Trending Assets

Top investors this month

Trending Assets

Top investors this month

Chart of the Day - moving day

Sending out a second chart today to take the place of tomorrow morning as it is time to hit the open road in a big ole U-Haul truck. I am sure I won't be the only U-Haul on the road as it is that time of the year with people coming home from college & heading to new apartments

We go through these same cycles in the markets as well. People start to move around the 'furniture' in their own portfolios, maybe setting up ahead of a catalyst, or more likely preparing a portfolio for a summer where they would prefer to do little to it with short staffs

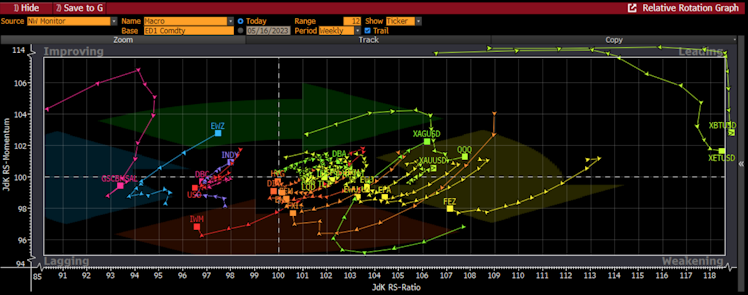

We can see this rotation happen in the markets using the RRG graph on Bloomberg. It is then a function of which assets we want to look at and what we want to use as our benchmark

I have used my 'Macro' list which includes all global asset classes. I am comparing it to 3 month cash because that is always a choice as well, especially since it is earning 5%

The places we want to focus on in this graph are the upper left and the lower right. The upper left, or improving category, are those assets that have been lagging the overall market, but where we are seeing some relative price performance suggesting they are playing catch-up

The primary asset I see in this category is the Brazilian ETF. Brazilian rates 10 year rates are 11.6% but expected to come lower this year. Brazil was ahead of the game hiking due to inflation & is ahead coming out. This should be supportive of equities

One index that was in this category but fell recently was the most short basket. We have seen quite a bit of short covering the past 6 weeks but over the last 1 or 2, shorts are being added to again. Something to watch

In the lower right, we have the weakening category. This is the area of the market that has been the leadership of the market, but where we are seeing chips being taken off the table. This is important especially if these areas have been carrying your portfolio

The primary focus in this quadrant is the rest of world stocks - Europe, Asia, China, EM, MSCI ACWI. I find this interesting because if we think there is going to be a dollar sell-off due to the debt ceiling debacle, these are the place that should benefit. However, we are seeing the opposite price action

This rotation, or moving, is important to be aware of in portfolio management. You don't want to over stay your welcome with assets that have worked. It doesn't mean you need to churn, but top-slicing some names and coming back closer to benchmark can save precious basis points

The moving I am doing is far less exciting. However, there is also risk management. That means if you are behind a U-Haul truck and you are complaining it is going too slowly, be patient. It might be me

Until we speak again ...

Stay Vigilant

#markets #investing #tacticalassetallocation #rotation #stayvigilant

Already have an account?