Trending Assets

Top investors this month

Trending Assets

Top investors this month

What I Learned from Trading: Focusing on Risk

So far, I've discussed the following trading principles that were instrumental in my improvement as a long-term investor:

- Know your edge (advantage) in the market and play to that edge.

- Have a repeatable, documented positive-expectancy investment process. Treat every instance where you haven't followed your process as a mistake, regardless of outcome.

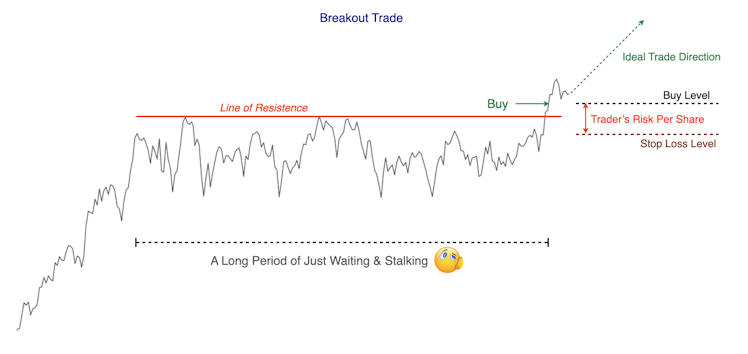

The Hollywood image of a trader in the financial markets is one of a slick, fast-talking, gambler who makes big bets in quick succession while staring at a kaleidoscope of screens and news feeds. The Hollywood trader's life is one of action and excitement. Of course, the reality is quite different. Most traders wait patiently and inert for very long periods of time ... sometimes days, sometime weeks ... until the right set-up eventuates. They're extremely decisive about taking their signals, but an alignment of factors can take a long time before the trader's entry rules are satisfied.

Patience and self-control is one of the key attributes of a successful trader. An obsession with controlling risk is another.

"The good fighters of old first put themselves beyond the possibility of defeat, and then wait for an opportunity of defeating the enemy"

Sun Tzu

The Art Of War

Master traders control the amount of capital they risk. They consider themselves to be risk managers, first and foremost. If you blow up your trading capital, it’s game over. You have to save up more coin and start from scratch. That's a massive handicap in the race to your financial freedom number. To win in this game, you have to stay in the game.

"Most successful market professionals achieve success by controlling risk"

Van Tharp

Trader’s always talk about the R value. This is the initial risk taken in a given position. The R-multiple is the profit expressed in multiples of the initial risk (R) taken. If a trader risks amount R, they hope to make a profit in multiples of how much they risk: 2R, 3R, 4R … 10R. This is the equivalent of investors talking about multi-baggers.

A trader might buy a stock at $10 and then place a stop loss order at $9. If the stock price falls to $9, the stock will automatically be sold and a $1 per share loss will be crystallised. This stop-loss order ensures the trader only risks $1 per share instead of the full $10. By design, the trader predetermines and limits their full downside risk. If the stock price rises to $14, then $1 per share has been risked to make a potential $4. This is a successful 4R trade and the essence of reward-to-risk asymmetry: profit is in multiples of what you risk (more on this in a future post).

Market index investors can also think in terms of R multiples. The market index investor puts money down and risks the entire amount invested: R = Capital Invested. This seems like a very risky play on the face of it, but long-term investors generate reward-to-risk asymmetry by capturing the long-term returns of the aggregate stock market. They hop on the big stock market growth trend, ride out any volatility and hold for multiple decades.

During the exuberance of the last bull market, a lot of young "investors" placed huge bets on one or two stocks in a YOLO strategy to make big money fast. The justification was it would take decades to build up enough capital to reach financial freedom, so why not throw in all your chips and go for it? For the lucky few who got in early and reaped the benefit of Ponzi herding, it worked. For most others, it was disastrous. The real problem is this type of "all or nothing" bet can become imprinted behaviour when it works. It won’t serve you well over the long run because for almost every "all or nothing" gambler, you’ll eventually bust.

"There are a few things you must learn and master to become a great stock trader:

- Respect Risk - managing risk vs. reward is the Holy Grail in speculation ..."

Mark Minervini

Trading Champion & Stock Market Wizard

Traders learn to preserve their capital by managing downside risk. Van Tharp believes the way traders put their investment capital to work will be responsible for 90% of their performance variability. He explains:

"What would you say if I told you that a little-known variable accounts for more than 90 percent of your performance variability? ... Well, there is such as variable, and we call it position sizing strategies. These strategies account for most of the performance variability between different investors and traders, and they help you achieve your objectives. Position sizing strategies define "how much" for you throughout your trade. And it is through "how much" that you will succeed or fail to achieve your objectives. It's that important"

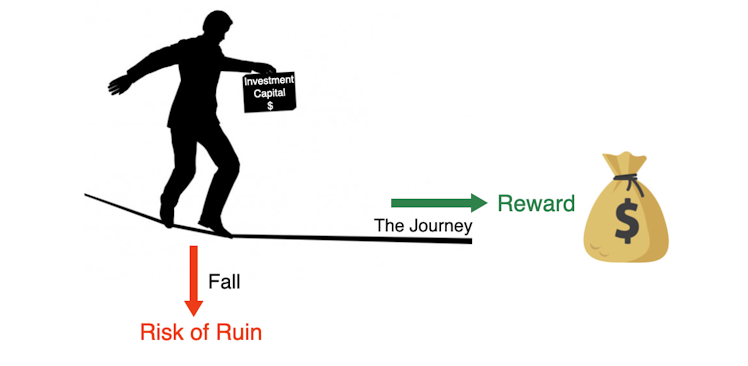

Traders need to find the right balance between allocating enough capital to each trade so it moves the needle enough to make a difference when it's successful, but not allocate too much that a string of losing trades exhausts the available supply of trading capital (risk of ruin). Position sizing refers to the percentage of total funds you allocate to a single position. Van Tharp explains the concept with an example:

"You should never enter a trade without predetermining your risk, which we call R for short. For example, you might buy a stock at $10 and decide to get out of if the stock falls to $8. Thus, your initial risk is $2 per share.

Your total risk for any one position probably should not exceed one percent of your capital. For example, if you are trading $50,000, then your risk per position should not exceed $500. Therefore, at $2 risk per share, you can buy 250 shares for $500 total risk. Notice your total investment would be $2,500 but your initial risk should be only $500 or one percent"

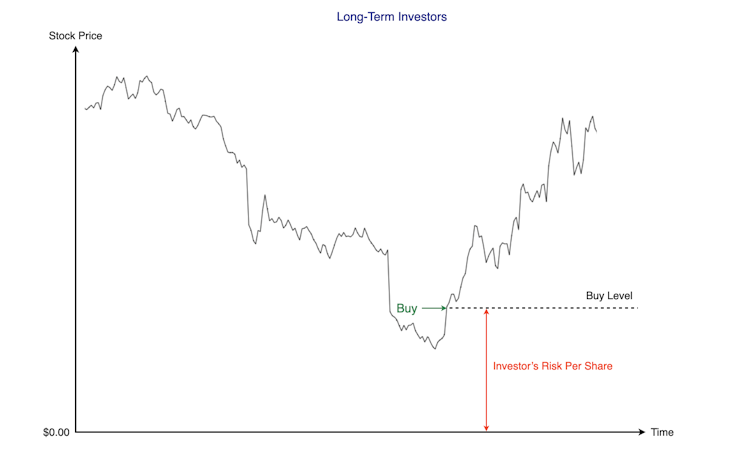

As long-term investors, we theoretically risk the full price per share because we don’t use stop loss orders.

Our exit criteria isn’t predicated on adverse price movements, it’s based on business considerations. We aim to hold a stock for as long as our business thesis holds. A drop in the stock price shouldn’t trigger an immediate sell. We have to re-evaluate our business thesis first and conclude that it’s broken as well as assure ourselves there’s no other attractive reason to hold the stock (a business thesis can evolve over time). Stock prices will regularly oscillate above and below the company’s intrinsic value because prices are tossed about in ocean swells of changing market sentiment.

Position sizing is tricky when you first begin investing with a small balance. It’s likely you can only open a couple of stock positions for each position to be worthwhile. This makes it even more imperative you choose wisely, or even start with a market index fund to get instant diversification before you start buying individual stocks.

If you have $10,000 available to invest in individual stocks, you could commit $2,000 for each stock position. You’ll end up with a total of 5 individual stocks. When I first starting buying individual stocks back in the early 90s, I only committed $2,000 per stock position. Since I didn’t use a stop-loss for my long-term investments, the entire $2,000 is the amount of capital I risked (variable R) per position. If I chose wisely and held for a decade or more, my position could grow into multiples of the original risk capital (5R, 10R or 20R). I’ve never had the skill or the good fortune to own a 100R stock.

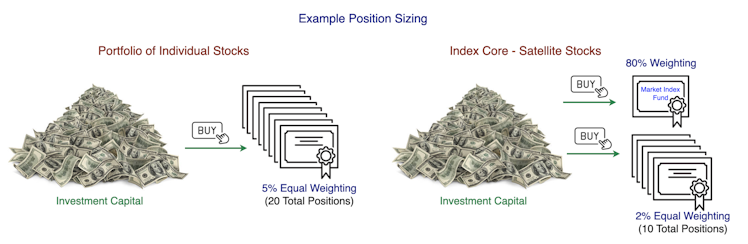

The most common method of position sizing is an equal amount or equal percentage of total capital for the initial stock purchase. An investor choosing to build up a portfolio of individual stocks might set up a first milestone of saving and investing $100,000 (your cost base, not your portfolio value). The investor could resolve to save $5,000 before opening a new stock position. A total of 20 stock positions could be opened by the first milestone.

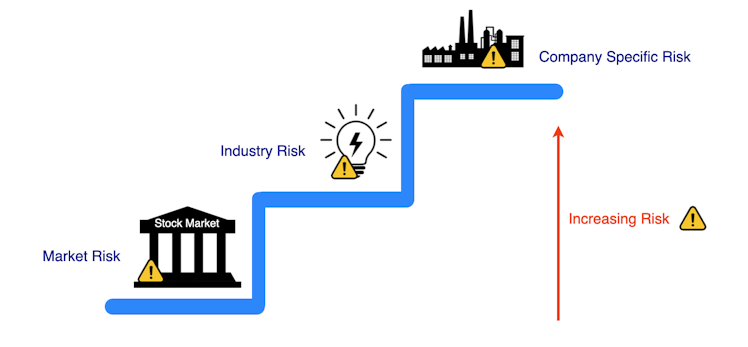

Numerous studies have shown a portfolio of 15 to 20 stocks spread across different industry sectors is sufficient to reduce company-specific and industry risk. Company-specific risk is the risk of a particular company’s stock will plunge because of an impairment to the operations and reputation of the business. A company faces a number of risks including, but not limited to:

- Falling revenue because of the actions of a competitor (disruption, price war)

- Loss of relevance due to changing consumer tastes

- Increasing input costs because of the actions of suppliers

- Missteps in strategic direction due to poor executive decisions

- Litigation risk because of product or service failures.

- Insolvency due to poor fiscal management

Companies are also subject to industry risk. This is the risk that all company stocks belonging to a specific industry tank because of an event or external factor emerges to threaten an entire industry. For example, falling oil prices will affect all stocks in companies that operate in the oil exploration industry.

When we invest in a market index fund, we only expose ourselves to market or "systematic" risk. This is the volatility risk of being invested in the stock market, irrespective of what individual stocks or funds you own. Systematic risk can only be diversified away by investing in other asset classes such as property, bonds, precious metals and cash.

If the investor decides to anchor the bulk of their portfolio in a market index fund, the remaining allocation can be split into 10 or more equal amounts for investment in individual stocks. An investor can continue to dollar cost average into the market index fund while saving the required cash for each individual stock.

There’s an infinite number of permutations when it comes to position sizing. The underlying reason for using position sizing is to avoid the risk of ruin. Luck and randomness can play a significant role in trading and investing outcomes. You want to spread your bets widely enough so your wealth isn’t hijacked because a few stock positions went disastrously wrong.

If you anchor your portfolio with a market index fund, your risk of ruin is almost negligible. The chances of the entire US stock market plunging to zero would be unprecedented. It’s not an impossible scenario, but if the US stock market goes to zilch you’re probably not going to be too worried about losing all your money because the currency of that world is going to be fresh water, canned food, guns and ammo.

The skilled investor walks the tightrope between reward and risk. Downside risk must be identified and managed at all times. Each bet should not expose the investor to ruin. An investor has to remain in the game long enough to reap the long-term expected reward. This means building resiliency into our processes. We can use judicious position sizing to overcome a string of bad outcomes. This is one of the key elements in the craft of investing.

Thank you for reading. I sincerely hope this particular series of essays about how I learnt to trade counterintuitively made me a better long-term investor has added value to your own investment journey.

Already have an account?