Trending Assets

Top investors this month

Trending Assets

Top investors this month

PayPal $PYPL - Earnings Review Q3 2022

The below is our review of PayPal’s solid Q3 2022 results announced on 3rd of November 2022.

Key results

- Revenue for Q3’22 of $6.85B beating estimates by c. $30M and exceeding guidance of $6.8B (up 10%, 11% FX- neural basis “FXN” compared to Q3’21).

- Non-GAAP operating margin of 22.4% (Vs 23.8% in Q3’21) the first q/q sequential increase since Q2’21 impacted by the cost savings program announced in latest quarter and in line with the targeted margin expansion. The company remains on track to save $900M in FY22 and $1.3B in FY23.

- GAAP EPS for Q3’22 of $1.15 beating estimates by $0.53 and guidance by $0.53 (up 25% compared to Q3’21) mainly explained by the $0.34 gain on strategic investments (not part of guidance).

- Non-GAAP EPS for Q3’22 of $1.08 beating estimates by $0.12 and guidance by $0.13 (down 3% compared to Q3’21).

Key metrics

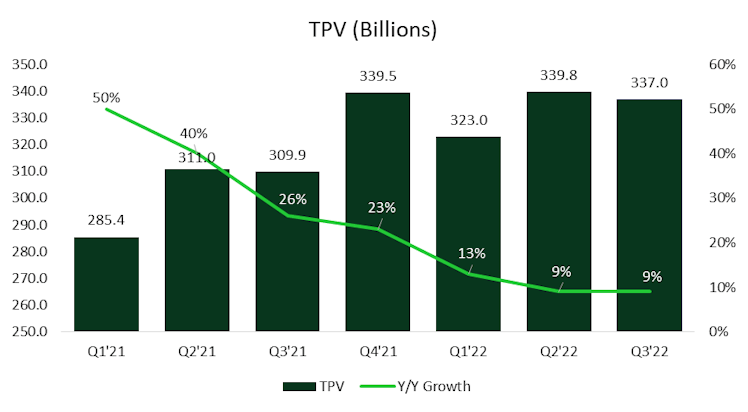

- Total Payment Volume (“TPV”) reached $337.0 billion for Q3’22, up by 9% (14% FXN) whereas Venmo TPV reached $63.6 billion, up by 6%.

Source: PayPal 10Q and 10K filings, StockOpine analysis

- Venmo: TPV grew by 6% y/y (in line with prior quarter) but no explicit commentary was made regarding total revenue growth. This is a bit absurd given the guidance of +50% for FY’22 and considering that they used to report that number!! Venmo commerce volumes increased by 150%. (refer to ‘Other Developments’ for partnership updates)

- Braintree: TPV growth of 38% in Q3’22 “driven largely by recent merchant wins and share of wallet expansions” with a recent example being Live Nation establishing Braintree as the primary card processor.

- International revenue showed the first increase on y/y comparison since Q4’21 depicting a growth of 6% and 9.4% FXN. Despite this, adjusting for the hedging gains of $156M in Q3’22 and the hedging losses of $44M in Q3’21, it would have resulted to a decline of 1.3%. PayPal expects a $504M hedging gains over the next 12 months if Sep 30, 2022, exchange rates prevail (c. 4.3% of Trailing Twelve Months international revenue).

- Processed 5.6 billion payment transactions during Q3’22, up 15%. Excluding eBay, transactions grew by 17%.

- BNPL continues its growth trajectory with Daniel Schulman, President and CEO mentioning

“And PayPal was just ranked as the best overall Buy Now, Pay Later value proposition in the United States by the Wall Street Journal. In the third quarter, we processed nearly $5 billion in volume, up 157% year-over-year with over 25 million consumers using our Buy Now, Pay Later services approximately 150 million times since launch.”

Consumers increased from over 18 million reported in Q1’22 and 22 million in Q2’22. Additionally, Dan Schulman claims that the company has one of the lowest loss rates in the industry.

- Honey: PayPal Rewards was launched in Oct 22, unifying Honey and PayPal rewards program (earn rewards, all in one place) -> Good timing given economic slowdown fears and holiday season approaching.

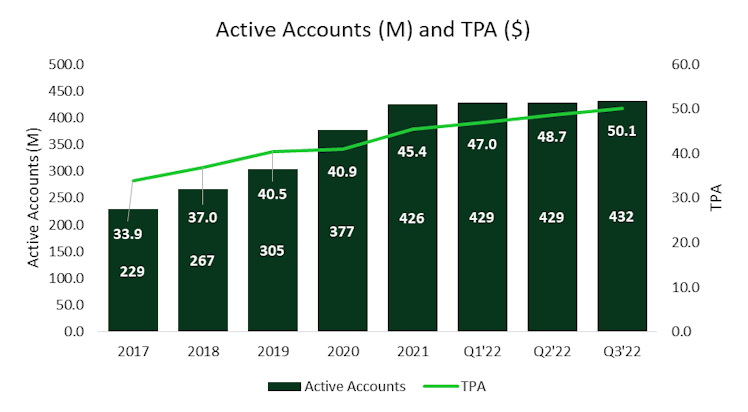

Engagement and Active Accounts

- PayPal ended the quarter with 432 million active accounts, up 4%, including 35 million merchant accounts. Added 2.9 million net new active accounts in Q3’22.

- Payment transactions per active account (“TPA”) to $50.1 increased by 13%, mainly by transaction growth from Braintree, reporting another quarter with an improvement in engagement.

- Recent product enhancements such as Mobile SDK, passkeys, improved latency and potentially accelerated checkout via vaulted credentials are likely to further improve conversion and thus engagement.

Source: PayPal 10Q and 10K filings, StockOpine analysis

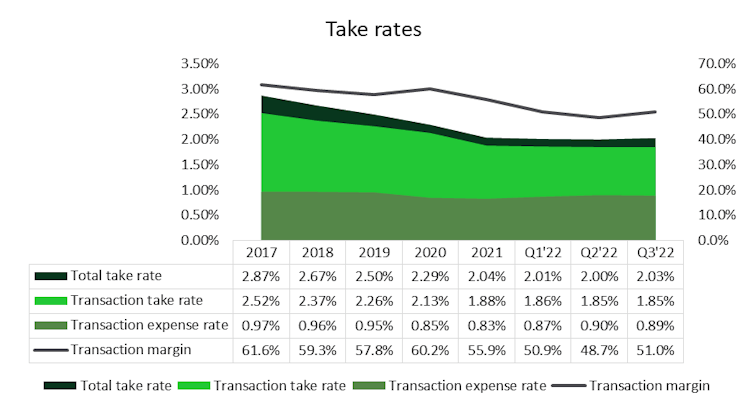

Take rates

- Take rates and transaction rates were relatively stable y/y and q/q, with a minor expansion (4bps y/y) being the result of Venmo and FX hedge gains, whereas transaction expense rates increased by 6bps y/y mainly driven by higher Braintree share which drags the profitability (transaction margin from 54.2% in Q3’21 to 51.0% in Q3’22).

- Despite the y/y decline in transaction margin, it was the first quarter since Q1’21 in which the company depicted a q/q sequential growth.

Gabrielle Rabinovitch, Acting CFO “This quarter, we began seeing benefits to our transaction expense from leveraging our scale across the network ecosystem. We expect this trend to continue in Q4 and into 2023.”

Source: PayPal 10Q and 10K filings, StockOpine analysis

Balance sheet position – A healthy cash machine

- Cash & cash equivalents, and investments amount to $16.1B, whereas debt totaled approximately $10.6B.

- Record organic Free cash flow of $1.77B for Q3’22, up 37% and 26% of revenue well above the historic average margin of c. +21%.

- Returned $939M to shareholders through share repurchases in Q3’22 at an average price of $93.93 (year to date $3.2B or 78% of Free Cash Flow). Another $1B in buybacks is expected during Q4’22.

Gabrielle Rabinovitch, Acting CFO “Given our conviction in our business relative to its valuation today and its long-term competitive advantages and ability to deliver sustainable value creation, we have taken a more aggressive approach to our capital return program this year. We believe that share repurchase remains an optimal use of capital for our shareholders while allowing us to retain the flexibility to continue investing opportunistically in our business.”

Other Developments

- PayPal and Venmo collaboration (work in progress) with Apple. A) PayPal and Venmo to use Apple’s tap-to-pay functionality so U.S. merchants could use their iPhone and the PayPal or Venmo iOS app as a mobile point of sale, B) Adding Apple Pay as a payment option in the unbranded checkout flow and C) (for next year) U.S. consumers will be able to add PayPal and Venmo cards to Apple Wallet to use them online or in-store (provided that Apple Pay is acceptable).

- Regarding C) it could also mean creating temporary digital cards that can allow bringing the BNPL from branded online Checkout to offline.

- Pay with Venmo on Amazon is expected to be fully ramped (live for select Amazon customers) in time for peak holiday shopping.

- Progress is made on the additional credit externalization and PayPal is committed to secure off-balance sheet funding for a portion of its global pay later portfolio for next year. Given the increase in Gross receivables to $6.5B (or 4% q/q) and a likely economic slowdown we believe that this action is sensible.

Outlook

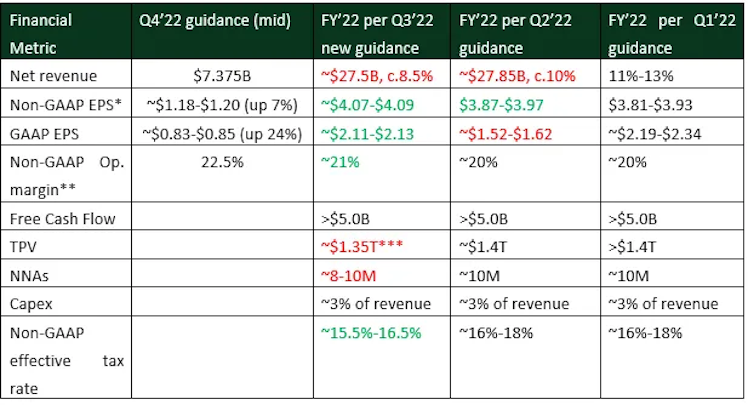

Source: StockOpine analysis, PayPal filings, transcripts

Note: expect at least 15% growth in FY23, expect at least 100 bps expansion in FY23, 2021 TPV multiplied by 1 + 8.5%, guidance refers to c. $1.4T.

The revenue guidance for next quarter assumes a y/y growth of 6.6% whereas FY’22 was revised from 10% on spot FX to 8.5%, which was frustrating to investors given the continuous drop in guidance (refer to 1st row of the table). The downward revision was effectively a result of trends observed in US e-commerce growing in the low single digits, the expectation for low single digit growth (Vs mid-single expectation in prior guidance) for holiday e-commerce, the weaker performance in UK (second largest market), and broader market trends.

The Q4’22 upward revision in EPS metrics and Operating margin, were mainly driven by the gains in strategic investments (only for GAAP-EPS) and the cost optimization program.

For FY23, no detailed guidance was given other than the following:

- Operating margin and non-GAAP EPS: +100bps operating margin expansion and a 15% non-GAAP EPS growth. At first, these figures seem good but given the FY22 misses in guidance, we consider it a bit premature despite, management being quite confident for achieving these, even in “a difficult economic cycle”.

- Garbrielle Rabinovitch, Acting CFO, also mentioned that for FY23, PayPal is expected to grow faster than e-commerce across core markets and thus gain share in the process, while at the same time she cautioned investors about a slowdown in discretionary e-commerce spending for FY23.

Dan Schulman, CEO further reinforced the statement of gaining additional share under this environment, demonstrating operational resilience.

“We want to take advantage of this environment that we're in. We are already seeing some of the investments we're making in those areas [Checkout, digital wallets and Braintree] pay real dividends in our ability to satisfy our customers. And we think this is an opportunity for us to take share going forward. We're in a rising interest rate environment. That's a tailwind for us. For many of our competitors, it's a headwind.”

Concluding remarks

Other than the revenue downward revision and the absurd decision (if not done accidentally) to avoid disclosing Venmo revenue growth, the quarter was solid. Engagement (TPA) grew by further 13%, margins are improving, cash flow generation is strong, and Management announced an interesting partnership with Apple.

❕❕ If you enjoyed reading the above earnings review, you can subscribe to our substack for earnings and company write ups ❕❕

Disclaimer: The team does not guarantee the accuracy or completeness of the information provided in the newsletter. All statements express personal opinions based on own financial and business analysis. Any estimates or forward-looking statements made are inherently unreliable. No statement of opinion is an offer or solicitation to buy or sell the financial instruments mentioned.

The content of our newsletter is not a trading or investment advice and we do not provide any personal investment advice tailored to the needs of any recipient. The information provided should not be considered as a specific advice on the merits of any investment decision. Securities trading involve risk and you might lose your capital and/or incur other damages. Investors should make their own research and consult their registered investment advisor or financial advisor before taking any investment decision.

Neither the team nor any of its affiliates accept any liability whatsoever for any direct or indirect loss however arising, from any use of the information contained herein. Any unauthorized copy of this newsletter or its contents is illegal.

This post may contain affiliate links, which means that we might get a commission if you decide to sign-up using any of these links. No extra cost is charged to you.

By subscribing / reading our newsletter or any affiliated social media accounts, you indicate your unconditional acceptance to the above and your unconditional acceptance to our terms and conditions.

stockopine.substack.com

StockOpine’s Newsletter | Substack

We focus on quality companies, providing high-quality fundamental research and stock ideas. Click to read StockOpine’s Newsletter, a Substack publication with thousands of subscribers.

Already have an account?