Trending Assets

Top investors this month

Trending Assets

Top investors this month

Medpace and the development of new drugs

This is one of my favorite ideas, not only because the numbers are good, but also because it is one of those companies that does a good for humanity. This company helps in the developing of new pharmaceuticals and has special expertise in cancer treatment.

Founded in 1992 and having a Market Cap of nearly $5B USD, Medpace is a Contract Research Organization (CRO). CROs provide outsourced clinical development services for the biotech, pharmaceutical and medical device industries.

Why would that be necessary?

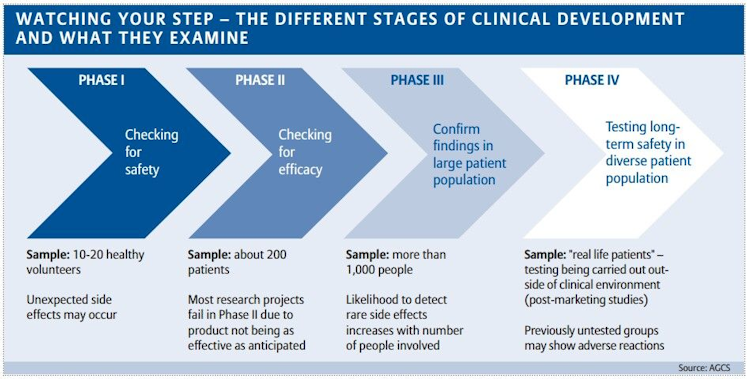

New drugs must undergo extensive preclinical and clinical testing and regulatory review to verify safety and efficacy. As you can guess, this is not cheap at all, in fact, it is estimated that the cost to get a new drug approved is around $2.5 billion dollars and takes about 10 years on average.

This is challenging for small companies that want to test their pharma products, and that is where companies like Medpace come in, which can do this work more efficiently, to successfully pass the development process from Phase I to Phase IV. This is mainly due to two factors: Medpace's existing professional infrastructure and the know-how to perform these therapeutic tests.

Revenues are generated through fees for the provision of these services detailed in contracts. The duration of the contract can range in length from a few months to several years and the price are generally based on a fixed fee. Stable and predictable income.

Market Overview

The CRO industry remains highly fragmented, with several smaller providers and a small number of full-service firms with global capabilities, like Laboratory Corporation of America, Syneos Health or IQVIA Holdings.

This is because there are significant barriers to entry, including the cost and expertise required to develop therapeutic areas, the infrastructure to support large global programs, or the expertise required to prepare regulatory filings in numerous jurisdictions.

Oncology - An opportunity

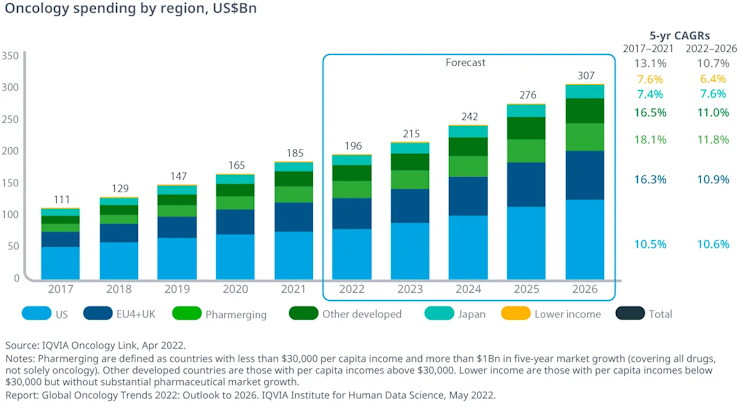

30% of revenues came from oncology tests. This is a large market, since 6,504 (29%) of the 22,684 drugs in process during 2020 are focused on treating cancer and it is expected that by 2026 more than $300B dollars will be allocated to Oncology (the study and treatment of tumors), maintaining double-digit growth only in this segment.

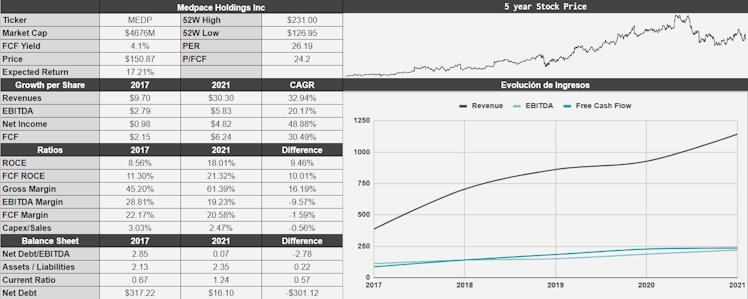

Key Ratios

- 32% CAGR growth in revenues and 30% FCF growth

- High Gross Margins of 61%

- FCF ROCE of 21% and solid FCF margins of 20%

- CapEx represents only 2.5% of Sales

- Net Debt/EBITDA of almost 0

An Asset Light company with no debt, growing both revs and FCF while generates high returns on investments.

Management

August James Troendle is the founder and is still in the company as CEO. He has extensive knowledge of the CRO and biopharmaceutical industries. He still owns 21% of the company, which is more than 1,500 times his annual salary. Skin in the game.

Also insiders have been buying stock in the last 6 months.

Capital allocation is focused on continuing to grow the business organically, since they don't pay dividends and do not make acquisitions. That's how they got able to get that 20% Returns on Capital Employed.

Also, they bought back -3.5% in outstanding shares during this YTD.

Valuation

Okay, business seems good BUT: Is it cheap?

Well, in my base case scenario, revenue will grow by a modest 15% CAGR over the next 5 years, maintaining FCF margins of 22%.

That's a FCF per share of almost $18 in 2027. With a multiple of 20x EV/FCF would result in a target price of $360 USD. A CAGR return of 19% from current prices ($150 USD).

Final Thoughts

There are more details to mention, but there's a word count limit and I think you can already get an idea of why $MEDP is one of my highest-conviction ideas.

Feel free to leave in the comments your thoughts about the company!

Already have an account?