Trending Assets

Top investors this month

Trending Assets

Top investors this month

27th May 2022 - Trading Journal

Situational awareness:

Bullish bias today, as mentioned yesterday I felt like we are at the beginning of at least a bear market rally and those can be powerful. My focus is not to try catch countertrend rallies and it remains centred on getting through this period of the market unscathed (and hopefully in the green) and ready for the next bull whenever that may be. That said I am looking at high probability opportunities and remaining flexible in my thinking.

If you are going to be dogmatic in your strategy in a bear market then you are better to simply remain in cash. If you wish to trade through it you must be opportunistic and flexible.

Pre Market Work:

As mentioned yesterday I was looking for a red or muted open in the $QQQ in order to place a call spread trade to give me exposure to a potential follow through rally. Unfortunately that is not the case. I went through my Stage one watch list and noted $AMPL & $ZM as two stocks that both look like they have bottomed to me (at least for now) and could be good alternatives to betting on the Qs.

I also brought some other names into my main watchlist - notably $GTLS, $IRTC, $EGLE, $GNK. The latter two are shipping stocks which have been setting up as a group.

I also spent a few minutes trying out some Traderlion Scripts from Richard Moglen. These are freely available to any Tradingview user. I liked their volume script which is like normal volume indicator but emphasises higher or lower than average volume. See below:

Trading day:

$QQQ did not setup right for me so I decided to leave it until EOD (End of Day) to see how we closed. Usually with options I never want to chase. It's not like buying stock. If you buy when the volatility is up you get crushed if it drops. I much prefer positioning myself in advance of any move with options and unfortunately in Ireland I cannot trade ETFs as stock. I am only allowed use leveraged options! (Makes sense right?!)

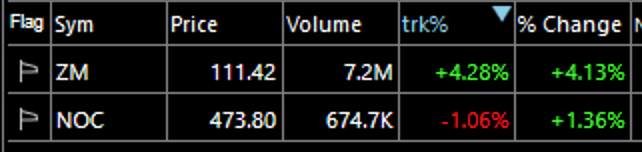

I noticed some action in $ZM that I have seen before. It was teetering on flat for the day but ZM does that and then rips hard. The stock had caught my eye before earnings as it seemed to be well on it's way to a bottoming formation and the strong earnings emphasised that belief. We had very strong volume after earnings (450% above average) and a nice pop above the 50 day. Today the stock was just sitting on the 50 day.

As mentioned above, my priority is to pick stocks on a stage two uptrend and catch those stocks. This takes time, if I am to participate in this rally I need to be flexible. $ZM has shown strong fundamentals, strong accumulation and a tradeable setup off the 50 Day MA that could potentially see the stock test it's 200 MA for the first time since August 2021. To put in perspective is only the second close above the 50MA since August. Also note the bullish cross on the 10EMA against the 20MA

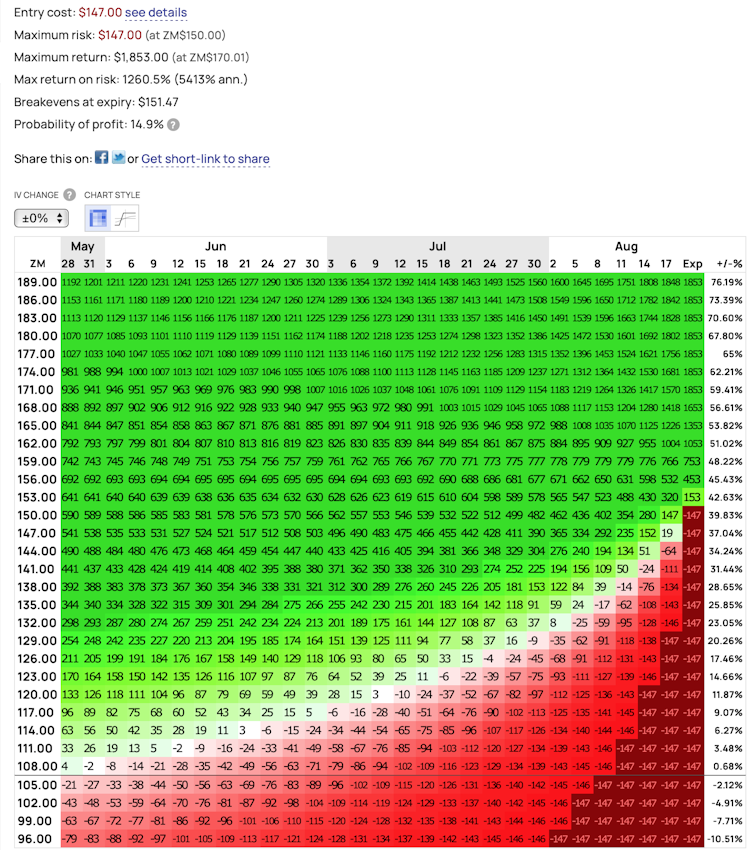

I placed a trade early in the day August 19th $150/$170 Bull Call Spread paying $1.49 per contract. Again I've chosen a spread because it hedges me somewhat to the downside while also enabling me to capture a lot of value if the trade works in my favour. See the optionsprofitcalculator below for any idea on how it can play out:

For a trade like this where I do not want to commit a lot of capital and want to protect myself in a volatile market options work well. My risk is limited and I am able to use a spread to reduce the overall cost. Happily the stock rallied 3% after I placed the trade. My timing intraday was perfect.

Near the close I looked again at a $QQQ trade but I felt that I would be chasing. I will revisit on Monday. we can easily just gap up again on Monday but I would be very bullish if we gapped down and recovered.

End of day Thoughts:

Long weekend, I am content with my trading this week. I have been conservative and I am making a strong effort to not get carried away. I can already see the FOMO and excitement on Twitter. I will continue to participate and position myself conservatively in opportune times to profit and to minimise my downside risk if the trade does not work. That is how to compound an account. Ignore what anyone else is doing.

Notes & Open Trades:

- $NOC - 5% Stock Position - Entry $464.50 - Stop: $459

- $ZM - August 19th $150/$170 Bull Call Spread - Cost $1.49 per contract

Please note I operate my risk with options that I can lose 100% of the premium. This is the safest way to trade them in my opinion. Even if I cut at 50% once I am setup to lose 100% within my risk threshold then I will stay ahead of my required R:R.

Already have an account?