Trending Assets

Top investors this month

Trending Assets

Top investors this month

Why I like dividend growth investing and you might too...

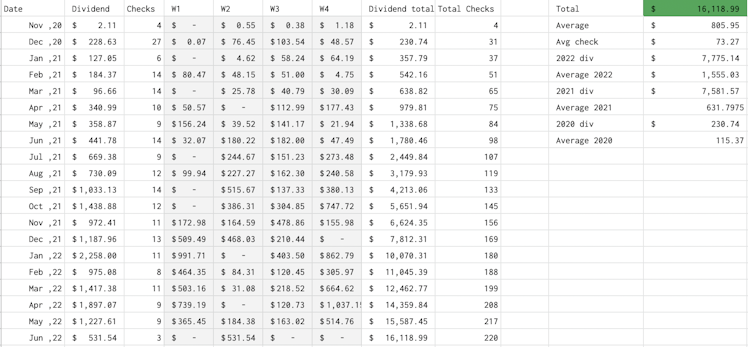

I have been a dividend investor for more than 20 months now and I was able to build a portfolio of over $350,000. Now the portfolio is hovering around $300,000. YTD my portfolio is down around 13% and wrecks my heart as my portfolio is going down everyday. There are times people in finance attack dividend growth investing at times for its focus on companies that payout dividends, and as it is passive form of investing - today I will try to defend DGI by showing how it's relatively good in all market conditions with a brief history and strategy of my portfolio. I look towards the positive side and why I choose Dividend Growth Investing in the first place.

💸 Dividend growth investing in every market conditions

The market can go in 3 directions and here are the scenarios and why dividend growth investing makes the best out of every conditions assuming companies that you invested doesn't cut the dividends:

- 👉🏽 Sideways: If the price stays relatively flat, we can buy more of the shares at $100, and once the sideways movement ends the compounding will be greater as we accumulated more stocks at a small price.

- 👇🏽 Downwards: Let's say if the market goes down, we still are getting the dividends from stocks that we hold. So, we can accumulate more of the dividend stock at a lesser price. We are increasing the cash flow and buying more assets.We just have to play the waiting game for the market to go to the bull run for capital gains.

- 👆🏽 Upwards: Although, our reinvested money won't be able to buy as much of the asset, we have both capital gain and dividends to re-invest.

📝 Brief history of my portfolio

I have been building my portfolio for few 20 months now and I have recently crossed $16k in dividends 🥳🎉. Capital gains can vanish like how it did with my $U but companies won't ask the dividends back

My portfolio link: here.

🙈 My strategy

I have concentrated down my portfolio into 3 parts in the hopes to achieve all the possible benefits of dividends and growth of dividend growth investing.

- 💰 Income: I want my portfolio to earn as much as I can, so I can re-invest as much as I can. This is possible due to covered call ETFs with high dividend yields like $JEPI, $QYLD and $BST. These 3 income ETFs yield at an average of 10.15% and has an expense ratio of 0.6% (on the higher side). They generate over 60% of my dividend income while they are 35% of my portfolio. I don't expect significant capital gain from it.

- 💸 Cashflow: While income and cashflow are similar, cashflow category consists of monthly dividend stocks that yields at lower rates and has capital appreciation. This includes stocks like $O, $STAG, $AGNC, $NRZ. They cover around 15% of the portfolio while generating around 20% of the dividends income.

- 💗 Growth: For growth in both capital gains and dividend CAGR I have stocks like $AAPL, $MSFT, $VICI, $VOO (i am planning to increase my position), $HD, $COST, $WM and $JPM. Together they make 45% of the portfolio and generating 20% of the dividends. They have a 3 year - weighted CAGR of 8.28% and average 3 year CAGR of 9.68%.

This gives my portfolio a decent place to stand. It will generate around $1,584.67 (while my cost per month are barely over $300) per month at 5%+ dividend yield (good cashflow). It also has a beta of 1.000217417 where I will be making gains similar to market (which I am happy about) and the movement lets me sleep well in the night as well (not too crazy in comparison to other individual stocks), so I can expect to make around 8ish% per year in capital gains. And, best of all the dividend CAGR is at 12%. So, I will be increasing my dividend cashflow too. This might be too conservative for some and but this gives me everything I need - cashflow and peace of mind.

Investing is like having sex - very personal. Everyone follows different strategy, and has different goals. But, every now and then it's exciting to mix things up. So, you might want to give DGI a try, you might like it...

And my final attempt to convince you to try DGI...

If this magic trick doesn't convince you, idk what will haha

M1 Finance

M1 Finance - Free Automated Investing

Get the most from your money.

Already have an account?