Trending Assets

Top investors this month

Trending Assets

Top investors this month

Rooting for Imperial Ginseng Products

Summary

Imperial Ginseng Products ($IGP.V) is a Canadian microcap trading at C$0.76 per share while its net assets are worth at least C$1.34 per share. The discounted price per share represents a potential upside of ~70% per my assumptions, and investors can expect the liquidation of the company with proceeds to be distributed amongst shareholders. Management has stated that the wind-up of operations is expected to be completed by the end of June 2023, less than one year from now.

Given the market cap of C$5.6 million, all institutions are likely barred from owning shares of IGP and furthermore, I can imagine that not many retail investors have caught wind of this either given an average daily volume of ~2,000 shares.

Get out (leave!) right now, it’s the end of you and me

There’s no avoiding it, but IGP is not a great business. It’s a commodity business whose fate rests with the weather and the price of ginseng roots. As such, COVID-19 was the catalyst for it to come crumbling down as operations took a turn for the worse:

- Only 1/3 of the temporary foreign workers IGP applied to have in Canada made it through travel restrictions in 2020.

- 14-day isolation periods reduced utilization for incoming workers.

- Ginseng exports to China were halted during the onset of the pandemic.

- When China’s restrictions were eased, retailers were oversupplied because consumers didn’t have access to stores selling ginseng.

- Ginseng prices dropped to $7.70 in mid-June 2020 (average selling prices were ~$32 in 2018 and ~$20 in 2019).

- Labor shortages continued throughout 2020 and continue until this day.

- Supply chains and logistics tangling were a heavy drain of resources.

- Civil unrest in Hong Kong, a primary destination for ginseng exports, put a strain on selling and marketing activities.

Ultimately, most of these factors came to a head and in May of 2020, the Board decided to cease future crop planting activities and instead, focus on harvesting existing crops. Subsequently in October of 2020, the Board decided IGP would exit the industry.

The proxy form released in November 2021 notes a special resolution proposing the liquidation of all the property and equipment followed by a distribution of proceeds to shareholders. The board and management recommended shareholders vote for the resolution. As for the results of the vote, it’s an unfortunate cliffhanger because since then, there have been no filings or press releases on the outcome of the vote. There have only been repeated wordings in subsequent MD&As saying that “the Company’s goal remains to generate the highest possible end value upon the Company’s exit from the ginseng industry”. While some may be turned off due to the lack of explicit vote results, I do believe that currently, management is aligned with shareholders. The board recommended that shareholders vote for the special resolution and continues to disclose that its goal is to exit the industry at the highest terminal value. To the benefit of insiders, Stephen McCoach (CEO and Chairman) and Maurice Levesque (Executive VP and Director) beneficially own ~49% of the company and if my calculations are correct, this unwinding process could benefit them to the tune of ~C$4-5 million. Given another year of working through the operations of a dying company with a seemingly paltry combined salary of ~C$460,000 or getting a nice payout worth potential multiples of that, I think I’d choose the latter.

Valuation

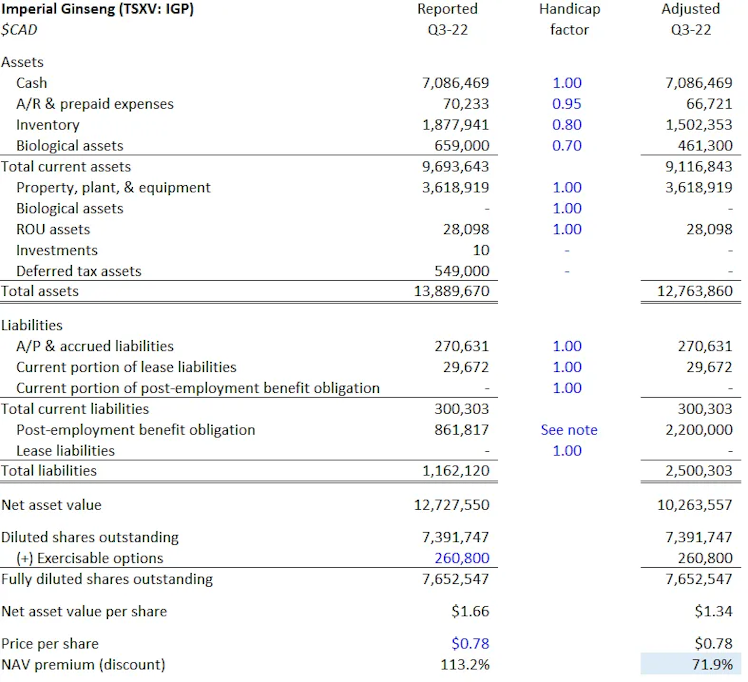

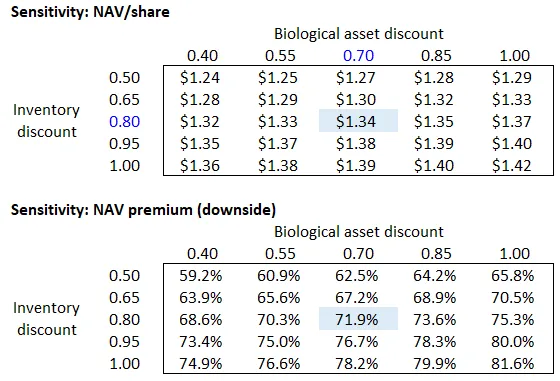

It is said that “liquidations are tricky, they always take longer than you expect them to, and you always get a little less than you expect as well”. As such, below is the most recent snapshot of the balance sheet with self-prescribed handicaps to arrive at a net asset value of C$1.34/share. Note that the post-employment benefit obligation has been adjusted to its future value of C2.2 million as it currently sits on the balance sheet at its discounted value.

Risks

The main risk here is whether the value of such assets can be realized as stated on the balance sheet. Should the company be unable to sell its inventory, it could be forced to take a loss on that inventory, reducing the potential payout, or it could wait longer to try and liquidate, depleting potential IRR. Furthermore, ginseng prices could fall even further. In Q3-22, IGP had to entice buyers with free products. Lower market prices could impair biological assets further and reduce future liquidation values. The good news is that a good chunk of the balance sheet comprises cash.

Already have an account?