Trending Assets

Top investors this month

Trending Assets

Top investors this month

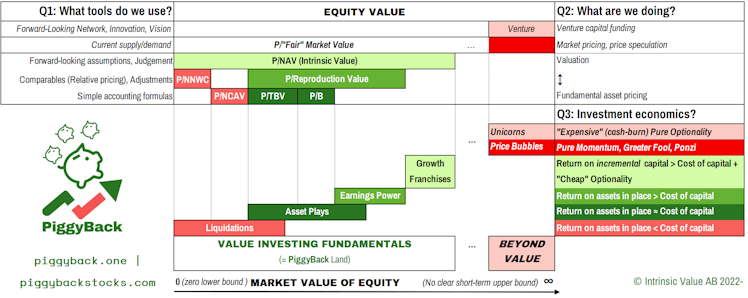

An Equity Value Toolbox - Valuation vs Pricing

*Equity = Assets - Liabilities *

But what asset and liability values are we going to use? The answer as always: it depends on what we are going to use it for.

Below is a map of how different equity value metrics apply in different "value-investing" type situations and in situations well beyond value:

(If the chart becomes too tiny on a smartphone: Try flipping the screen to

horizontal. Or revisit the article on a desktop or reading pad.)

As shown in the chart:

1 @piggyback will try to keep its "piggybacking" research of public capital allocator strategies to the left-most fundamental "Value" parts of the stock market distribution. There we can cover anything from bargain-basement "Liquidations" scenarios to quite richly valued "Growth Franchises" (call this GARP or Quality, depending on terminology).

2 Nothing wrong to move into the rightmost Venture (if you have the special skills and connections) or pure price speculation parts of the stock market. We should just not fool ourselves we can motivate these activities with any precision using fundamental "valuation", whether that is multiples or actual valuation models. It is a different beast.

New and old stock investors interested in fundamental investing find this whole Background in PiggyBack's recent Shades of Value.

Q to @commonstock users below

Q to @commonstock users: If forced to label your current market activities, what would you best characterize yourself as?

66%Fundamental investor

3%Price-driven trader/speculator

14%VC/Entrepreneur

14%All of them, more or less

27 VotesPoll ended on: 6/28/2022

Already have an account?