Trending Assets

Top investors this month

Trending Assets

Top investors this month

16th June 2022 - Trading Journal & Market Breadth

Today's trading journal is brought to you by IBKR. I use them as my main brokerage for both investing and trading. As a European investor I have tried several different platforms and I can safely say they have the most comprehensive platform available to any EU based investor. In terms of platform power, safety and products (Stocks, Options, Futures etc.) You can check out the platform here.

Market Outlook:

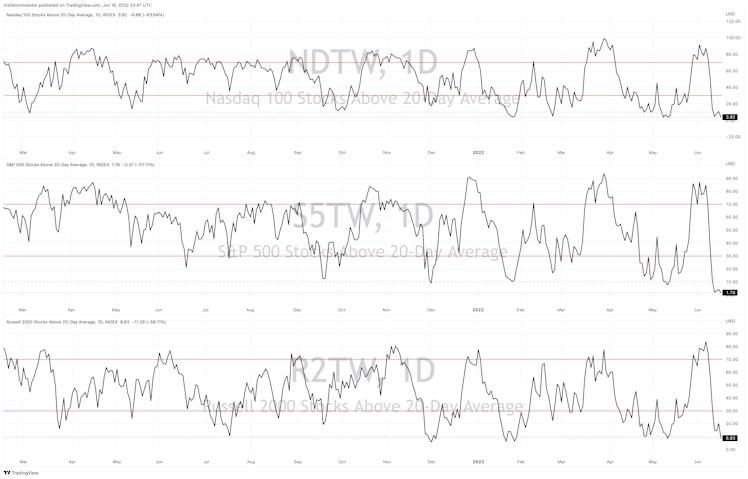

I want to develop this section somewhat along with the tools I use to measure the market. I have been building some simple market breadth indicators and charts. These could be very useful to any trader or investor. h/t to StageAnalysis on Twitter for some inspiration on these. All of these are built in Tradingview.

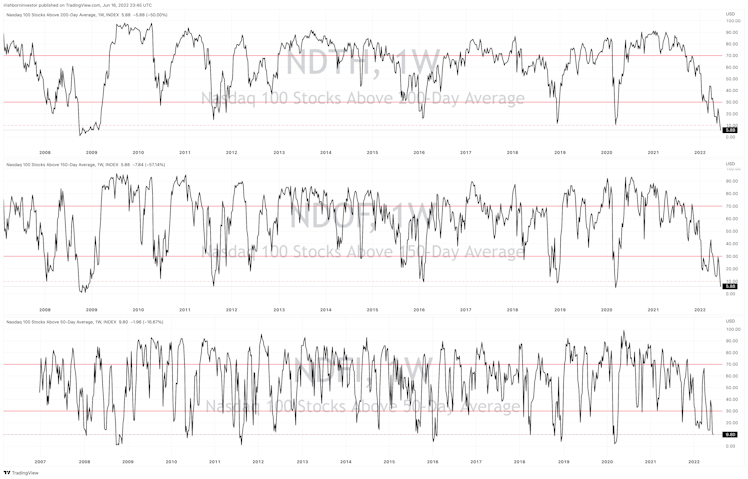

$QQQ Stocks Above 100 Day, 150 Day & 50 Day

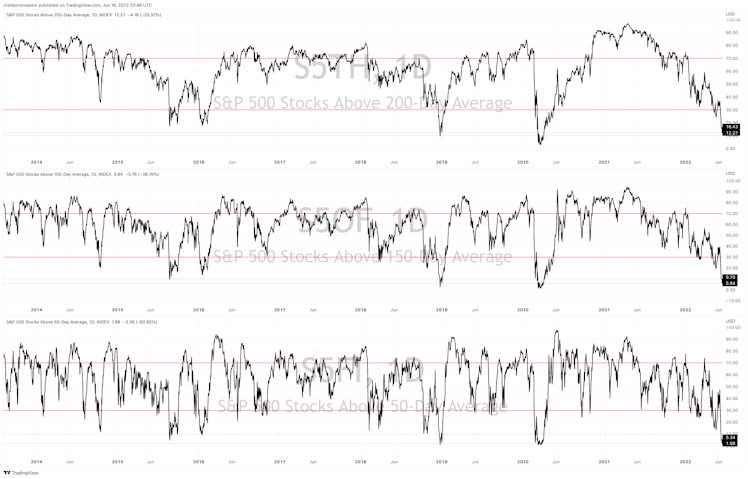

$SPXC Stocks Above 100Day, 150 Day & 50 Day

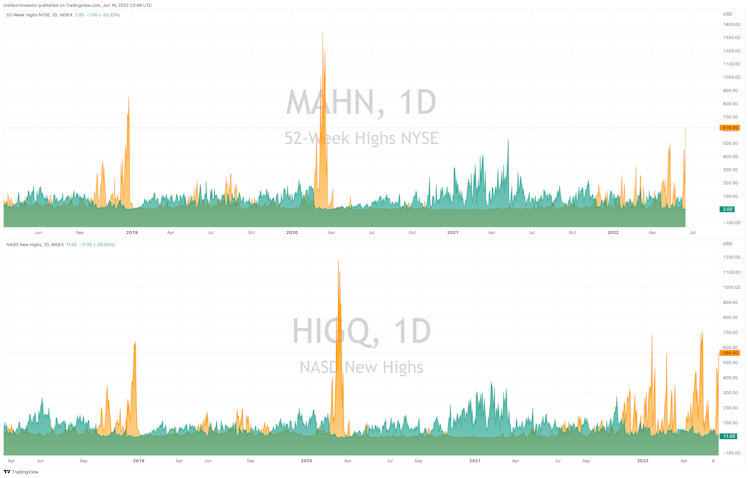

The above charts are useful warning or buy signals. For the moving averages you want to see at least 30% of stocks move above the main averages before considering a buy and you want to see that trending upward. Same for New High/Lows. As you can see today we have made 618 New Lows while only making 2 New Highs! That is not a market you want to buy!

Pre Market Work:

Only stock that caught my eye today was $GO. But not looking for any swings while this level of selling is happening. Trimmed all my watchlists with the stocks that have been badly broken the past week.

Trading Day:

Executed a small but good $SPXC futures trade toward the end of the day today. I entered at $3642.00 with a stop at $3635 and a profit target of $3665. I sold after a few minutes at $3670 exactly. Perfect in and out trade. It's really nice when they work like this.

End of day Thoughts:

It's very important in a market like this not to force trades. I've said before that if I try to consistently day trade I get frustrated. When I am working toward swing trading it's interesting I find the one or two hit and run day trades much easier. It's as if there is no pressure and I am far more patient. It is such a different feeling to sitting down at the beginning of the day searching for trades to make.

I hope we begin to level out soon however for now I will remain patient and look to make small moves or none at all. Tomorrow is a large options expiry date volatility and shenanigans will be high!

Notes & Open Trades:

- No Positions

Please note I operate my risk with options that I can lose 100% of the premium. This is the safest way to trade them in my opinion. Even if I cut at 50% once I am setup to lose 100% within my risk threshold then I will stay ahead of my required R:R.

X (formerly Twitter)

Stage Analysis (@stageanalysis) on X

Stock Trading & Investing – Stan Weinstein's Stage Analysis & Wyckoff

Stocks, Watchlist, Videos, Market Breadth

➜ Members: https://t.co/mtOKZZIXec

Already have an account?