Trending Assets

Top investors this month

Trending Assets

Top investors this month

CIVETS, TIGERS, AND THE NEXT ELEVEN: Part 1 - The Oft Ignored Emerging Markets

No, not those types of CIVETS & TIGERS...though you may find the trivia behind the world's most expensive cup of coffee interesting:

Kopi luwak has been called one of the most expensive coffees in the world, with retail prices reaching US$100 per kilogram for farmed beans and US$1,300 per kilogram for wild-collected beans.

It consists of partially digested coffee cherries, which have been eaten and defecated by the Asian palm civet. It is also called civet coffee.

These types of CIVETS & TIGERS...

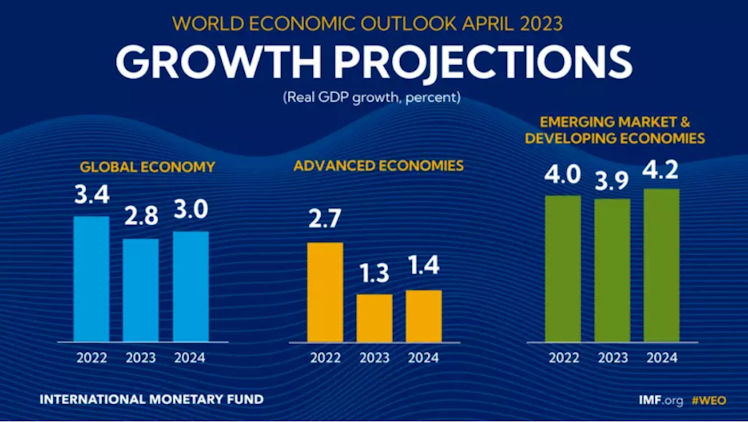

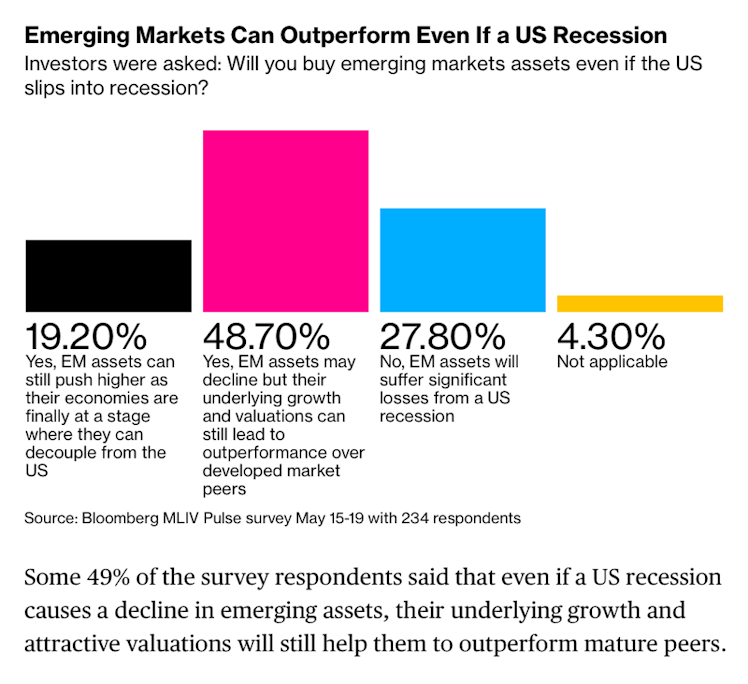

“Over the last 10 years, not only have EM economies become more resilient, they have been almost entirely neglected by global investors.”

As countries like China are exporting goods of far higher value than 20 years ago, the potential of emerging markets is still not fully recognized by investors. EM’s represent nearly half of global GDP but make up just a fraction of global equity markets. Spending by the growing middle class is making emerging markets more independent.

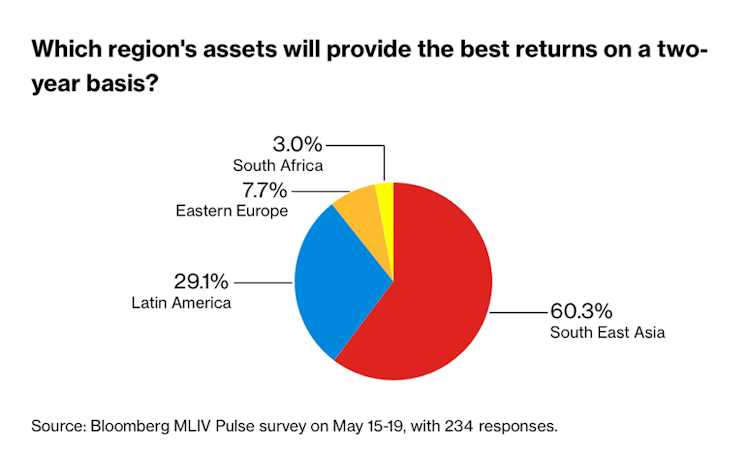

The influence of the Asian tiger (four regions in Southeast Asia known as the Asian Tigers are Hong Kong, Singapore, South Korea, and Taiwan) economies is likely to increase in the years to come. Each location has a large population of consumers eager to buy international products and services.

“Southeast Asia is one of the best places to be for long-term investors,” said Aninda Mitra, a macro and investment strategist at BNY Mellon Investment Management in Singapore. “There’s a track record of sound macro management, better demographics and a steadily rising flow of foreign direct investment.”

CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa) countries were thought to be the next generation of “tiger economies” because they shared fast-growing, relatively diverse economies as well as large populations that were younger than age 30. Hence, these countries showed great potential for high levels of growth in domestic consumption.

These countries are predicted by some to be among the next emerging markets to quickly rise in economic prominence.

With so many EM's to discuss, I thought it would be best to offer an introduction to the list of countries in Part 1, and then follow with a series that discusses investment opportunities within each.

I'd like to begin with Vietnam - as there is a SPAC of interest that will be listed soon. The Economist described Vietnam as a winner in the era of de-globalisation.

Since 2000, it wrote, Vietnam’s GDP has grown at a faster rate than in any other Asian country bar China, averaging 6.2% annually. Vietnam is clearly emerging as an important link in the global supply network and is likely to become one of the largest manufacturing hubs in the world.

Vietnam estimates that a total investment of $134.7bn is required for the development of power sources and transmission grids up until 2030, said the country's ministry of industry and trade on 15 May. It estimates that a further $399.2bn-523.1bn will be required over 2031-2050 for the same purpose.

But Vietnam currently relies heavily on coal-powered generation, which made up 38pc of the country's total generation in January-October 2022, according to state-controlled utility EVN. The country is aiming for an average GDP growth of about 7pc/yr over 2021-2030, and its coal-power fleet is crucial to power its economic growth prospects.

Vietnam is targeting net zero emissions by 2050. Under the plan, the country aims for renewable energy to make up 67.5-71.5pc of its power mix by 2050.

Growth is expected to pick up to 6.5 percent in 2024 as the economies of Vietnam’s main export markets gain strength, the report says.

"There’s an enormous opportunity for Vietnam in an era where supply chains are becoming fragile and unreliable. Vietnam can become a reliable partner to ensure that critical supply chains are maintained clean and safe," he said.

HANOI, May 17 (Reuters) - Vietnam's VinFast expects to sell as many as 50,000 electric vehicles (EVs) this year, an almost seven-fold increase over 2022 as it ramps up exports to North America and starts shipping to Europe, the company's founder said on Wednesday.

HANOI, May 12 (Reuters) - Vietnamese electric automaker VinFast said on Friday it will list in the United States via a merger with special purpose acquisition company (SPAC) Black Spade Acquisition Co (BSAQ.N).

The move comes after the startup last month said it had received a fresh round of funding pledges worth $2.5 billion from parent company Vingroup (VIC.HM), Vietnam's biggest conglomerate, and founder Pham Nhat Vuong, Vietnam's first billionaire and richest man.

VinFast, which was founded in 2017 and began selling EVs in California this year, previously filed for an initial public offering in the U.S. to list on the Nasdaq under ticker symbol "VFS" in December last year, aiming for a valuation of about $60 billion.

The company has said it has almost 55,000 orders globally and is able to churn out 300,000 EVs per year.

Black Spade Acquisition is a Hong Kong-based SPAC which listed on the NYSE in July 2021 with a plan to merge, within two years, with a company ideally in the entertainment business, according to its website.

It was founded by Black Spade Capital Limited, the private investment arm of Lawrence Ho, the head of Melco Resorts & Entertainment Ltd , which operates casinos in Macau and the Philippines, according to the company's website and Refinitiv.

VinFast's move to list via a special purpose acquisition company follows the likes of EV companies Microvast , Faraday Future (FFIE.O), Nikola Corp (NKLA.O) and Lucid (LCID.O), despite a cooling in the once frenzied SPAC market, which has been subjected to closer scrutiny by the U.S. Securities and Exchange Commission.

SPACs are seen as a quick route to the stock market, particularly for auto technology firms, and have proven popular with investors seeking Tesla-like (TSLA.O) stock valuations - although the valuation of merged firms often falls in the months after listing.

Given the history of SPAC sector performance, I haven't yet invested in one. At this point in time, I don't intend to do so - but I have to say, I did find the BSAQ & VinFast one somewhat intriguing.

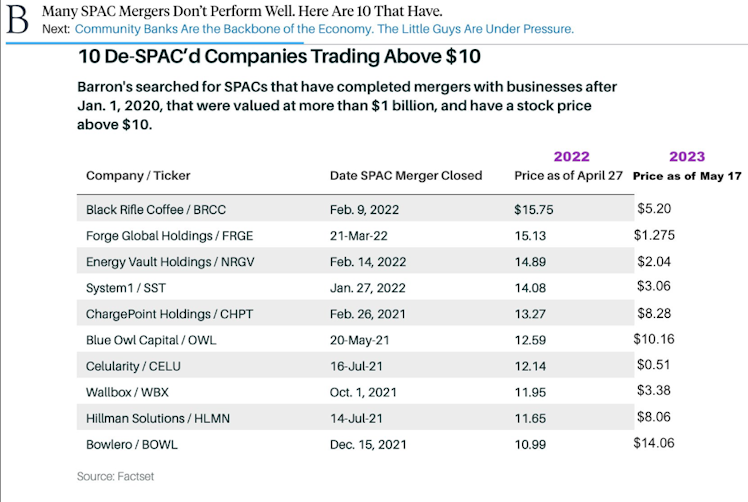

Word to the wise if you're new to SPACs, according to Barron's these were 10 SPACs that performed well in 2022. I decided to add an update for 2023 in the last column, as you can see - your odds don't look great with this type of investment:

Vietnam is a Communist country, so investment opportunities are difficult to come by. If you know of others, I would love to hear about them in the comments below.

For now, if you're interested in investing in Vietnam, an ETF may be the safest to consider. According to Investopedia, the "best and only Vietnam ETF is VNM." You could also look at $GTDDX which is Invesco's EQV Emerging Markets All Cap Fund Class A.

I do not own any of the aforementioned equities/ETFs, but I do have a growing interest in covering Emerging Market opportunities, and look forward to discussing more of them here.

Reuters

Vietnam EV maker VinFast to list in US via a SPAC

Vietnamese electric automaker VinFast said on Friday it will list in the United States via a merger with special purpose acquisition company (SPAC) Black Spade Acquisition Co .

Already have an account?