Trending Assets

Top investors this month

Trending Assets

Top investors this month

Surgical Science Sweden (SUS-ST) - A high growth play on robotic surgery

Surgical Science Sweden is a Swedish software company founded in 1999 by Dr. Anders Hyltander, David Löfstrand, and Anders Larsson. The company provides surgery simulation software to medical and educational institutions. Its first software LapSim, a laparoscopic surgery simulator was released in 2001 and formed the basis for the business it is today.

Investment thesis

Surgical Science has an established reputation within the surgery and medical education community. Through acquisitions, Surgical Science has positioned itself as the leader in the surgery simulation software and has a privileged relationship with the key players in the growing robotic surgery space. We expect the growth in robotic surgery to be strong in the next 5 to 10 years. Surgical Science is a leader in a very attractive part of the value chain, has great economics and major tailwinds at its back. Although it is difficult to forecast the exact performance Surgical Science will deliver, we believe the company has room to positively surprise investors, even with such a demanding valuation.

Business overview

Surgical Science only sold its simulation software to academic institutions until 2016. This helped the company with being recognized by key institutions that train tomorrow's surgeons. Surgical Science has parlayed this recognition from the academic/residency space to selling to Medical Device companies, more specifically to robotic surgery companies. With the acquisitions of SenseGraphics in 2019, Mimic Technologies in 2021, and, most recently Simbionix during the summer, Surgical Science has bought out all the major competitors that are active in the robotic surgery space.

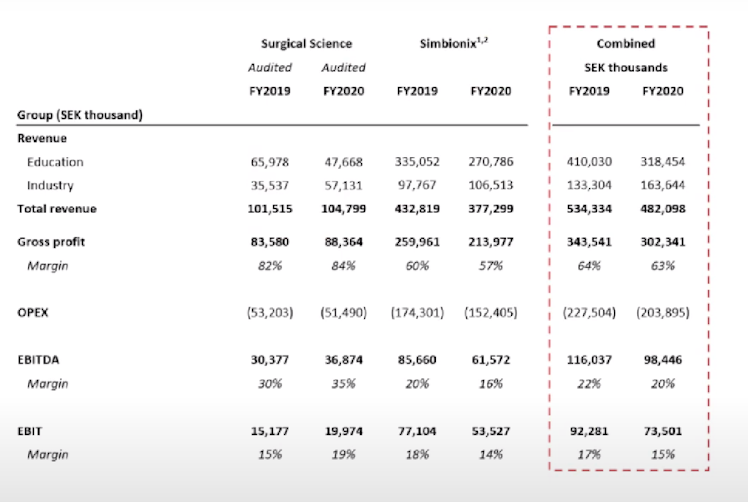

Surgical Science sells its simulation software to academic institutions and university hospitals. This segment is referred to as the Education segment of the company. The sales are mostly done through distributors, while only a small part is sold with a direct sales team. This revenue source is not recurring and has about 60% Gross Margins. In 2019 and 2020, the consolidated Surgical Science (including SenseGraphics, Mimic Technologies, and Simbionix) booked 410M SEK and 318.5M SEK, respectively. The decline from COVID is to be expected. Surgical Science indicated they expected this segment to grow at a 15% CAGR over the next few years.

Surgical Science's second segment, which is the most interesting and fastest-growing segment, is the Industry/OEM segment. In this segment Surgical Science works with robotic surgery companies like Intuitive Surgical, CMR Surgical, Auris Health (part of Johnson&Johnson), and Medtronic to implement their simulation software into their robotic system. Surgical Science gets a consulting/professional services fee for this implementation and later on gets a royalty for each system sold with their simulation software. The royalty revenue comes with 90+% Gross Margins and no sales and marketing costs, the robotic surgery companies essentially sell the software for Surgical Science. In 2019 and 2020, this segment contributed 133M SEK and 163.5M SEK to the consolidated revenues.

As a combined entity Surgical Science and the acquired companies have shown good profitability during these two years, with 116M SEK (21,4% EBITDA margin) and 98,5M SEK (20,4% EBITDA margin) in 2019 and 2020 respectively.

Source: Company press release

To better understand the opportunity Surgical Science has in front of it, we will first go over why we think the robotic surgery space is set to grow significantly in the next 10 years.

Robotic surgery

The current robotic surgery landscape is dominated by one company, Intuitive Surgical. This company will be familiar to many investors as it has been a great stock for its shareholders since becoming a public company. Intuitive Surgical introduced the Da Vinci robotic system in 2000 and the company has been the only company with a robotic system on the market ever since.

Intuitive Surgical has helped legitimize and show the case for robotic-assisted surgery (RAS) as an alternative for minimally invasive (meaning; with small incisions) surgery to laparoscopic surgery. Laparoscopic surgery is also minimally invasive but is done by manually inserting a camera and instruments in the body through small incisions. Open surgery is more invasive and requires large incisions. The advantages of minimally invasive procedures are that patients can recover faster, have less scarring, and need less pain medication.

While many were skeptical about the benefits of RAS, many studies have shown that RAS can be as good if not better for many types of procedures. For anyone interested in Intuitive Surgical and numbers on the penetration of RAS, we would recommend Adu Subramanian's write-up on the company.

In short, there is room to grow even in areas where robotic surgery has decent penetration. As robotic surgery becomes more mainstream, we will see many different types of procedures becoming possible with a robot. Most industry experts state that there is still a lot of growth remaining for robotic surgery in the US, but even more internationally. Depending on what source you use to determine market penetration and the way it is calculated, we think it is likely that the total market grows to multiples of its current size over the next 10 years.

The competitive landscape is changing rapidly as large Medtech companies are investing in robotic surgery, most notably CMR Surgical, Johnson&Johnson's Auris Health (founded by Intuitive Surgical founder Dr. Fred Moll), and Medtronic. While many of these could-be competitors have had trouble bringing their system to market when expected, it seems clear that Intuitive Surgical's days of being the only company in the space are over. Johnson&Johnson and Medtronic's existing relationships with hospitals are going to be crucial in their attempt to take market share from Intuitive.

Intuitive's Da Vinci system costs between 1.5-2.0M USD. This is a significant price tag for hospitals. With high enough volumes of procedures, hospitals actually can get a decent payback on their investment and are incentivized to use the robot as much as possible. With competition looming, it is not a stretch to assume prices will go down as new entrants try to build their installed base. Additionally, Intuitive Surgical, anticipating future competition, has already started experimenting with different pricing structures to lower the barriers for hospitals to acquire the Da Vinci. This will make robotic systems more affordable for more hospitals, which should have a positive effect on adoption.

Surgeons also benefit from robotic surgery. By having robotic surgery as an option, they can help those clients that especially seek out robotic surgery. A common comment from the surgeon's side is also that the robot offers better ergonomics than traditional laparoscopic surgery. Surgeons can extend their career by experiencing less back pain, canceling out tremors that might manifest as they get older and the imagery systems offer great vision, which inevitably deteriorates with age.

Now that we have laid out the case for why we think robotic surgery will grow in the next 5-10 years, we will go through why we think Surgical Science is well-positioned to do well in this environment.

How does Surgical Science fit in all this?

We believe Surgical Science benefits from many tailwinds and incentives in the system that makes surgery simulation increasingly more relevant.

First, let's consider Intuitive Surgical's point of view. By working with Surgical Science, they can quickly educate the surgeon on how to use the Da Vinci system. This would mean that the surgeon can go on to operate on real patients sooner. Intuitive's profit center is not the sale of the Da Vinci, but the sale of instruments for each procedure. Intuitive makes about 2000 USD per procedure. This is where the profit margins lie and where 70% of revenues come from. The royalty that they have to pay to Surgical Science is relatively small compared to the cost of the system, but an important part of its success.

Intuitive Surgical has a standardized education course that must be completed before a live operation. The Da Vinci SimNow simulation package and the Da Vinci Skills Simulator that is integrated are powered by Simbionix software and before that with Mimic Technologies software, both are now part of Surgical Science. Intuitive only can benefit by making sure their surgeons are well educated and certified before they operate on real patients. Not doing so properly would have catastrophic repercussions on the reputation of Intuitive and the Da Vinci systems.

Now, let's consider why a hospital benefits from buying the simulation software along with the robotic system. Here again, the added costs of simulation are somewhat trivial compared to the total price tag of the system. The simulation software would add somewhere around 10-15% to the price tag. A hospital is especially incentivized to make sure that its surgeons are well-trained and adding the simulation software would ensure this is the case. An adverse event due to poor training/education would be a disaster for the hospital (less of a disaster than for the patient, of course). We would argue 10-15% of the initial purchase amount - even less when taking the total cost of ownership into account - is a small price to pay compared to the potential damages poor training would cause.

The case for upcoming competitors (J&J, Medtronic, etc.) is somewhat similar. Those systems still need to get approved by the FDA. They have already chosen Surgical Science as their software partner. The Monarch system, Auris Health's robotic system, recently announced it had performed its 1000th procedure. Compare this to Intuitive's 1M procedures a year, and you'd understand how important it is for these new systems to be used by well-trained surgeons. The stakes are high and they need to ensure their system can go to market without any doubts about safety. Failing this early in the process would set these companies back years and billions of dollars. It would then be very difficult to switch from Surgical Science's software after they have used this software to get FDA approval.

Lastly, as robotic surgery gets more and more common, it wouldn't be surprising that regulators require certification for performing robotic surgery. These certifications would need to be based on trustworthy software that measures performance in an objective manner. A great place to start would be to use the current leader in the robotic surgery simulation space, which currently is Surgical Science.

This brings us to the competitive advantages we think the company has.

Competitive advantages

- Switching costs: As explained above, we think it is very difficult for robotic surgery companies to switch away from Surgical Science's software. Surgical Science embeds their simulation software onto their systems, removing it would cost significant effort on the part of the robotic surgery company. Replacing Surgical Science's software simply because a competitor accepts a lower royalty fee does not seem very attractive considering the risks of implementing another simulation software. The cost of failure is high and that should make any responsible executive think twice and think hard before switching to another vendor.

- Data advantage: Surgical Science has access to 20 years of simulation data in various procedures. As robotic surgery companies sell their software for them, Surgical Science can use the simulation data to improve their software. This head-start is significant. Because the software is so sticky, we think it would be years before an OEM even considers other vendors. Surgical Science can use the training data from all the end-users (surgeons) to improve the software. We think this might lead to a sort of network effect that can keep them ahead of competitors, especially as current and future competitors have to make the software for the procedures Surgical Science already offers from scratch.

Management and Ownership

Surgical Science benefits from a concentrated and long-term focused ownership structure. Board member Roland Bengtsson owns 12.59% of the shares, his family member Jan Bengtsson owns 16.45% through his company Marknadspotential AB. Tommy Forsell, who sold SenseGraphics to Surgical Science, is still involved with 6.87% of the shares. All of them are also on the Board of Directors. We will discuss examples of this long-term mindset and why we believe the largest shareholders are very bullish on the company's long-term prospects.

The management team reveals how Surgical Science thinks about its acquisitions. The CEO, Gisli Hennermark, has had the job since 2015. He is responsible for the implementation of the strategy to focus on robotic surgery and has led the company through its IPO. The CFO, Anna Ahlberg, was previously at another Swedish Medtech company, Vitrolife. She has experience in Finance and working at life sciences companies.

The CTO, Anders Larsson, is one of the co-founders at the company and has led the research and development efforts since the company's creation.

Previous executives of SenseGraphics and Mimic Technologies are still active at the company as Head of Development and Chief Innovation Officer.

An interesting fact is that Simbionix employees have received shares as a retention incentive. These shares have not been issued or granted by the company but by the two largest shareholders Roland and Jan Bengtsson. You read this right. They did not dilute other shareholders but incentivized key Simbionix personnel out of their own pocket. More recently, they have sold call options to the CEO, CFO, and CTO. These executives paid the Bengtssons the option premium and when the options are exercised, other shareholders will not be diluted, only the Bengtssons will be. This is the first time we have encountered such a structure and signals a lot of confidence from the two largest owners.

The Simbionix transaction

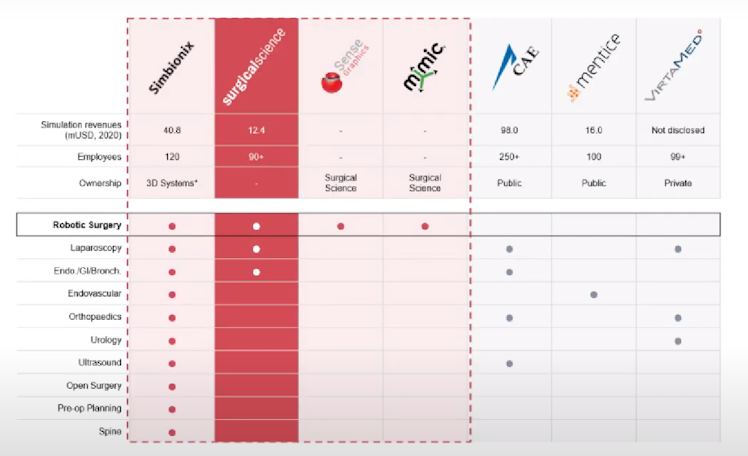

The transaction to acquire Simbionix from 3D Systems is quite interesting. 3D Systems announced they would seek strategic alternatives with some of their business lines to focus on added manufacturing. This meant that their Simbionix subsidiary was suddenly on the block. Coincidently, Surgical Science was already focused on expanding its offering, customer relationships, and technology. In 2019, SenseGraphics was acquired, in 2021 Mimic Technologies. Months after the Mimic Technologies deal, Surgical Science announced they would buy the Simbionix business, which is >3x larger than Surgical Science. All of a sudden, Surgical Science has acquired their only real competitor in robotic surgery simulation. With 3D Systems' financial power, they could have posed many problems to Surgical Science. Now, Surgical Science is the only company focused on robotic surgery. Other competitors like Mentice, CAE Healthcare offer a fraction of the simulation procedures the combined Surgical Science can offer for robotic surgery and have yet to develop any relationships with robotic surgery companies. Out of all these possible competitors, CAE Healthcare would be the most worrisome due to their relationships in the healthcare sector and their financial strength. We are confident in Surgical Science's ability to compete with them, CAE Healthcare is just about 10% of CAE's total revenue and they currently do not seem very focused on surgical simulations, preferring to focus on other types of simulation (mainly Patient simulation and Ultrasound simulation)

You can find an overview of the competitive landscape below.

Source: Company presentation

Simbionix has lower margins than Surgical Science due to the mix of revenue from the Education segment. While Simbionix has a meaningful relationship with Intuitive Surgical, the majority of its revenues come from selling to academic institutions and teaching hospitals. As the companies get integrated we expect Surgical Science to sell the Simbionix simulations to their other clients and vice versa. In the long run, we think the majority of Surgical Science's revenue will come from the very high margin Industry/OEM segment.

It is important to note that the transaction was financed by offering shares to institutional investors. The participants, like Berenberg, TIN Fonder, and Montanaro are already large shareholders with a long-term focus. The largest shareholders did not participate in the offering and thus suffered the same dilution as other shareholders. The size of the transaction and, by extension, the offering was very large relative to the market cap. Simbionix was >3x larger than Surgical Science. We believe the largest shareholders must be very confident in the future of a combined company to give up that much equity and, on top of that, give some of their equity to Simbionix personnel.

The company has revealed it long-term targets. These targets came in exactly at what we underwrote in the model below.

Financials

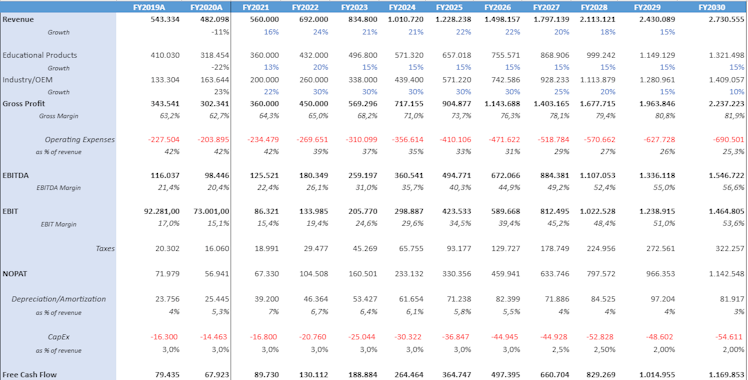

In their previous financial goals, the company had the ambition to reach 400M SEK and a 40+% EBITDA margin by 2024 or 2025. Considering they only had 100M SEK in revenue, this growth probably would have come from organic growth and some M&A. With the Simbionix acquisition, the company has reached its revenue goal. We think that the business model Surgical Science operates should lead to very high margins (think 50+% EBITDA margins) and very low capital intensity. The Education segment has 60-70% GM while the Industry/OEM segment is almost 100% GM once the software is implemented (one-time consulting revenues are lower margin). Additionally, the company does not need to sell its software to every hospital in the Industry/OEM segment, the robotic surgery company sales force does. Distributors do the selling for them in the Education segment. This means that the only costs Surgical Science realistically has are R&D-related and some General and Administrative expenses. We will take those considerations into account in our financial model.

Over time, we expect Surgical Science to grow their revenue in the Industry/OEM at a 30% CAGR until 2026 with the growth rate slowing to 10% by 2030. Revenue in the Education segment would grow at a 15% CAGR on average until 2030. This revenue is lumpier and we are going with what management previously stated as a goal for this segment.

We expect Gross Margin to be strong and to reach 80% as the Industry OEM segment becomes the largest part of the business.

At this scale, we do not think operating expenses should be much more than 20-30% of revenue due to their business model. We go with 25% in our model, this would be plenty for R&D and Administrative expenses.

This leaves us with a 55% EBITDA margin in 2030 at maturity. Considering the company was guiding a 40+% EBITDA margin at a 400m SEK in revenue and the operating leverage the business has, a 55% margin at the much larger scale they now can achieve seems achievable.

Here is how the model looks.

Source: Own estimates

The efficiencies of scale embedded in their business model and high gross margins can do wonders with the growth rate Surgical Science is poised to show.

Based on these expectations and assuming a 25x Free Cash Flow exit multiple, the stock would return an 11,5% IRR over 9 years (exit year is 2030) from the current stock price. A 4% Free Cash Flow yield (Free Cash Flow Yield = 1/25x multiple) is a decent valuation for a business as asset-light, with 80+% GM's and 50+% EBITDA margin. Considering the company does not require that much capital, it is likely that the company would return some cash to shareholders during this period. We did not factor this into our IRR calculation although the company has previously stated intending to pay a dividend in the future.

This is our best estimate of the base case. A reasonable bull case would see Industry/OEM grow at 35% a year until 2026, with growth quickly slowing down to 10%. The Gross Margins would revert back to the Gross Margins Surgical Science had before the Simbionix acquisition (84-85% GM). In this scenario, assuming they spend 22% of revenue on Operational Expenses, the EBITDA margin in 2030 would end up at 62,5%. Assuming similar investment needs and a 30x FCF exit multiple, the stock would return a 16% IRR. Again, we have ignored distributions in our IRR calculation.

A bear case would be that growth is below our expectations and margins do not expand as much as the base and bull case. For the bear case, we assume a 20% CAGR in Industry/OEM, slowing to 7% in 2030. Gross margins do not revert back to pre-acquisition levels and end up at 74%, while Operational Expenses stand at 33% of revenue. The EBITDA margin would be 40%, not bad, but not anywhere near where we think the business could be at scale. With a 20x FCF exit multiple, the stock would return a poor 1,7% a year, excluding any distributions.

As you can see, our expectations are high, as are the market expectations. With the tailwinds we previously discussed, we would not be surprised if the company outperforms our base expectations. This can happen by growing faster, longer, or by achieving high profitability levels earlier than we have modeled. We believe there is some low-hanging fruit by cross-selling simulation modules they have acquired across the customer base to grow revenues and margins. The general growth in the adoption of robotic surgery is another tailwind that makes us believe the company could well 5x their revenues in the next decade.

While today’s price reflects these high expectations, we think starting a smaller position in the Partnership Investing portfolio at these prices is a decent opportunity. This is a volatile stock and not for the faint of heart. But the volatility could present an opportunity to build a larger position at lower prices for the long-term investor. We thought this was such an interesting company with good prospects that it would be a shame not to let our readers know about it sooner solely because of the current price and hope that even those who are not as positive about the stock have enjoyed our thoughts and analysis.

Risks and question marks

Any investment case knows risks. Some are known, some unknown. We will try to take you through our thinking when evaluating the risks for Surgical Science.

1) The Robotic surgery companies could decide to do the simulation software themselves.

This is could definitely be a risk. These companies have the wherewithal to insource this part of their offering. Our thinking on this matter starts by looking at the decisions that have been made until now and ask ourselves Why have they not done it yet?

During our primary research efforts, we encountered that Intuitive Surgical was keen in choosing to insource parts of the Da Vinci robot that were initially outsourced. Yet, they have chosen Simbionix as their partner as recently as 2019 after a 12-year relationship with Mimic Technologies. If they ever wanted to start insourcing, this would be the perfect moment, right before competition enters the market. But they didn’t.

Medtronic and J&J have also chosen Surgical Science as their partner. They did not choose to outsource the simulation software due to a lack of internal resources, these companies are flushed with cash and have access to amazing talent. It is also not due to a lack of software expertise. Yes, these are medical device companies, but these robots have very advanced software in them.

We think it boils down to differentiation. Having a “better” simulation software to bundle with the robot is not a key differentiator. While training surgeons properly is key to the success of the product, the main considerations in the buying process are patient outcomes and costs/ROI. The simulation part is, at the very most 15% of the purchase price. When adding the cost of servicing the robot, the costs per procedure, and other ancillary costs, the simulation software is a rounding error in the ROI calculation. Medtronic and J&J will not take market share from Intuitive by having better, proprietary simulation software, but mainly by showing better outcomes and ROI with their surgical robot systems. The initial purchase price of the system is also low margin anyways; all or most of the profits come from service fees and surgical instruments. So if we were the CEO of Intuitive Surgical, would we focus our efforts on making the software used for the real surgical procedures better, or would we focus on an add-on product that you essentially sell at cost? The answer seems clear to us and it then makes sense to work with the company that is perceived by everyone as the default choice. These are the main reasons why we believe Surgical Science is in an interesting niche of the value chain that the large robotic surgery companies will not try to vertically integrate.

2) Surgical Science currently has no competition but will have more competition soon.

Interestingly, Surgical Science had a lot of competition — until they bought them all. Not only that, but they retained the key talent in all these companies and kept them incentivized. We believe the switching costs make it difficult to switch to a competitor with little to no experience in robotic surgery simulation. Additionally, Surgical Science is the only company that has a wide portfolio of different procedures and is focused on robotic surgery. This head-start, combined with the data Surgical Science has and will acquire through the installed base will make it very difficult for a competitor to emerge and challenge Surgical Science as the default choice in the market (see Data Advantage).

However, if Surgical Science’s software was to fall behind dramatically, robotic surgery companies, hospitals, and surgeons would be incentivized to switch to preserve their own reputation. Although we are confident in the company’s ability to keep improving their software, there is always the risk of competition on the horizon. We therefore must keep an eye on how often Surgical Science releases new software, new entrants and their products, and how much Surgical Science spends on R&D.

3) Valuation and size of Total Addressable Market

Currently, around 2% of all surgeries are done using robots. This gives a lot of room for growth. But the valuation of Surgical Science, paired with the uncertainty of how many surgeries can actually be done using a robot actually are good reasons to be uncertain. Could the 2% penetration be raised to 10% globally within 10 years? We think so. Could this number be higher? Maybe. Are there reasons why the penetration might disappoint (say 5% in 10 years)? Yes, some surgeries do not lend themselves as well to robotic surgery and costs will be prohibitive in many less developed markets. This is a risk that we will have to monitor. Intuitive has been able to expand the addressable procedures and costs will come down with competition looming, this makes us more comfortable than we would be in an unproven industry. In short, the range of outcomes is wide and we will size the position appropriately.

Conclusion

We believe Surgical Science Sweden is another innovative Swedish life sciences company with tremendous growth potential. A bet on Surgical Science is a bet on the adoption of robotic surgery without having to pick the winner between Intuitive Surgical and its future competitors. The largest players in the industry have chosen Surgical Science as their partner for simulation software, demonstrating confidence that Surgical Science is the leader in this market.

The risks are that the company does not achieve the business results the market expects, however, we have reasons to believe that these risks are mitigated for the reasons described earlier. Although we do not expect their clients to develop simulation software themselves and Surgical Science is well ahead of the competition, we should constantly re-evaluate the company's moat by keeping an eye on the competitive and industry dynamics.

With everyone in the system benefiting from implementing surgery simulation, we see a lot of demand in the future as robotic surgery grows globally. Surgical Science, backed by long-term owners with skin in the game, is well-positioned to take advantage of this opportunity. The stock price should reflect such business performance if the investment case plays out as we described.

Additional resources:

Disclaimer: Always do your own research. This is not investment advice and is for informational purposes only. Partnership Investing is not a registered investment adviser and may or may not hold securities discussed on this blogpost.

YouTube

Company Presentation Sep 2021

Company PresentationPareto Securities’ Annual Healthcare Conference September 1, 2021 (English)CEO Gisli Hennermark

Already have an account?