Trending Assets

Top investors this month

Trending Assets

Top investors this month

3Q 2021 Investment Letter & Results

Below is the 3Q 2021 Letter that I sent to clients.

Performance Analysis

During the third quarter of 2021, our aggregate managed capital (the “Portfolio”) returned -1.17% net of fees, versus the S&P 500 Index (the “Index”) return of 0.58%.

Our aggregate performance metrics can be accessed here

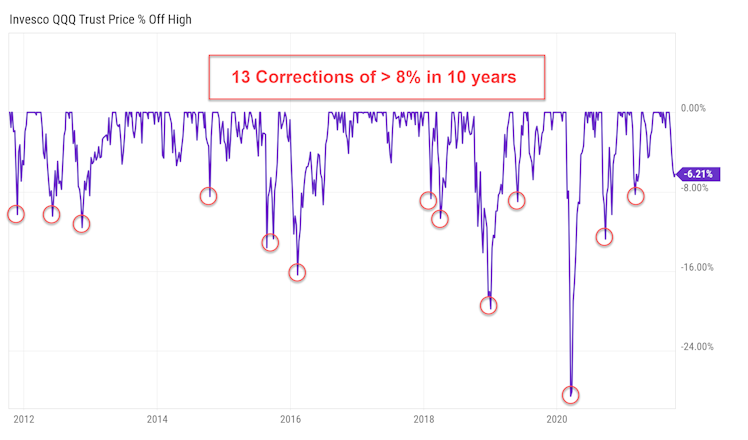

The past couple of weeks were challenging on our portfolio. Out of the +126 months we’ve been in business, September 2021 ranks as the 8th worst monthly performance. As I write this, the start of October is showing signs of turning around. Historically, these corrections usually last between 2 - 3 months. It is not uncommon for corrections of 8% to 15% to occur.

While we don’t manage the portfolio with short-term monthly, quarterly, or even a single year’s performance in mind, it’s important that our partners understand the context for these last few months.

Looking at the last six months, we have seen a rather notable rotation into cyclicals, traditional financial services, and commodity-driven stocks such as energy. Ironically, we believe that these two sectors are most likely to be disrupted by innovation during the next five years.

It just proves that predicting the market's short-term future behavior is impossible. Instead, our goal is and always will be to optimize for long-term wealth creation, and part of the trade-off is short-term volatility along the journey.

Currently, there are strong and disruptive secular forces at play, and we would prefer to own businesses that are disruptors rather than those that are being disrupted. The Portfolio remains well-positioned for long-term growth. It appears that secular tailwinds, which have accelerated during the pandemic, will continue to persist, mainly because they offer a better value proposition. We have focused on companies that move technology infrastructure to the cloud, as well as enable mobile services, new payment methods, big data, and internet security.

Market Environment

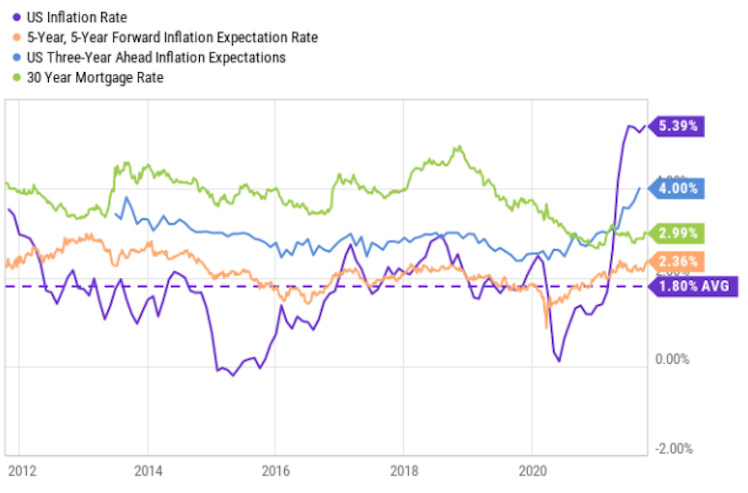

A material number of economic events have transpired that point to a breakdown in the notion that inflation will be “transitory.” Inflation has rapidly accelerated this year, and there seems to be no policy urgency to stop it.

- Over +10 million job openings, hires of 6.3 million, and quits of 4.3 million

- Energy commodity costs have risen over 40%

- Food costs are up 4.6% YTD

- John Deere unions are striking for “insufficiently increasing wages…”

- The spot price for sending such a box from Shanghai to New York, which in 2019 would have been around $2,500, is now nearer $15,000

- Social Security Administration will increase benefits +5.9% in 2022

- Henry Hub Natural Gas Spot Price is up +100% YTD

- US natural gas rotary rigs in operation have decreased ~50% since January 2019

- The copper spot price is up +50% since January 2021

Further increases in energy inflation are inevitable in the coming months given the recent surge in wholesale gas prices and the spurt in crude oil prices.

The long-term impact of inflation and supply chain disruptions

Due to a constrained labor pool and high wages, companies will be forced to rely less on hiring low-paid workers and more on automation and artificial intelligence. Jobs such as supermarket check-out clerks and assembly-line workers in manufacturing plants can both be automated away.

Who will fare better in an environment of rising wages and supply chain stress?

(1) Companies that are able to invest large sums of capital into automation will perform better than those that are capital constrained. (2) Businesses that operate in an environment where the inputs are constrained but have the technical and capital capabilities to vertically integrate, thereby, securing supplies and resources to produce outputs.

Portfolio Management

Turnover was above average during the quarter. We initiated positions in Okta, Elastic, Palo Alto Networks, Upwork, Fiverr, Square, and Ondas. We sold off our position in Bristol Myers Squibb and SailPoint Technologies.

Elastic ($ESTC)

Elastic is a search company that builds self-managed and SaaS offerings for search, logging, security, observability, and analytics use cases. I’ve been waiting for quite some time for an entry point. We got that entry point and executed the trade.

Palo Alto Networks ($PANW)

Palo Alto Networks is a leading cybersecurity vendor, transitioning successfully from a hardware-led to a subscription-led revenue model. We purchased the stock recently and it has blown past what we consider fair value. Growth, margins, and the balance sheet are all very strong. Cyber intrusions are occurring more frequently and companies need to protect their data, driving the industry to a secular growth trajectory. If it continues to appreciate throughout the year, we would consider reducing our position.

They are both considered to be at the forefront of the future of work. $FVRR is productizing jobs and $UPWK is making it more efficient to hire longer-term freelancers across the world. These companies are breaking down the boundaries of geography. As marketplaces, $UPWK and $FVRR are affected by network effects. I believe these companies will continue to grow, innovate new products and services, and ultimately be the place where you go to find short-term and long-term employment.

Square ($SQ)

Square's ($SQ) original focus was on merchant services and mobile POS hardware, but the company has arguably created a peer-to-peer payment conqueror with Cash App, similar to PayPal's (PYPL) Venmo. While Square began by offering a broad range of merchant services, Cash App is now its primary source of revenue. Square can take advantage of Cash App's expanding ecosystem and growth to accelerate revenue growth after the merchant side recovers from its Covid slump.

In August, Square announced that it intends to buy Afterpay for $29B. The deal will be completed by Q1 2022. “Buy now and pay later” is a story that will largely play out in emerging markets, where credit card penetration is low. Growing in countries with established credit cards will require a lot of effort. My bet is that this deal could be beneficial to both companies in driving international growth where the financial system is still in development.

Okta ($OKTA)

During our review of SailPoint, we decided to invest in Okta and divest from SailPoint.

Okta is the leading independent provider of identity for the enterprise. The Okta Identity Cloud enables organizations to securely connect the right people to the right technologies at the right time. In other words, it manages how users access applications, data, and other enterprise resources. Okta verifies your identity, determines what you have access to, and helps an organization manage policies and processes at scale for its networks and systems. The Company also provides enterprise tools for access governance and administration. Tasks include advanced controls, monitoring, logging, reporting for compliance, analytics, and audits.

The incumbent, SailPoint Technologies, has a large customer base with their software installed on-premises. However, the move towards the cloud has opened up the space to new entrants. Okta’s products and services are structurally better. As far as functionality, Okta has a broader range of cloud capabilities, especially when you factor in their new offering. Additionally, the cost of implementation is significantly lower with Okta. These structural benefits will likely provide a lasting advantage that will be reflected in revenue growth.

Okta’s products and services are divided into two solutions:

- Workforce Identity - Protect + enable your employees, contractors + partners

- Customer Identity - Create frictionless registration + login for your apps

These solutions are essentially a bundle of platform services.

Okta Valuation

Despite the fact that Okta shares have never been particularly cheap, the combination of a stagnant share price, paired with a negative reaction to what was a positive quarter, provided investors with an entry point that had not been available in some time. With an expected CAGR of 40% for the next year, the EV/S should be ~20x (FY 2023), slightly below average for the company's growth cohort.

Okta Acquires Auth0

Okta’s acquisition of Auth0 was a “forced chess move.” Auth0 was Okta’s primary potential competitor. There were rumors that Salesforce, an investor in Auth0, was eyeing it as a potential move into cyber-security. By acquiring Auth0, Okta eliminated the direct competitor and gained additional firepower from their customer identity product, increasing the addressable market and a new way of reaching out to customers. Auth0 was built on a “developer-first” sales strategy.

Their go-to-market strategies are different. Auth0 targets a wider audience and offers a freemium model (a business model in which a company offers basic features to users at no cost and charges a premium for supplemental or advanced features). Developers have access to a good portion of their services free of charge and this is a reason why Auth0 is popular amongst developers. The strategy is built to acquire, expand, and extend amongst the masses. With time, they have acquired a large pool of clients and this allows them to perform sales at a lower price.

Okta’s goal is to target large clients with big budgets. They target companies with large IT departments that can use their platform very frequently and increase their spending/usage on the platform.

Other Readings You Might Enjoy

Crytpo / NFTs - Getting Acquainted with the Terminology and the Ecosystem

- The marketplace behind NFT mania (Link)

- The NFT ecosystem explained (Link)

- DeFi deep dives (Link)

- Starters guide to crypto (Link)

- ProShares Bitcoin Futures ETF Starts Trading on Tuesday 10/19/2021 (Link)

The Future of Lasers // Used in cameras, and in the car’s auto-pilot systems.

- Why lasers are so brilliantly useful (Link)

Firm Update

I am excited to share some details of the next chapter for my firm. I am rebranding the investment arm as Strategic Investors. This will be more in line with the vision I have for the firm as an asset management firm. In our work with private clients, I have come to believe that it is not enough for investment managers to have conviction in their portfolio positions. Clients must also have conviction in the investment manager and the investment process. In addition to producing high returns for the accounts that I manage, my goal is to help clients maximize their personal returns by helping them keep their convictions during the inevitable challenging periods we are sure to face.

Final Thoughts

Having a patient and long-term-minded investor base is a huge advantage as it allows me to think about our portfolio on a multi-year horizon. This requires trust and patience on your end, and I am thankful that you extend that courtesy to me.

So again, thank you.

Gabriel Kaplan, CPA CFP®

Strategic Investors // Wealth Habits

PS: I will be starting my own substack in the near future

The Economist

Why lasers are so brilliantly useful

It has failed to live up to its perceived military potential, but the laser’s peaceable applications have been spectacular

Already have an account?