Trending Assets

Top investors this month

Trending Assets

Top investors this month

What makes a product/service compelling from an investment POV?

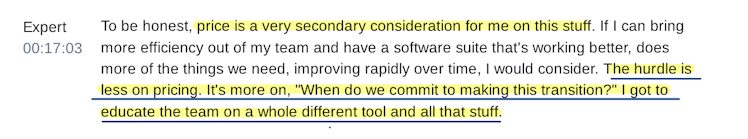

Products where price is secondary for customers exhibit pricing power and high retention

In the context of business management software (such as $INTU's QBs), there's too much hassle to go through to justify a change due to price unless competing software is much much better

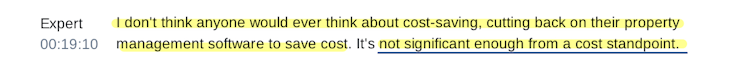

Pricing power and high retention is further strengthened if a product makes up a small part of a customer's overall costs.

There will be other places where customers will look to cut costs:

It all boils down to how mission-critical a product is and how much it costs to the customer as a proportion of total costs

This is what, for example, Constellation Software $CNSWF goes after when investing in VMS software.

Can you think of any other examples? Let me know in the comments!

Btw, images above are from AlphaSense, a platform for expert calls. You can sign up for a free trial (a work email of some sort is required, but no credit card) and download all the transcripts you want, in the following link.

stream.alpha-sense.com

AlphaSense

AlphaSense

Your question brings to mind Motley Fool co-founder David Gardner's "snap test." To paraphrase: if I snapped my fingers and a company/product disappeared from the face of the earth, how many people would notice? How many people would care? In $AAPL's case--a bunch! $PTON though? Not so much. In terms of business softwares, a lot of businesses would probably be affected if $PAYC, $DDOG, $CRWD disappeared. For something like $MDB the answer isn't quite clear yet.

Already have an account?