Trending Assets

Top investors this month

Trending Assets

Top investors this month

Not your Grandma's printer $DM

TLDR

- Formed a starter position in Desktop Metal, waiting on a correction + holding for the long term

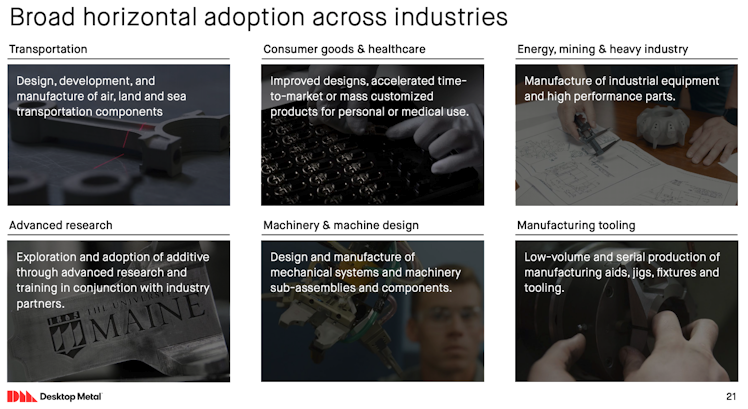

- Manufacturing space is moving from old tools and machinery to a new era with printers

- Investor syndicate, board of directors, and team is very solid

- Market is expected to grow to $146B by 2030 (currently $12B)

- Still a decent amount of execution (beginning stages of rev growth) and product (early stages of market formation) risk

- Reduces waste and is better for the environment

The Market

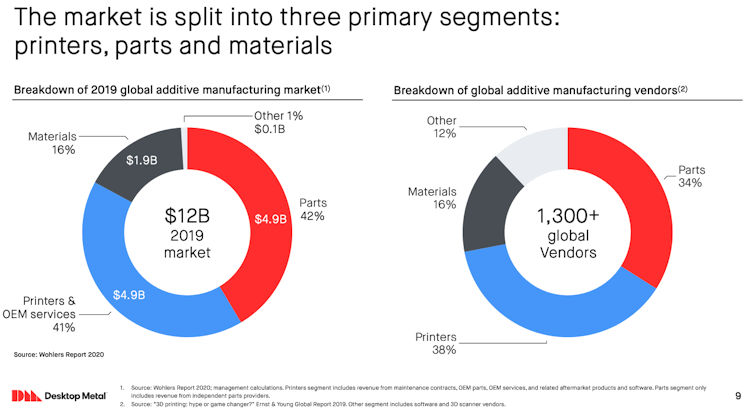

Traditional industrial production (Era 1.0) is done slowly and with a large amount of waste and cost. The future of manufacturing (Era 2.0 aka Additive manufacturing) relies on innovations in materials and the assembly of those materials (via parts and printing).

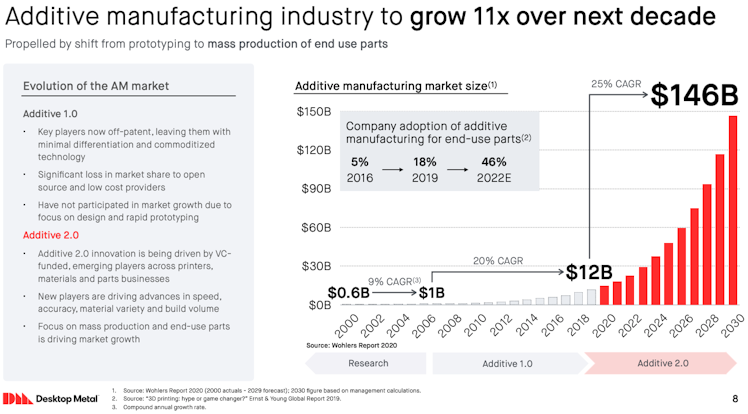

Additive manufacturing is estimated to grow 11x to $146B as companies shift from using 3D printers for prototyping to manufacturing.

The Company

The Founding Team is made up of mostly MIT professors, with the CEO and CTO coming from companies within the hardware space (A123 Systems, Bose, Stanley Black & Decker). Other executives have backgrounds in Venture Capital (NEA) and other hardware companies (Kodak, Stratasys, and A123 Systems).

What I really like about this team is that they have a history of working together (MIT, A123 Systems, and Stratasys) and have been in the hardware + 3D printing space. Further, the fact that the VP of Global Sales and VP of Customer Support come from another 3D printing company instills confidence in future execution.

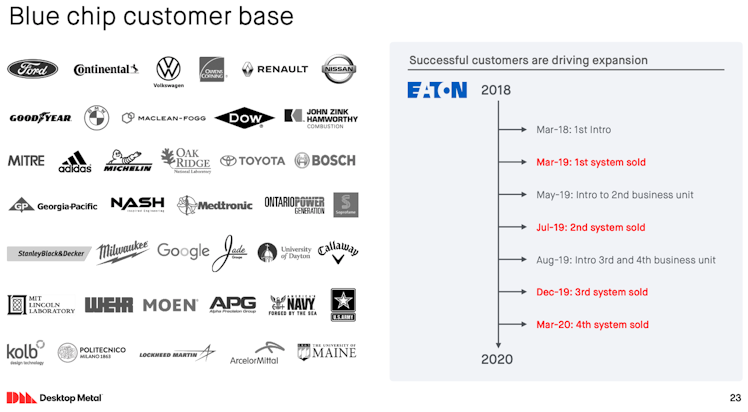

Great investors and strategics fill the company's board. VCs from Google, Kleiner and Lux (a very sci-fi focused VC firm) plus strategics like the CMO of Ford and former CEO of GE make me confident in the network and assistance Desktop Metal will receive over the long run.

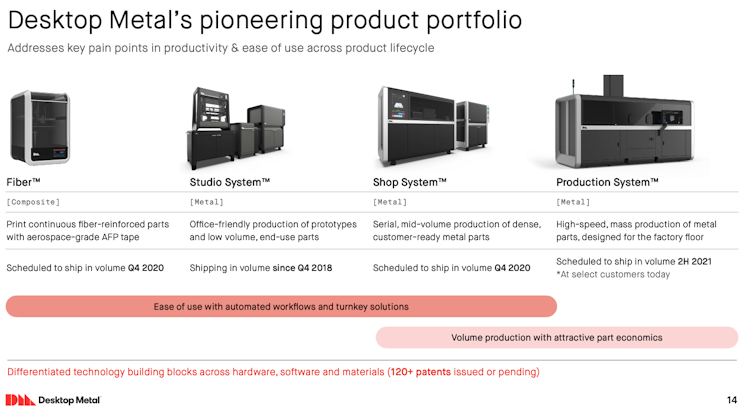

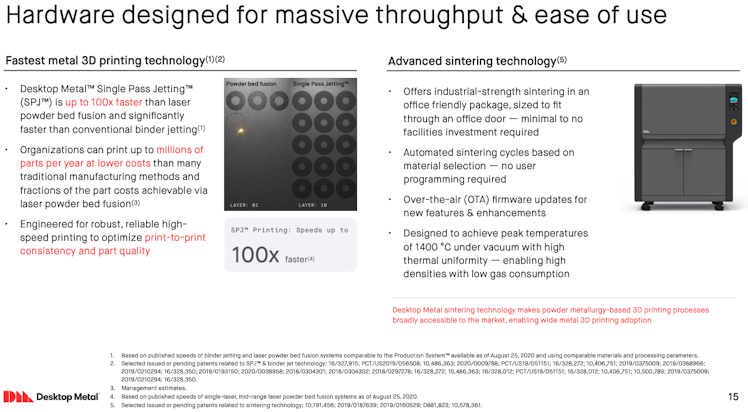

There are currently four main products from the company. These range from composite and metal printers to office-friendly and factory floor suitable.

Financials

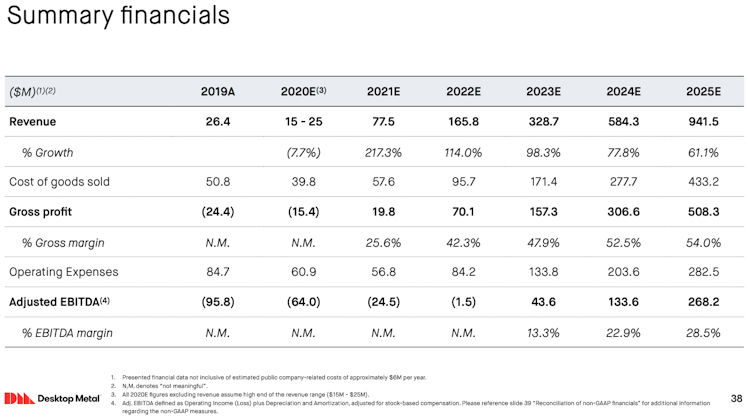

While the market, team, and product are solid - the financials aren't as compelling and clearly show how early this opportunity is (thus why I am looking so much at the team and market). That said, they estimate that in 2022E they'll near positive EBITDA and by 2025E close in on a billion in revenue. While these estimates are certainly years in advance, they already have 90+ Production System (see product graphic above) reservations that provide visibility through the first half of 2024E. I'm hoping that the sales cycle for these products, while I'm sure long, more predictable. Additionally, more near-term, they've experienced a 30% MoM growth in Studio System pipeline in 2020 YTD. It is worth noting that this is also all done via organic growth.

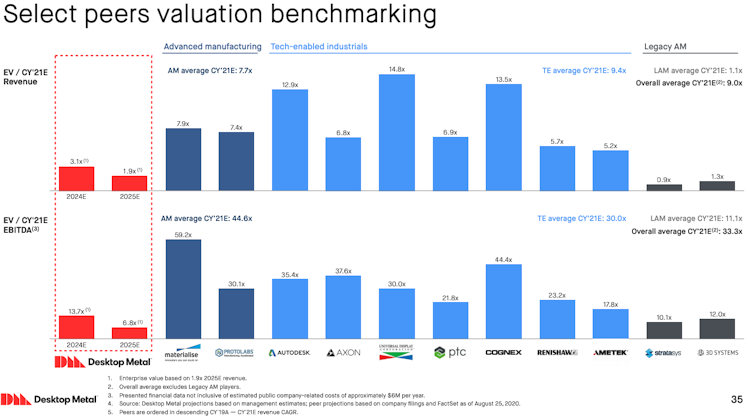

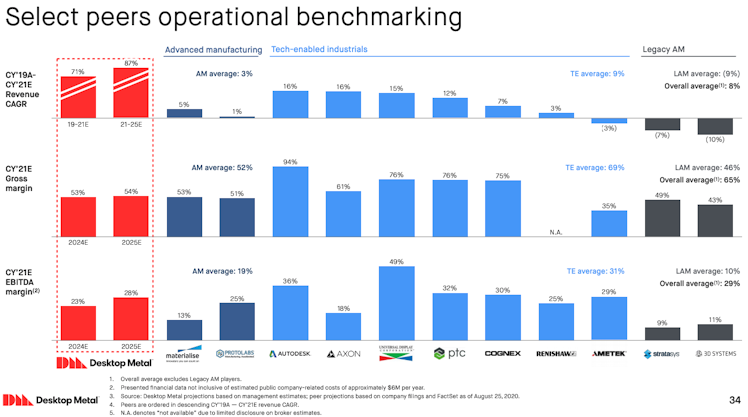

The current price has TRINE around $900M market cap which, based on 2019A is around 40x revenue. This is the biggest risk right now, as the market is incredibly frothy, and while this valuation makes sense in 2023 revenue numbers (see estimates above and benchmarks below) it doesn't right now. Basically, given current benchmark numbers, Desktop needs to drastically outperform estimates or the stock is overvalued.

Conclusion

I bought Desktop Metal to get skin in the game and because I'm a believer in the market and team. Its current valuation is extremely high and doesn't make much sense given revenue numbers. However, I will keep an eye on the team's execution and look to slowly form a more concentrated position (or get out quick). This buy was also about diversifying away from traditional SaaS and gaining more exposure to "hard sciences". I've now done this through my $MP and $SPCE investments.

Sources:

3DPrint.com | The Voice of 3D Printing / Additive Manufacturing

Critical Analysis: Desktop Metal's SPAC Deal - 3DPrint.com | The Voice of 3D Printing / Additive Manufacturing

By now you’ve probably heard about the latest surprise in additive manufacturing startup companies going public. During what is clearly not the best of times for the metal additive industry,...

Already have an account?