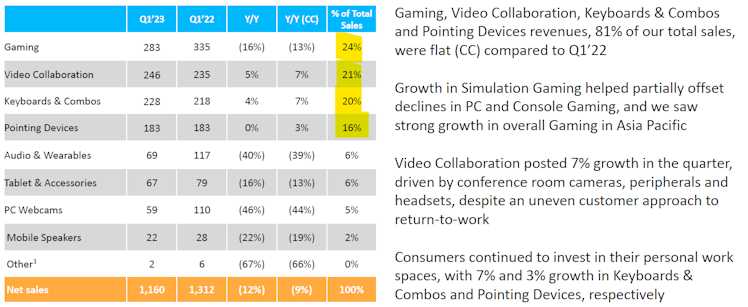

Anyway, looking deeper into the last report, we can find some small negative news. First, the four main business lines of $LOGI are flat or growing, apart from Gaming, which represents 24% of company revenues that is declining.

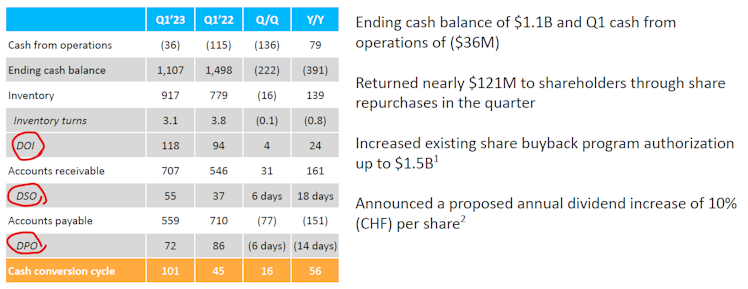

What is also a big concern is the cash position:

DOI and DSO (Days Outstanding Inventory and Days Sales Outstanding) both increased, making it harder for Logitech to generate cash flow fast. At the same time, DPO (Days Payable Outstanding) decreased, meaning money flowed out of the bank faster.

All together mean a weaker cash flow status.

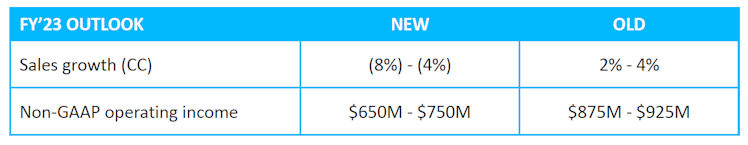

And to complete the list of problems and concerns, we have the revision of the 2023 outlook, which was quite strong. A single-digit sales contraction and a lower Operative Income

But let's look at the bright side. 💎

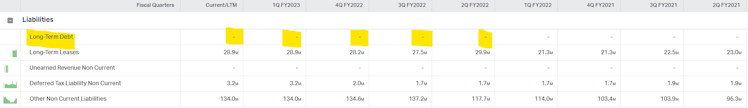

No matter whether the cash position worsens, this is nothing compared to the company's strong balance sheet. Not only do they have in cash $1.1B, which is a pretty good number if we look at the company turnover, but the company has ZERO debts.

Pretty remarkable nowadays; a company with zero long-term liabilities 😲

It means that all the FCF coming from the business can be used for:

A) Buyback program 🪙

And yes, $LOGI approved a $1.5B buyback program that will help to support the stock price soon.

B) Acquisitions 🛍️

Nothing at the window right now, but Logitech has a big list of acquisitions in the past, and I will not be surprised if they will expand their business in such a way

C) Dividends 💸

Logitech started paying dividends in 2013 and has an 8-year dividend increase streak. So we are looking at a future dividend aristocrat here. They are also committed to increasing the dividend pretty fast, and they just approved a +10% increase a few days ago.

The dividend is pretty safe cause FCF easily covers it.

Disclaimer 2 ⚠️

Due to the fact Logitech is a Swiss/American company, dividends work a bit differently. At first, they are distributed once per year and not quarterly. Secondly, they are subject to 35% Withholding Tax. Such tax can be reduced if your country of residence has a double tax treaty signed with Switzerland. For me, in the UAE, it's 15% only.

Is it the right moment to open a position in $LOGI?

I believe YES 👍

I know that P/E and P/S ratios are not the investor's holy grail, but I think these are still powerful indicators to understand the company. Maybe it is not understandable from this chart, but both ratios are near the 3-year low while the stock price is at a 52-week-low.

Logitech is much cheaper than pre-covid, while the price is at the same level.

Another indicator I like to check for dividend payer companies is the comparison of the dividend yield with the previous year's average.

The situation is good cause it's near the five-year high.

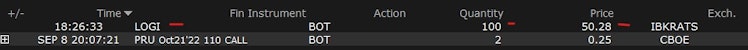

I consider $LOGI a good addition to my portfolio, and for such a reason, I opened a position buying 100 shares last week in IBKR.

I plan to stay at the window after seeing the Q4.2022 numbers (actually Q3.2023), and if I like what I see, I will add another 100 shares.

Already have an account?