Trending Assets

Top investors this month

Trending Assets

Top investors this month

Revolving-Door Capitalists (Extended Preview)

This is an extended preview of today's write-up, exclusively for Commonstock readers. To read the remainder of the post, please subscribe to the TSOH Investment Research service.

Yogi Berra: "__You can observe a lot just by watching.”

In October 2020, hedge fund manager Dan Loeb sent a letter to Bob Chapek, the CEO of The Walt Disney Company. In the letter, which was penned to “express appreciation” for Disney’s increased focus on its DTC businesses, Loeb wrote the following (bold added for emphasis):

“We understand that a more aggressive investment strategy may pressure short-term earnings on the path to creating long-term value. Lest there be reservation about making such a trade-off and any potential shareholder concerns, we highlight an observation from Warren Buffett: ‘Companies get the shareholders they deserve.’ Disney deserves growth-minded, long-term oriented investors, and we believe that a strategy centered around using Disney’s many resources to drive growth in the DTC business will further attract them.”

While Loeb implored Disney management to seek out the “long-term oriented investors” that they deserved, his actions should make one question whether he belongs in that group; less than 18 months after that letter was sent to Chapek, Third Point had liquidated its position in Disney.

Fast forward to August 2022, when Third Point disclosed that it had once again invested in The Walt Disney Company. In addition, Loeb sent another letter to Chapek with a list of key strategic and financial changes that he would like to see implemented (and which would meaningfully impact the long-term value and direction of the business, as I’ll discuss momentarily). As a long-term Disney shareholder, I think this situation demands a thoughtful response (words and actions) from management; importantly, misplaying their hand here could derail much of what they’ve worked to build over the past five-plus years.

First, it should go without saying that Loeb’s ideas may be valid and are worth exploring; management should give them their proper consideration with respect to the fiduciary responsibility it has to the long-term owners of the business. That said, management should also ask themselves whether the requests of an activist investor (trader) are truly aligned with the long-term interest of the business and its shareholders. His ideas should be reviewed solely against the relevant test (its impact on long-term value creation).

On that point, if Loeb truly believes that his proposed solutions are additive to the long-term value of the enterprise - as one piece or the sum of its separate parts - I think it would be beneficial to his position if he committed to eating his own cooking (to the extent that he cares about garnering the support of Disney owners, like myself, who may be skeptical of his intentions given how he’s acted previously). Specifically, it would greatly increase my willingness to trust Loeb if he publicly committed to maintaining his stake in Disney for a period of time - say, the next three years - if his proposed solutions were applied (including in any new entities to be created as a result of a spin-off).

For what it’s worth, there is a historic precedent for acting in this manner; as a matter of fact, we’ve seen a few prominent examples from the man that Loeb quoted in his first letter to Chapek: Warren Buffett. Consider what Buffett wrote about his investment in Cap Cities in the 1985 shareholder letter:

“As evidence of our confidence [in Cap Cities], we have executed an unusual agreement: for an extended period Tom, as CEO (or Dan, should he be CEO) votes our stock. This arrangement was initiated by Charlie and me, not by Tom. We also have restricted ourselves in various ways regarding sale of our shares… Some might think we’ve injured Berkshire financially by creating such restrictions. Our view is just the opposite. We feel the long-term economic prospects for these businesses - and, thus, for ourselves as owners - are enhanced by the arrangements. With them in place, the first-class managers with whom we have aligned ourselves can focus their efforts entirely upon running the businesses and maximizing long-term values. Certainly this is much better than having those managers distracted by “revolving-door capitalists” hoping to put the company “in play”… By circumscribing our blocks of stock as we often do, we intend to promote stability where it otherwise might be lacking. That kind of certainty, combined with a good manager and a good business, provides excellent soil for a rich financial harvest. That’s the economic case for our arrangements.”

In summary, I think it would behoove Loeb to consider copying Buffett on his Disney investment if he’s willing to think and act like a long-term owner and if he truly believes that his ideas are additive to the long-term value of Disney. Personally, I think those are two big if’s. I have no real knowledge on Loeb’s willingness to own a stock for the long-term, so I’ll focus my time on the second question: are his proposed changes likely to meaningfully improve Disney’s competitive position(s) and the long-term value of the enterprise?

The Future of ESPN

I want to specifically focus on Loeb’s fourth suggestion, which would have significant strategic and financial implications for Disney: spin-off ESPN.

I won’t repost the entire discussion (here’s the link to Loeb’s second letter), but here’s the meat of what he suspects could improve at ESPN if it became a standalone entity: “Employees of ESPN could be compensated in a security directly tied to their performance. ESPN would have greater flexibility to pursue business initiatives that may be more difficult as part of Disney, such as sports betting. Customers of ESPN and sports leagues would be better served by a focused management team driving a leadership position in sports distribution. We believe that most arrangements between the two companies can be replicated contractually, in the way eBay spun PayPal while continuing to utilize the product to process payments.”

As it relates to the question of ESPN’s long-term value – in its current structure as a key component of Disney as opposed to as a standalone entity – this particular comment from Loeb’s letter stood out to me: “a focused management team driving a leadership position in sports distribution”.

I won’t rehash too much of what I’ve written previously (please revisit “The Future Of ESPN” for more on this topic), but I think that comment really misses the transitional work that has been underway since ESPN+ launched in April 2018, as well as Disney’s broader DTC evolution in the past few years. Based on my research, I’d argue ESPN’s likelihood of being a leader in U.S. sports distribution in the future is greatly improved as part of Disney.

Importantly, as the method of delivering content continues to shift from linear to OTT / DTC (with the pace and magnitude of that change an open question), Disney has a balanced portfolio in terms of its distribution channels and the breadth / quality of its content (and not just in sports).

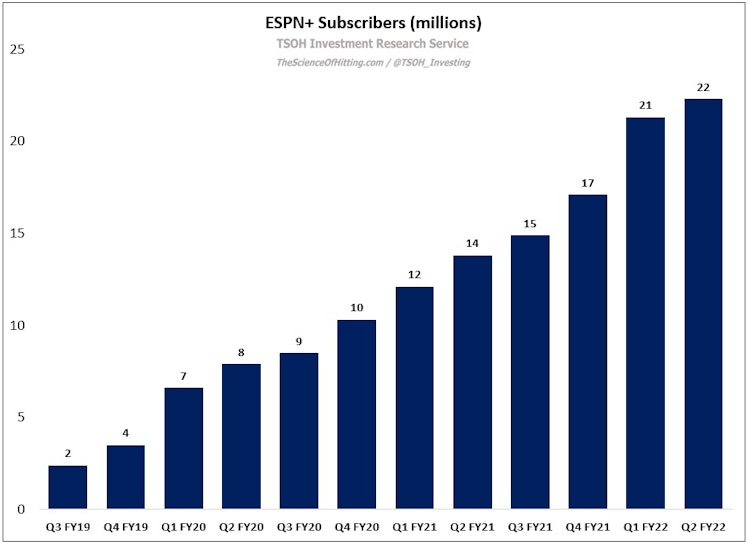

While we’re still at an early stage on this transition (relative to what we’ve witnessed over the past decade with entertainment programming), ESPN+ has established a strong starting position for OTT / DTC distribution for live sports; it has ~22 million paid subs in the U.S., or >2x higher than what management originally expected for the service by yearend FY24. The adoption of ESPN+ benefits from its inclusion in Disney’s U.S. DTC bundle, as well as from cross-promotion within the DTC apps (for example, ESPN content featured on Hulu). Over time, if Disney consolidates its DTC services – as Loeb has previously argued that they should – I believe that the benefits from ESPN’s inclusion will be very significant (“We also believe that collapsing all of Disney’s DTC services into the Disney+ app will simplify the product and be a meaningful enhancement to Disney’s offerings.”)

(End Of Preview)

thescienceofhitting.com

Revolving-Door Capitalists

Dan Loeb, Disney, and The Future of ESPN

Already have an account?