Trending Assets

Top investors this month

Trending Assets

Top investors this month

Bilibili ($BILI) Part 2: Monetization

Hey folks! Playing around with Commonstock's memo maker, and decided I'd port over my Bilibili piece. I've noticed that the original piece in all it's glory is a tad long for most people to read in one sitting, so I'm going to be breaking it up into a "series" of memos on here.

I'll be posting these over the next few days, but if you want to read the whole thing right now, please visit my website here. And if you like our work, please consider subscribing. This is part of a sample research report we did. We will be publishing one more before putting it behind the paywall. Members Plus subscribers will also have access to a downloadable copy of our detailed financial model.

*Please see our disclaimers at the bottom of this memo and our full disclaimer here. By reading this memo, you acknowledge you have read our disclaimers and agree to our terms of use.

Monetization:

Bilibili monetizes primarily through four means:

1) Advertising.

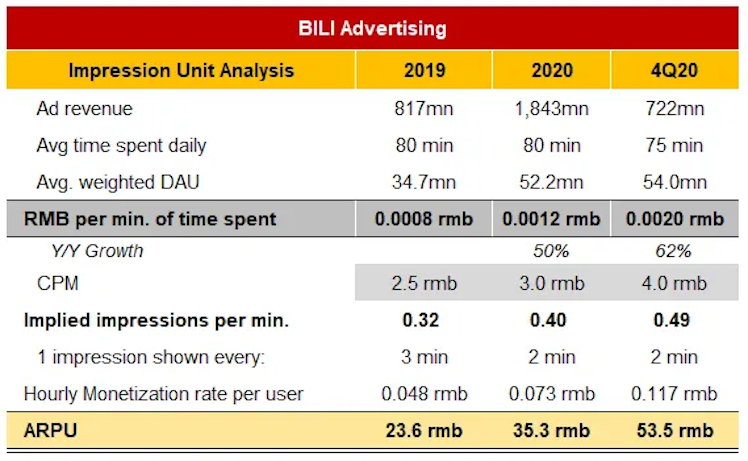

This includes display ads, feed ads, and a prominent ad at the app’s opening screen. Notably, Bilibili has eschewed pre- and mid-roll ads, an ad format popular on YouTube, to better ensure a positive user experience amid many other video alternatives, while also keeping that “community” Bilibili originally envisioned by not over-commercializing. Rui Chen mentioned they plan to keep ad load flat at 5% (ambiguous metric), but there is still room for inventory expansion before it becomes a cumbersome experience. In our advertising analysis below, we estimate that there is an ad impression roughly every ~2 minutes, which has been corroborated by our channel checks, although it does vary by user.

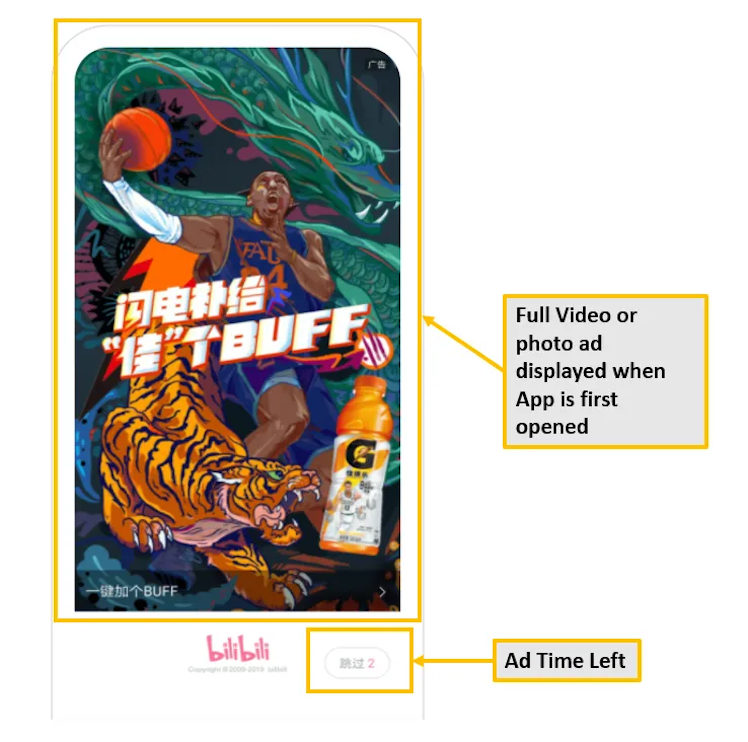

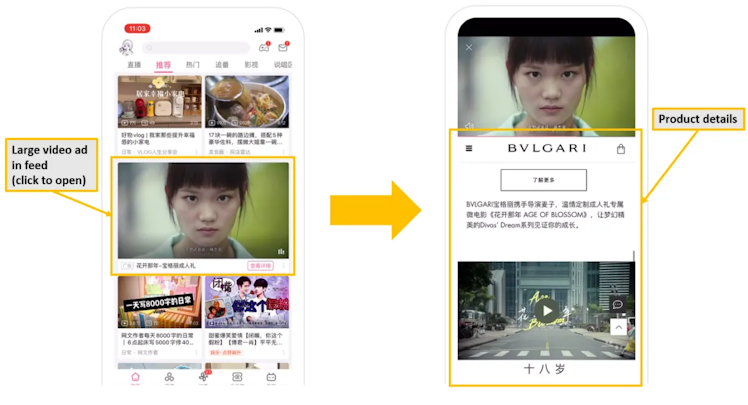

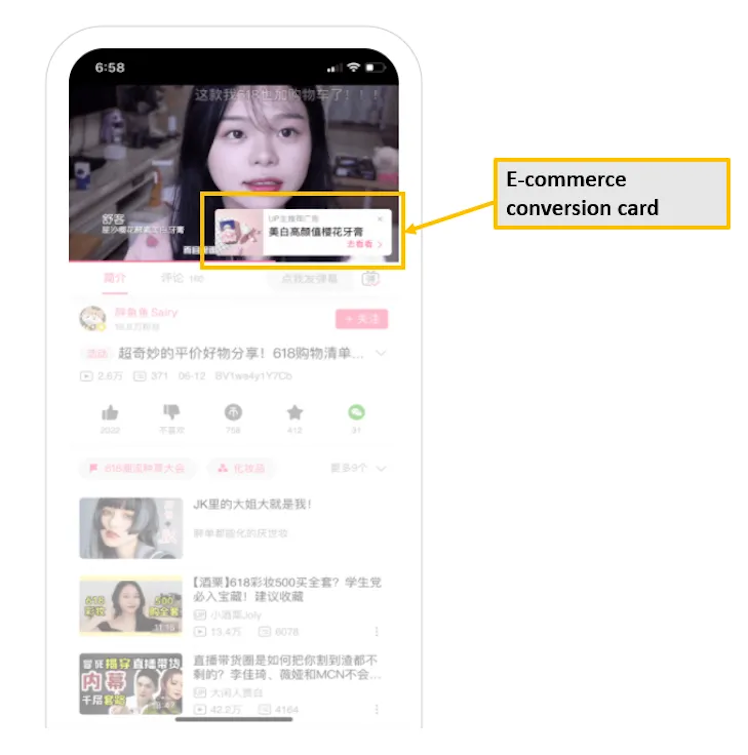

*Here are a few of the types of ads run on the Bili platform. There are full video/photo ads that are displayed right when the app loads, an expanding half-screen ad that also allows you to browse the advertisers’ website, and e-commerce conversion cards that allow viewers to go directly to a store.

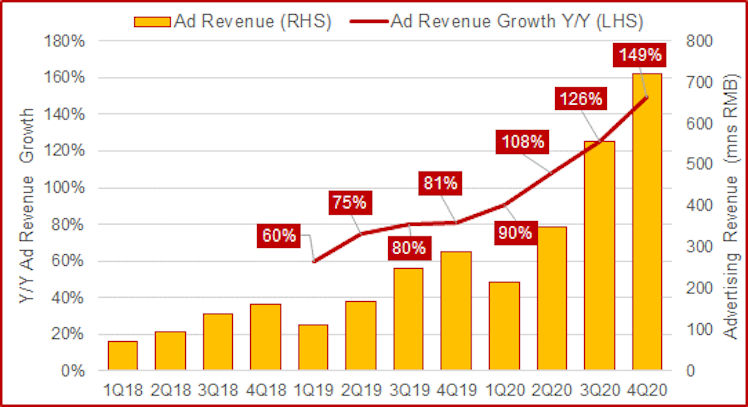

While impressions could go up overtime, the big unlock for their advertising initiatives is building better ad products for advertisers. Namely, an amped up direct response product with an easy-to-use self-serve platform and high quality attribution metrics. Coupling this with more advertisers is a powerful way to raise ad pricing (CPMs) on the platform as ad buyers spend to achieve specific ROAS targets that tend to be multitudes ahead of traditional channels. This was the playbook for the U.S. Social Media companies. Our estimated ARPU from advertising is lower versus peers like Kuaishou (~70rmb) vs Bili’s run-rate of ~50rmb. On a CPM basis though, we can see a more meaningful discrepancy with WeChat ranging from 50-150rmb, Douyin from 70-200rmb, and QQ at ~25rmb versus Bili’s ~4rmb. Below you can see that Ad revenue growth has recently been accelerating, with revenues +149% in the last quarter, almost twice as fast as they were growing just a year ago. However, the advertising story isn’t just about ad CPM parity with peers, but also the Chinese ad industry maturing with more advertisers joining the relatively new digital ad pool and buying ads on attributable return metrics (which before digital ads could never be done). While the US isn’t a great yardstick, Facebook does monetize users in their most developed North American market at ~$165 (~1,075rmb) and is still growing. PPP (purchasing power parity) adjusted by 3.5x (estimates vary) we get an ARPU of ~300rmb, which can be thought of as the full opportunity in a more mature ad ecosystem down the line. We go into more details below in our segment build.

2) Gaming.

While Tencent is the 800lb gorilla in gaming, Bilibili has been able to find some success by focusing on niche titles that fit well with its original ACG user base. Fate Grand Order (pictured below) is a Japanese game that Bilibili licensed in China with knockout success. Two years ago, it generated over a billion RMB in revenues for Bili, representing over half of its revenues. While a blockbuster gaming-hit is always welcomed, it changed the narrative of Bili in the investment community, and few felt good about the sustainability of a business model predicated on a single mobile game whose underlying IP it didn’t own.

*Fate/Grand Order is Bili’s flagship gaming product — it made up the majority of Bili’s revenues for it’s first few years, and acted as a cash flow generator that allowed it to invest in other areas (think how Search made up 99% of Google’s until recently).

However, those focusing on existing revenue pools missed the bigger picture: Bilibili’s audience was basically unmonetized. As other revenue initiatives became more mature, the top line importance of Fate/Grand Order started to fade–it represents just ~11% of revenue this year. For those unfamiliar with the Bilibili story, it might seem odd to start the gaming segment by downplaying its contribution, but it’s important to dispel the notion that Bilibili is just a one-hit mobile gaming company, as well as have a sense of how sentiment and the story has changed overtime.

*This is the mobile game download screen — looks very similar an App Store.

As far as its current gaming strategy goes, Bilibili continues to license and partner with developers, although with middling success so far. It is also investing in developers and started an in-house studio to produce proprietary games, although not much has come from this yet. Notably, some game developers are looking to Bilibili for distribution in hopes of circumventing the Tencent ecosystem and their high take-rate (estimated ~80%). As long as Bilibili keeps its audience engaged on the core of its platform, it will have plenty of time and multiple chances to break into mobile gaming in a bigger way.

*Bilibili recently spun off Bilibili Gaming, which just raised a $28mn financing round. Bilibili Gaming was formed in 2017, operates e-sports teams for a number of games (ie League of Legends, Overwatch), manages players, and organizes and broadcasts tournaments. They still own their gaming distribution, first party studios and other licensed IP.

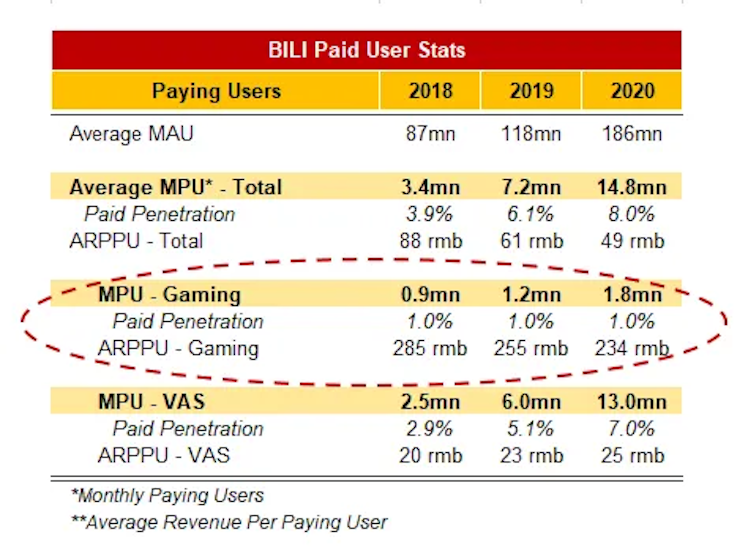

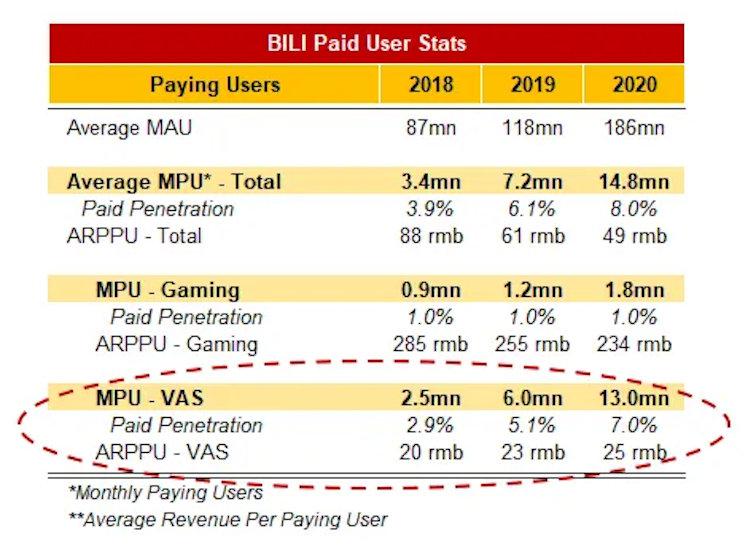

3) VAS (Value Added Services).

There are two main items housed in this segment: Premium Subscriptions and Live Broadcasting. Premium subscriptions are for exclusive content and include content Bilibili produces itself. Subscriptions range from 20-25rmb a month depending on subscription length. Today they have 14.5mn premium members, up over +60% YoY, which represents 43% of this segment’s revenues. Bilibili plans to continue to invest in their OGV (occupationally generated video, basically proprietary videos) content to further convert users to premium paying members.

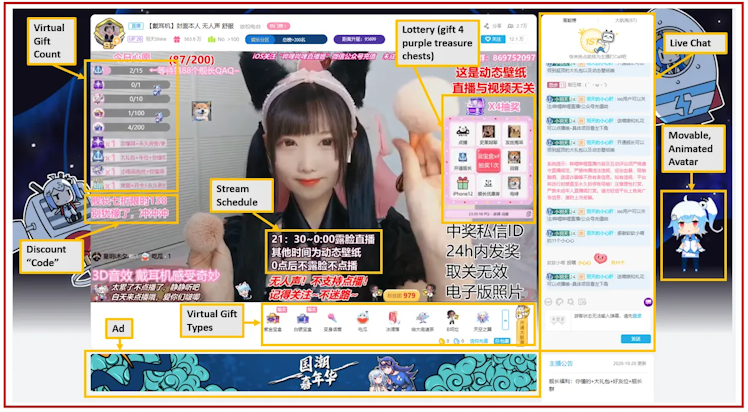

Live Broadcasting revenues are generated from selling virtual items during live video streams. Essentially, a creator will live stream with users interacting with them through messages. It is common for users to send virtual gifts which show up on the screen and can produce special effects like fireworks, with the gift sender often receiving public acknowledgement from the creator. Bilibili has an estimated 30-45% take-rate (depending on creator size) with the creator getting the rest. While virtual gifts may seem like an odd novelty to Western readers, they are common across Asia and growing in usage. 34% of VAS revenue comes from virtual items, but their importance is much broader than the direct revenue impact. Virtual gifts are a vital revenue stream for many content creators as it allows them to directly monetize their userbase. This is important because the more money creators earn from Bilibili’s platform, the more time and energy they will put in to produce more content for it, which in turn brings in more users. Having creators make money is an essential underpinning of a vibrant and durable platform ecosystem. However, having to share a majority of revenue is also a negative and will weigh on incremental margins (expanded on below). Additionally, Bilibili has started to pay up for exclusive rights, like their 800mn RMB, 3 year contract to broadcast the League of Legends eSports World Championship. This helps increase brand visibility, decrease churn by offering something exclusive, and could have a symbiotic relationship to cross sell with their gaming and e-commerce offerings down the line.

The last pieces of VAS are Bilibili Comic, a standalone comic app, and Maoer (80% ownership), a premium platform that offers audio drama. While disclosures are limited, we know that together they are responsible for 23% of this segment’s revenues, which equates to a non-inconsequential 7% of Bilibili’s total revenue.

4) E-commerce and other.

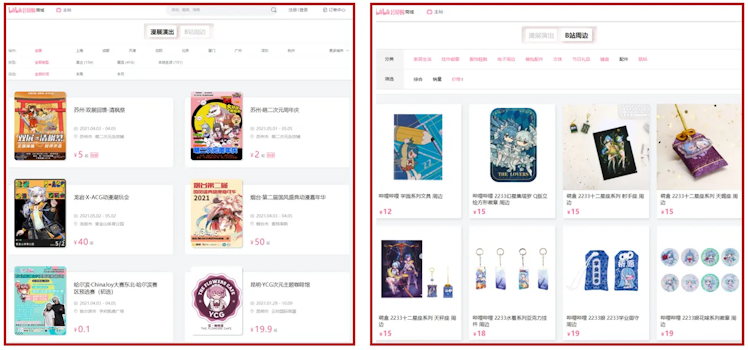

Bilibili’s e-commerce initiatives are still very nascent, and currently focus on IP related to ACG content. Given ACG fans are fervent consumers of merchandise and they still have a large core audience here, it makes sense to start with this vertical. To speculate though, they could eventually allow creators to add shoppable posts alongside their videos or live streams, enabling frictionless purchase of whatever the creator wants to sell.

One of Bili’s e-commerce efforts showed in the form of a partnership with Taobao. The platforms aimed to connect creators and users in a virtual bazaar, with Bili creators becoming Taobao KOLs (Key Opinion Leader) and promoting merchandise through interactive content. The deal was created in the hopes of finding new ways to commercialize popular shows created by not only Bili’s creators, but also by Bili itself.

Left: Bili Mall Live Events

Right: Bili Mall Physical Goods

Beyond the Taobao partnership, Bili has been putting in much effort to build out their own e-commerce platform, expanding beyond physical goods to include real world events, such as anime conventions, movie showings, and festivals.

End of Part 2

Part 1 was an introduction to Bilibili and it's product.

Part 2 was a deep dive into Bilibili's monetization.

Part 3 will be an exploration of our core thesis on Bilibili.

Reminder that I'll be posting these over the next few days, but if you want to read the whole thing right now, please visit my website here. And if you like our work, please consider subscribing. This is part of a sample research report we did. We will be publishing one more before putting it behind the paywall. Members Plus subscribers will also have access to a downloadable copy of our detailed financial model.

And if you've gotten this far, thanks so much for reading! Would love any feedback anyone has - on content or on structure. Do you like this shorter version? Or would you prefer to read the entire thing at once? Are the photos stacked vertically okay, or do you prefer the slideshows?

*Disclaimer: I have a position in Bilibili and people who have helped craft this analysis may individually (or through funds they work at) have a position in the company. Absolutely nothing in this report is investment advice nor should it be construed as such. We make no claims to the veracity of all facts and figures presented in this report. Certain figures could be stated erroneously and certain analysis could be incorrect. Please see the full disclaimer linked above.

DJY Research, its author(s), any of its contributors, and any funds they may advise at may own securities in the companies, or related companies, written about on this website.

DJY Research

Disclaimer - DJY Research

Users of this website are responsible for observing all applicable laws and regulations in their relevant jurisdictions before proceeding to access the information contained herein. By proceeding to access the information, users are deemed to have represented and warranted that the applicable laws and regulations of their relevant jurisdiction allow them to do so. No … Continue reading "Disclaimer"

Already have an account?