Trending Assets

Top investors this month

Trending Assets

Top investors this month

Ashtead Group $AHT.L – Renting is Flexible and Affordable

Every month we share 2-3 write-ups on companies we decided to examine as potential additions to our portfolio.

The below is an extract of our write-up on Ashtead Group (Ticker: $AHT.L ), a leader in the equipment rental industry. Below is an extract of the first 4 parts of the report.

1. KEY FACTS

Description: Ashtead Group (“Ashtead”, “Company”) rents construction and industrial equipment across a wide variety of applications. Ashtead is North America’s second largest equipment rental company and operates in US, Canada and UK under the brand name Sunbelt Rentals.

Key Financials: Over the period 2012 to Q1’2023, the Company depicted a Revenue Compound Annual Growth Rate (“CAGR”) of 15.9% reaching a Trailing Twelve Month (“TTM”) revenue of c. $8.4B. Ashtead has a balance sheet with Cash and Short-term investments of $28 million compared to a debt and lease liabilities amounting to $7,744 million.

Price & Market Cap (as of 22nd November 2022): Its market cap is £22 billion with a 52-week high of £65.7 and a 52-week low of £32.7, whereas it currently trades at £49.9. Ashtead pays dividends since 1993 and its forward dividend yield stands at 1.3%.

Valuation: Ashtead trades at a TTM EV/EBITDA of 8.9 (10 Year average of 7.8) and at a TTM P/E of 19.8 (10 Year average of 17.9).

2. WHO IS ASHTEAD?

Ashtead’s durability speaks for itself; the Company has been around for 75 years, founded in 1947 in UK and listed in the London Stock Exchange in 1986. Since July 1988 (price data available on Yahoo Finance), Ashtead generated a compound average annual shareholders' return of c.18% including dividends. Over the years, Ashtead managed to grow and become the second biggest player in North America’s equipment rental industry behind United Rentals. The industry has been undergoing consolidation for years and Ashtead engaged in a high number of acquisitions to gain market share.

From 2011 until April 2021, Ashtead went for 103 acquisitions in North America and paid an average EBITDA multiple of 5.2x for 96 acquisitions (under $100M deals) and 6.1x for 7 acquisitions (above $100M deals).

One of the most significant acquisitions in the Company’s history has been NationsRent Companies, Inc for $1B in 2006. At the time, NationsRent was the 6th largest provider of rental equipment in the US and by paying 1.4x sales and 5x EBITDA for NationsRent, Ashtead became the 3rd largest player.

3. BUSINESS OVERVIEW

“At its most basic, our model is simple – we purchase an asset, we rent it to customers through our platform and generate a revenue stream each year we own it (on average, seven years) and then we sell it in the second-hand market and receive a proportion of the original purchase price in disposal proceeds. Assuming we purchase an asset for $100, generate revenue of $55 each year (equivalent to 55%-dollar utilisation) and receive 35% of the original purchase price as disposal proceeds, we generate a return of $420 on an initial outlay of $100 over a seven-year useful life. We incur costs in providing this service, principally employee, maintenance, property and transportation costs and fleet depreciation. Ashtead Group, Annual Report 2022.”

Customers

Ashtead offers industrial and construction equipment for rent on a short-term basis to a diversified base of customers like construction, industrial and homeowner customers, service, repair and facility management businesses, emergency response organizations, event organizers, as well as government entities such as municipalities and specialist contractors.

The Company serves 800.000+ customers with its largest reporting segment being the US. In 2022, Sunbelt US served 710,000 customers who generated an average annual rental revenue of $8,500 each indicating a highly fragmented customer base.

Markets

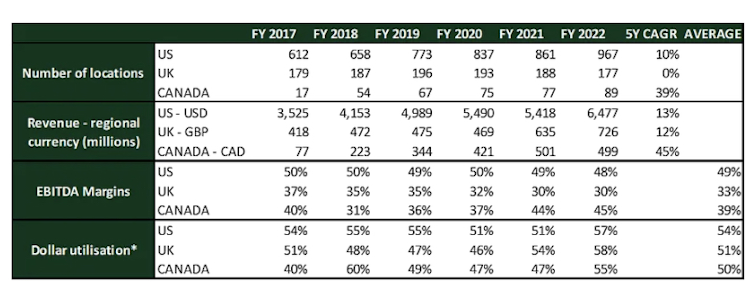

In terms of geographic mix, 81% of Ashtead’s FY22 revenue was from US, 12% from UK and 6% from Canada. The latest reported number of Ashtead’s locations/stores are 991 in the US, 93 in Canada and 181 in the UK. The below table highlights some of the key characteristics of each market.

Source: StockOpine Analysis, Ashtead Annual Reports and Quarterly Earnings Presentations

- Trailing 12-month rental revenue divided by average fleet size at original cost measured over a 12-month period

The reduction of locations in the UK is part of management’s plan to migrate to a regional operating center model with fewer but larger locations.

Ashtead’s largest market is construction and represents 40% of the business (55% in FY2007) whereas non-construction business continues to expand by growing the Company’s specialty business. Non-construction related activity like live events, building maintenance, municipal activities and emergency response are typically less cyclical than construction.

General Tool and Specialty segments

In the US, Ashtead operates through General Tool and Specialty rental locations. The General Tool business includes equipment which is more directly related to construction like earth moving, forklifts, mobile elevating platforms, etc.

The specialty rental business consists of products with low rental penetration in predominately non-construction facing markets. Specialty includes the below businesses:

- Power and HVAC

- Climate control and Air Quality

- Scaffold services

- Flooring solutions

- Pump Solutions

- Lighting, Grip and Lens

- Ground Protection

- Industrial Tool

- Shoring Solutions

- Temporary Structures

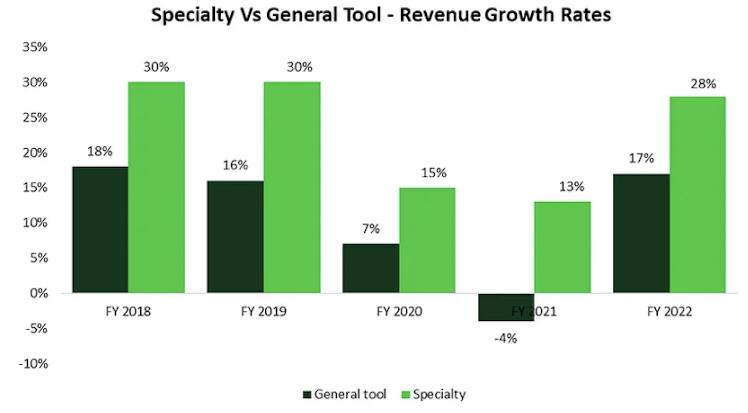

The addition of Specialty stores enables Ashtead to differentiate itself and diversify its customer base and its end markets. Specialty is growing faster than the general tool business and accounted for approximately 30% of North America revenue in 2022 compared to 22% in FY2018.

According to Ashtead, specialty segment has $6B+ revenue potential and plans to increase segment revenue to $2.4B by 2024 ($2B in FY22) under its current strategic roadmap, Sunbelt 3.0.

Source: StockOpine Analysis, Ashtead Quarterly Earnings Presentations

Sunbelt 3.0 (April 2021 – 2024)

In April 2021, Ashtead launched its new strategic plan, Sunbelt 3.0. On a high level the growth plan communicated the following:

- Add 298 (126 general tool and 172 specialty) locations across North America bringing the total to 1,234 by 2024. As of July 2022, Ashtead added 88 locations through greenfield openings and 35 through acquisitions.

- Transform the UK business to deliver sustainable margins and returns.

- Grow specialty business revenue from $1.4 billion to $2.4 billion. Specialty revenue was c.$2billion in FY22.

- Grow the general tool business at 9% CAGR (55% from existing locations and 45% from greenfield openings).

4. EQUIPMENT RENTAL INDUSTRY

The equipment rental industry is primarily driven by construction activity, although rental penetration increased over the years to areas like theme parks, building maintenance, live events, movies, and television production. Hiring of equipment provides a number of benefits for customers as it frees up capital and provides access to skilled labor and technologically advanced equipment. Hiring of equipment is also the preferred choice in periods like today where economic uncertainty and cost of raising capital is high.

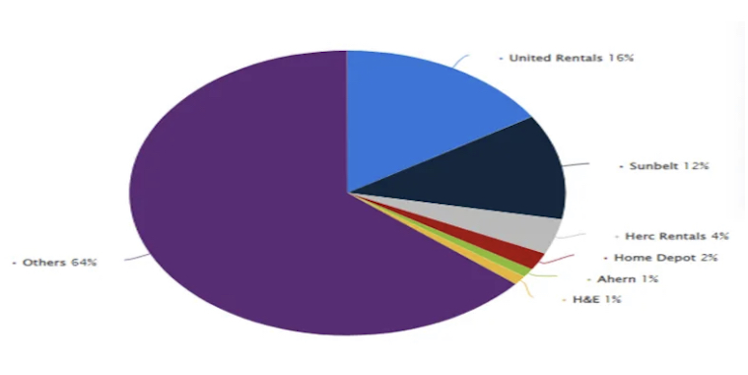

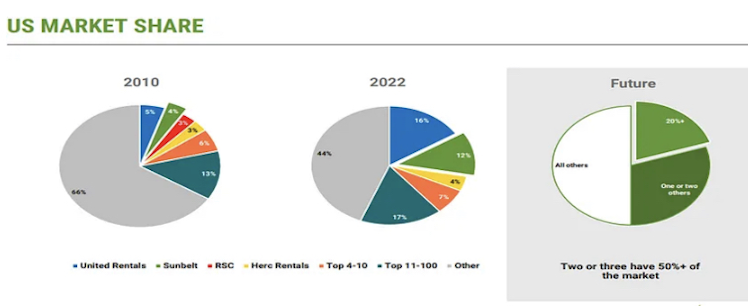

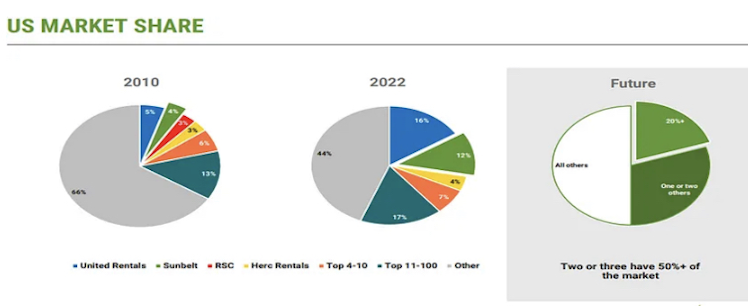

The industry has been undergoing consolidation with large players overtaking smaller ones and gaining significant scale advantages. The three leading rental equipment players in the US are United Rentals $URI, Ashtead (Sunbelt) $AHT.L, and Herc Rental $HRI which hold 16%, 12% and 4% of the market respectively.

Source: Statista

This compares to 4% and 5% market share for Ashtead and United Rentals respectively back in 2010. High fragmentation of the industry is evident by the remaining players’ market share, with the top 4-10 players holding 7%, top 11-100 holding 17% and the rest holding 44%.

Source: Ashtead First Quarter Results FY23 presentation

According to the American Rental Association (ARA), the US market of equipment rental is expected to grow by 11.2% to exceed $55.9 billion in 2022. ARA expects equipment rental revenue to grow by 6.2% in 2023, 2.5% in 2024, 3.3% in 2025 and 3.7% in 2026, reaching more than $65.1 billion.

In Canada, ARA forecasts equipment rental revenue to grow by 14.4% to $4.7 billion in 2022 and reach $5.4 billion by 2026. Ashtead’s market share in Canada according to management estimates, stands at 8% and is the second biggest player behind United Rentals which holds 18% share.

The UK equipment rental market is estimated at £6.6 (c. $7.8) billion and is expected to decline by -1.3% in 2022. Ashtead is the largest equipment rental company in the UK with a 10% market share.

Competition

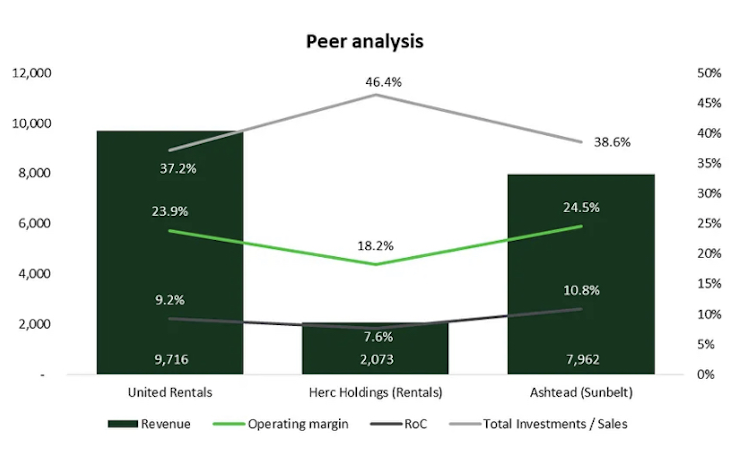

Comparing the 3 key players, namely, United Rentals, Ashtead (Sunbelt) and Herc Rentals, Ashtead portrays better financial metrics. For instance, revenue and operating income CAGR in latest 8 fiscal years (“FY”) is 14.2% and 14.3%, respectively, well above the 8.8% and 9.2% of United Rentals and the 2.2% and 4.3% of Herc Rentals.

For the latest 5 fiscal years, United Rentals and Ashtead show similar margin profile with an average operating margin of 24.3% and 25.1%, respectively, whereas Herc with an average of 11.8%, lacks behind peers. It shall be noted that both United Rentals and Ashtead had a lower margin in the latest FY compared to the first FY of the analysis by c. 200bps, whereas Herc Rental increased its operating margin from 6% back in 2017 to 18.2% in 2021.

The growth of these companies is mainly funded through net capex (purchase of rental & non- rental equipment less proceeds from disposal) and acquisitions. In the latest 5 FY (excl. 2020) it is shown that Ashtead mainly funds growth through CAPEX (average of 27.4% over sales) compared to acquisitions of 11.9%, Herc with effectively only CAPEX (25.2% of sales) with the exception of 2021 where acquisitions spiked from near 0 to 20.8% of sales, and United Rentals uses an equal proportion of CAPEX and acquisitions (19.3% and 22.5%, respectively).

We cannot conclude whether one funding method is superior to the other as Returns on Capital (“RoC”) (latest 5 fiscal years) vary irrespective of method used, with United Rentals, Ashtead and Herc averaging at 9%, 11% and 4.9%, respectively. Although Ashtead seems to be superior, it shall be noted that it is the only company from the peer group that had a considerable decline compared to the first period under review (from 12.7% to 10.8%). This is not necessarily a cause of concern since returns are impacted by Koyfin calculation method which uses opening capital and in periods where a significant acquisition takes place, the RoC might be inflated as earnings include consolidated results. Therefore, average periods better serve for comparisons (though it should be monitored).

Source: Koyfin, StockOpine analysis | Note: Data represent latest fiscal year (Dec 31, 2021, for United Rentals and Herc Holdings, Apr 30, 2022, for Ashtead), Total Investments = Net CAPEX + Acquisitions

Going forward, Ashtead and United Rentals seem to be better positioned to take on leverage to fund their growth if needed since the Net Debt / EBITDA ratio (TTM) stand at 2.0x (2.0x in latest FY) and 2.9x (3.5x in latest FY), respectively, compared to 5.3x (5.0x in latest FY) of Herc. This is further justified by TTM Interest coverage ratio (EBIT / Interest Expense) which stands at 7.2x (7.0x in latest FY) for Ashtead, 7.7x (5.9x in latest FY) for United Rentals and 4.8x (4.4x in latest FY) for Herc.

Hope that you enjoyed reading this extract. If you are interested to read more, refer to our newsletter which also includes Financial Analysis, Competitive advantages, Opportunities and Risks, Valuation and Concluding Remarks.

Disclaimer: The team does not guarantee the accuracy or completeness of the information provided in the newsletter. All statements express personal opinions based on own financial and business analysis. Any estimates or forward-looking statements made are inherently unreliable. No statement of opinion is an offer or solicitation to buy or sell the financial instruments mentioned.

The content of our newsletter is not a trading or investment advice and we do not provide any personal investment advice tailored to the needs of any recipient.

This post may contain affiliate links, which means that we might get a commission if you decide to sign-up using any of these links. No extra cost is charged to you.

stockopine.substack.com

Ashtead Group – Renting is Flexible and Affordable

Ashtead Group rents construction and industrial equipment across a wide variety of applications. Ashtead is North America’s second largest equipment rental company and operates in US, Canada and UK under the brand name Sunbelt Rentals.

Already have an account?