Trending Assets

Top investors this month

Trending Assets

Top investors this month

Has Twitter Truly Changed?

Given the recent developments at $TWTR, I've decided to remove the paywall on my December 2021 post, "Has Twitter Truly Changed?" As I wrote at that time, "I’d rather a company be forthright with investors, even if it means pulling guidance, as opposed to stubbornly clinging to an unrealistic goal." I think it's an open question whether sticking with the unrealistic mDAU targets put the company in a tough position once they faced an outside bidder (it's hard to say "this offer is insufficient" while simultaneously telling investors "we can't hit our numbers"). Hopefully we get some great reporting on this story! The entire post is reprinted below.

In “Twitter: An Audacious Goal” (05/21/2021), I wrote the following:

“Has Twitter truly changed? The Analyst Day event started with CEO Jack Dorsey explaining that he agrees with Twitter’s critics – “we agree we’ve been slow… we agree we haven’t been innovative… we agree many people don't trust us”. The problem I have with the “we’re better now” story is that many of the people in the C-Suite have been there for years. For example, Dorsey returned as CEO in 2015, and Ned Segal joined as CFO two years later (2017). The same is true for the Chief Technology Officer (Parag Agrawal) and the Head of Consumer Product (Kayvon Beykpour), who assumed their current roles in 2017 and 2018, respectively. A fair retort may be that change doesn’t happen overnight – for example, it takes years of effort to complete an “architecture rebuild” (it sounds like those efforts are still ongoing). All I’m saying is that I’m more skeptical than the bulls that this management team has suddenly seen the light, especially since they’ve had their hands on the steering wheel for many years. (The fact that Elliott Management was trying to push Dorsey out early last year speaks to this reality.)”

On to today’s update.

What’s Changed

Since May, a number of important developments have occurred at Twitter.

First, the stock has continued to struggle. At Wednesday’s close (~$44 per share), Twitter’s stock price has declined by 20%+ since mid-May; over the same period, the S&P 500 has increased double digits. Since the February 2021 Investor Day, which was initially met with a positive response by Mr. Market, the stock has declined by ~40%.

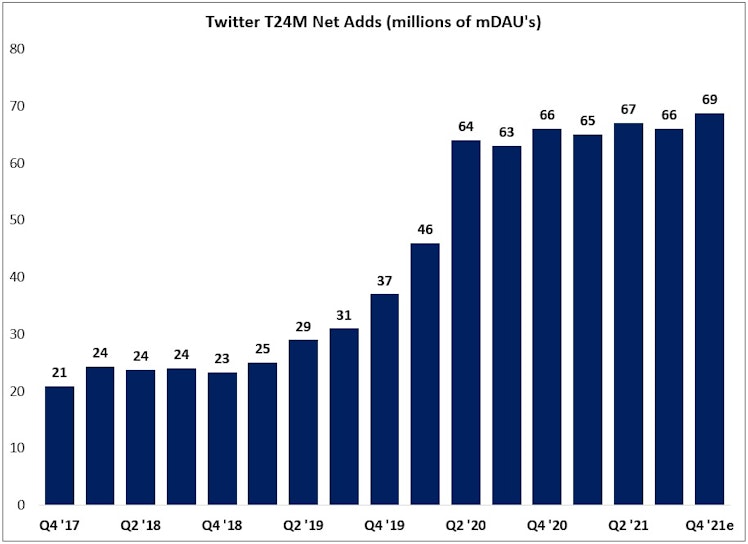

Second, that “audacious goal” (at least 315 million monetizable daily active users, or mDAU’s, by yearend FY23), has become an even tougher hill to climb. Based on guidance, the company is likely to end FY21 with roughly 221 million mDAU’s; if so, they’ll need to add 94 million mDAU’s over the next 24 months to reach their FY23 target. As shown below, the pace of trailing 24-month (T24M) net mDAU’s has held in the mid-60’s (millions) over the past six quarters, with help from the surge in engagement throughout 2020 as a result of the pandemic. In order to reach the FY23 target, the pace of T24M net adds will need to climb another ~40% in the face of much tougher comps as the strong FY20 net adds roll off. Simply put, based on current trends, I don’t think there’s reason to believe Twitter will come close to reaching the mDAU target (more on this in a moment).

Third, and most importantly, the company announced on November 29th that Jack Dorsey’s (second) run as CEO had come to an end; whether he resigned or was fired depends on who you ask (“the framework for his departure - including identifying his designated replacement - had been in place for more than a year”). Dorsey will be replaced by 37 year old Parag Agrawal (he will be the youngest CEO of any company in the S&P 500), who has been employed at Twitter for the past decade and has been its CTO since 2017. I’d note that the press release from the company was not made available until 10:40am ET (during market hours), which would seem to indicate that the news was leaked before the company was ready to act.

In addition, Twitter announced that Bret Taylor would become Independent Chair of the Board of Directors. Interestingly, on November 30th, the day after the Twitter changes were announced, Taylor was named co-CEO at Salesforce (he’s been COO at Salesforce for the past two years). This has led to some speculate that Taylor parlayed the developments at Twitter into a promotion at Salesforce (Marc Benioff may have been keen to keep him as opposed to seeing him named Twitter’s CEO). To top this all off, remember that Salesforce considered making a bid for Twitter back in 2016.

Financial Targets and Trust

Near the end of the press release, Twitter noted that “There are no changes to the Company's previously shared outlook for the fourth quarter and full year 2021, or its 2023 goals.” In addition to the unchanged financial targets, management has been clear that there is no plan for a shift in their strategic vision (CFO Ned Segal, at an investor conference on December 2nd, 2021: “We're not changing our strategy. We still want to get the rest of the world to use Twitter. We want to do a better job monetizing our service. We think we have the right strategy in place in order to do that. It's Parag's job to build on top of the really strong foundation that Jack has led us to, but to allow us to move faster and execute even better against it.”).

Not to beat a dead horse, but I find it particularly difficult to accept the reiterated FY23 mDAU guidance. I think Elliot Turner of RGA Investment Advisors hit the nail on the head when he said the following on the “This Week In Intelligent Investing” podcast (starts at the 36th minute):

“The mDAU target became increasingly challenging… If you look objectively at the company, people by and large think that Twitter is in a much better place than when they started the year, but the stock is down a lot. And I think it’s because they effectively tied their fates to this mDAU target… just about every question is about mDAU’s; a million different iterations of ‘How are you possibly going to achieve this?’ And it keeps the company from talking about things that are actually working, that are actually going well.”

I think Turner is spot on. This has become a distraction for the company and it is having a real impact on investor sentiment (trust); in fact, you’d be hard pressed to find a single bull who believes they’ll hit the mDAU guidance (I’ve asked). That’s pretty striking; I’d argue it demands some explanation.

I think this disconnect probably speaks to the events of the past 24 months, which likely played a role in Dorsey’s exit. Based on press reports, the main reason Twitter introduced the FY23 revenue and mDAU targets was to appease an activist investor, which saved Dorsey from a fight for his job. But as the mDAU target has become increasingly unlikely, investors have started to lose faith in management. It’s a reaction I understand: I’d rather a company be forthright with investors, even if it means pulling guidance, as opposed to stubbornly clinging to an unrealistic goal.

By the way, if we assume management still believes they can still hit those FY23 targets, it would behoove them to clearly detail how. The reason why “every question is about mDAU’s” is because management has not done a good enough job to date explaining how they can get there. This answer, from Segal at the December 2nd investor conference, simply doesn’t cut it: “When we think about our DAU goals, whether it's in the U.S. and other more developed markets for us like Japan, the U.K. and others or some of the emerging markets where we've seen real strength in DAU recently like the Middle East, the Philippines, Indonesia, Brazil, we still see lots of opportunity to grow our audience across those markets and others.”

This is a big sticking point for me. Honest and transparent communication with investors is important (to be fair, I think Agrawal did a much better job at this during his first investor conference on December 7th). In the past, this is the kind of thing I’d try and compensate for by adding some arbitrary risk premium to my hurdle rate. But these days, I think the best solution to a lack of trust isn’t a higher return requirement; it’s to move on to another idea until the underlying problems have been addressed.

Conclusion

The Investor Day was pitched as a reset / coming clean moment for Twitter.

Ten months later, Dorsey is gone and the financial targets are in question.

I don’t want to overemphasize a single point, but I get the sense management is uncomfortable in being forthright with its investors (maybe Segal is worried about losing his job as well). In the interim, they’re losing credibility with the investment community, which may explain why the stock has continued its poor performance despite the reiteration of the FY23 guidance.

In summary, while I appreciate that we may be nearing a point of peak uncertainty / pessimism, which is generally a good time to be bullish, my investment process demands that I see a path for Twitter to become a high-quality business, run by individuals with a long-term time horizon, integrity, and managerial skill. At this point, I don’t think I can honestly make that assertion; for that reason, I have no plans to buy Twitter at this time.

That said, I still believe this situation is worth keeping a close eye on.

The C-Suite changes may be a key step in Twitter’s evolution. And further reshuffling is already underway: days after Agrawal was promoted, the company issued an 8-K outlining changes to its org structure (“cross-functional leaders who have complete ownership of all the resources required to deliver on the goals that they have… and to be held accountable to the outcomes delivered for our customers and for our shareholders”), along with the resignation of its Engineering Lead and its Design & Research Lead. These are crumbs, but I think it’s a good start (Agrawal’s comments at the previously mentioned investor conference were also encouraging).

The end of an era presents the opportunity for a new beginning.

If I believe that effective change is underway, I’ll likely buy Twitter.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial advisor or in any fiduciary capacity.

thescienceofhitting.com

TSOH Investment Research Service | The Science of Hitting | Substack

Long-term investment research with 100% transparency (prior disclosure of all portfolio changes). TSOH is written by Alex Morris, a former buyside equities analyst and CFA Charterholder. Click to read TSOH Investment Research Service, by The Science of Hitting, a Substack publication with tens of thousands of subscribers.

Already have an account?