Trending Assets

Top investors this month

Trending Assets

Top investors this month

Debt ceiling, June rate hike, is the market overly optimistic?

In the past week, from a macro level, there are two major events that give investors further optimistic confidence.

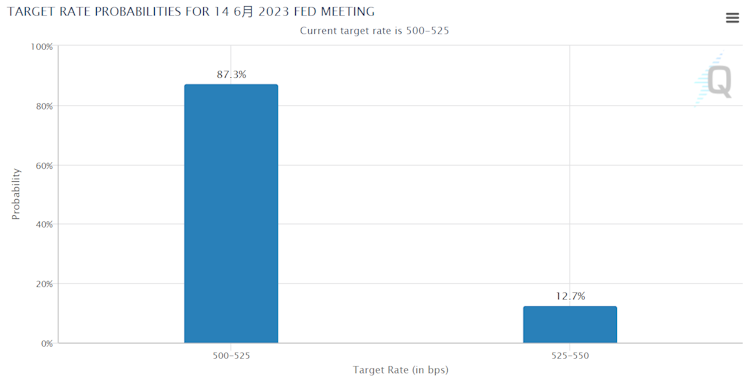

First, the market believes that the Federal Reserve suspended the rate hike in June, and has got the corresponding information from FOMC members.

First of all, Powell's starting point is that the tightening of credit conditions caused by the banking crisis has already played a tightening role to a certain extent, so he supports that the peak interest rate of the Federal Reserve will be lower than expected. As a result, the market reacted strongly, US bond yields rose and the US dollar exchange rate strengthened.

However, the suspension of rate hike in June does not mean that rate hike has stopped since then, and other officials have expressed support for continuing the rate hike.

Bostic, chairman of Atlanta Federal Reserve, said that inflation may be more sticky than the market thinks, the unemployment rate is the lowest level in more than 50 years, the economy is very strong, the Federal Reserve may suspend in June, and it may be more inclined to further rate hike rather than cut interest rates in the future, and it is not expected to cut interest rates this year.

Williams, the "No.3 person" of the Federal Reserve and chairman of the Federal Reserve of New York, delivered a speech before Powell's speech, indicating that the epidemic "has not changed the model estimation of neutral interest rate".

Mester, chairman of the Cleveland Fed, based on the data I have so far, considering that inflation has been so stubborn, for me, I don't think the probability of Federal Funds rate rising and falling in the next step is equal.

Dallas Fed Chairman Logan said that the current economic data cannot rule out the possibility that the central bank will continue to rate hike at the next meeting, and Logan said that inflation still has a long way to go to return to the target level.

This means that the market is already Price-in, which is likely to be too optimistic. Once the CPI data (especially the core CPI) in May continues to show strong stickiness, the rate hike channel may continue to exist.

Second, the market thinks that the debt ceiling problem is just a bipartisan tug and will be solved eventually.The U.S. government will usher in the debt ceiling X day, and an agreement must be reached before June 1. However, because Biden will attend the G7 meeting, the negotiations were suspended last week.

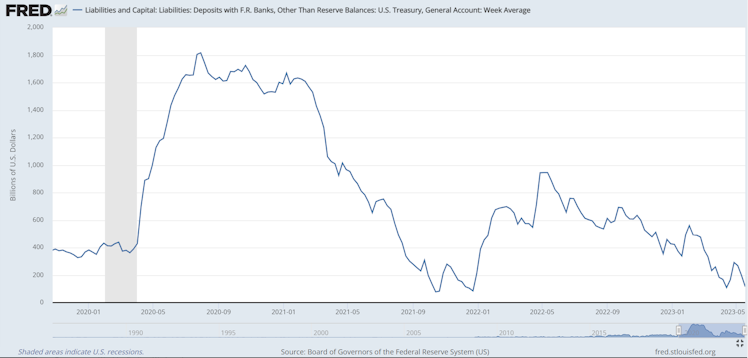

And Biden's follow-up negotiations after returning to the United States from the G7 summit. Once the debt ceiling crisis is resolved, the U.S. Treasury Department will return to borrowing more than one trillion dollars to make up its cash reserve (TGA) account.

Therefore, market liquidity may once again be occupied by subsequent Treasury Bond.

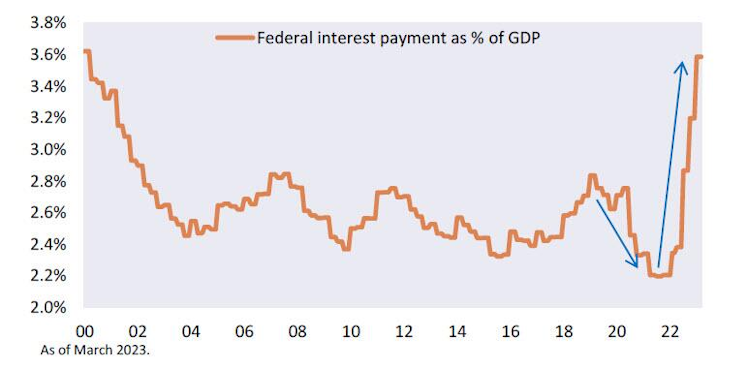

At the same time, the foundation of the US budget has been greatly improved in the era of low interest rates, which enables the United States to ensure low financing interest rates while printing money to create inflation, thus promoting GDP growth and federal tax revenue.

But that positive trajectory is rapidly worsening as interest rates rise, inflation returns to more normal levels and the economy slows. The government's Treasury Bond interest rate payment as a percentage of GDP has reached the dot-com bubble era in early 2000.

Already have an account?