Trending Assets

Top investors this month

Trending Assets

Top investors this month

Verify for yourself

I don't fundamentally disagree with what Leandro @invesquotes has posted below. In almost all cases with an index it's probably the best bet rather than trying to chop and change. Especially if you are a passive long term investor.

Everyone has to decide what they want to do. Ultimately I think the $SPX may not be the best example because history has shown that it goes up eventually and goes up more than it goes down.

Many of us are invested in individual companies so this theory does not necessarily hold true. In fact many companies top out eventually and get disrupted, only a handful stand the test of time.

For some thought here is another stat:

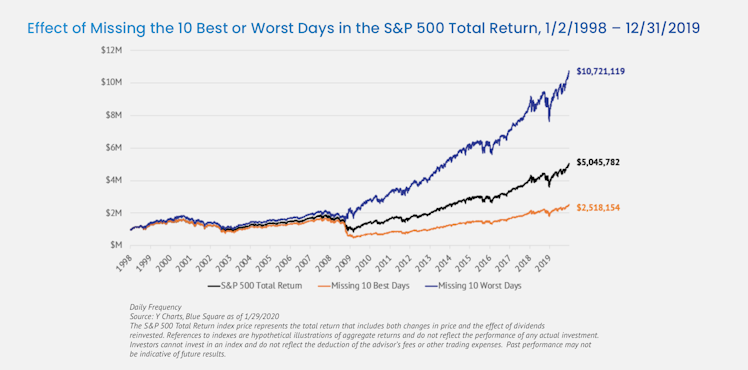

The following chart shows the performance of the S&P 500 Index from 1998-2019 utilizing 3 Different Scenarios:

Buy and Hold: $1,000,000 invested into the S&P 500 in 1998, grows to $5,045,782 in 2020.

Missing the 10 Best Days in the Market: If you invested $1,000,000 into the S&P 500 in 1998, but MISSED the 10 BEST performance days, twenty years later your investment had grown to $2,518,154

Missing the 10 Worst Days in the Market: If you invested $1,000,000 into the S&P 500 in 1998, but AVOIDED the 10 worst performance days, twenty years later your investment had grown to $10,721,11

Already have an account?