Trending Assets

Top investors this month

Trending Assets

Top investors this month

Mathematical formulas to explain investing

There's a lot more to investing than numbers, but the underlying investment principles can be translated into formulas.

Giverny carried out this excercise and translated 4 core investing principles into mathematical formulas.

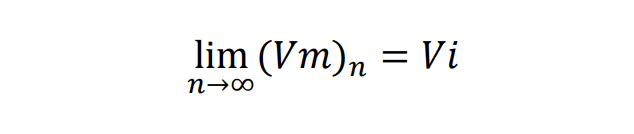

- CONVERGENCE BETWEEN INTRINSIC VALUE (Vi) AND MARKET VALUE (Vm)

As "n" years go buy, the market value of the companies you own should approach their intrinsic value, without exception:

"n" is unknown, though.

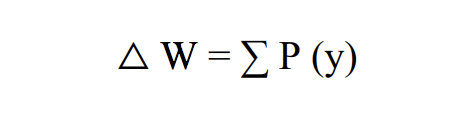

- EQUATION OF WEALTH INCREASE

The increase in stock market wealth (W) is the sum of the aggregate Patience (P) over a time variable (y):

Wealth is built by patient investors. Trying to make money fast can end up making you lose it faster.

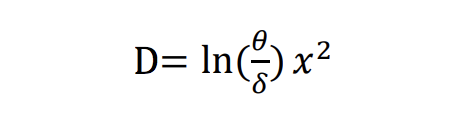

- RISK DECREMENT MEASUREMENT EQUATION

Risk decrement (D) is proportional to:

a. The level of profit margins

b. The level of debt

c. Competitive advantages

Higher "a", lower "b" and stronger "c" should do the trick.

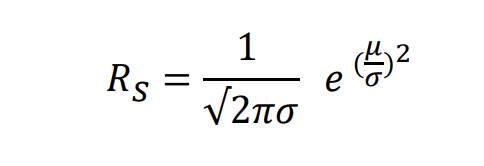

- EQUATION FOR THE NORMALIZATION OF PARAMETERS INFLUENCING RETURNS

Stock market returns (Rs) eventually follow a normalized curve proportional to the rationality of an investor and inversely proportional to their crowd following instinct:

You must be rational & think differently.

Thx for sharing this Leandro. Always interesting to go back to "basics" :)

Already have an account?