Trending Assets

Top investors this month

Trending Assets

Top investors this month

Carbon dating—value in Polish coal mining

With little debt, half the market capitalisation in cash, and ample free cash flow, Bogdanka offers an attractive return to those brave enough to venture into the coal mines of Eastern Europe.

•••

Company: Lubelski Wegiel Bogdanka SA

Ticker: LWB (Warsaw Stock Exchange)

52-week range: zł26-70

Market cap: zł1.3bn ($276m)

Price: zł41

Target: zł69

Upside: +68%

Recommendation: Buy

•••

Business model

Bogdanka is a Polish coal miner. It extracts coal from its mine near Lublin in South East Poland and sells it to local electricity and heat producers. The company provides almost a third of the coal the country’s commercial generators burn.

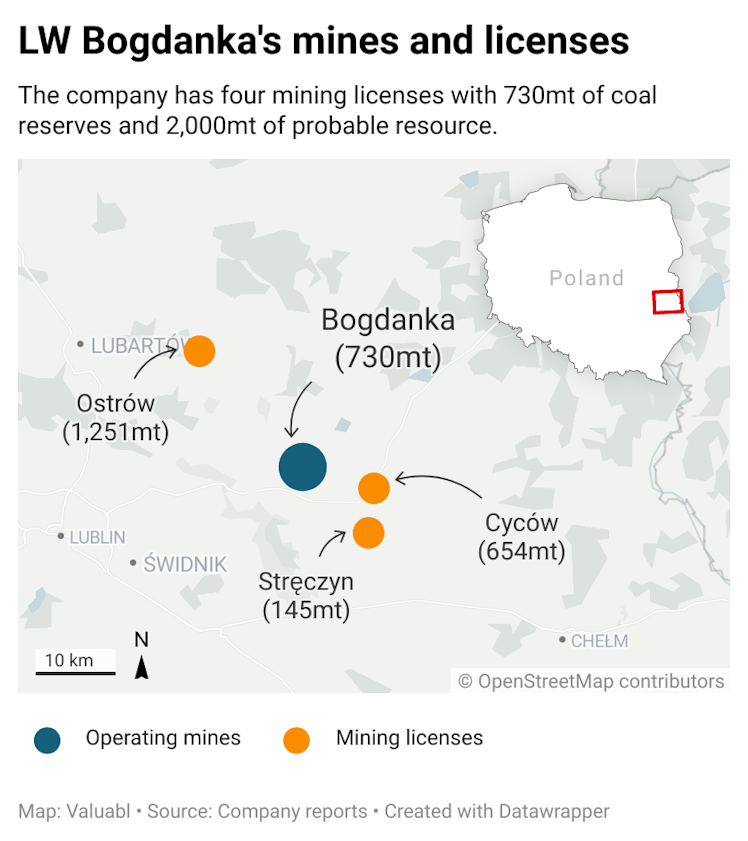

Bogdanka has three excavation fields (Bogdanka, Nadrybie and Stefanów) across Lublin Coal Basin with 730mt reserves. It extracts 14mt of coal annually, processing 10mt of it for sale.

Competitive advantages

- Poland’s power market depends on local coal: Three-quarters of electricity comes from the black stuff, which is now almost wholly locally sourced after the government banned Russian imports. Before the embargo, Russians supplied 17% of the coal burned.

- Source of national pride: Poland is Europe’s second-largest coal producer and uses more of it than anyone else. The industry has the largest union in Poland and is the only one with regulatory clout. “As children, we are taught that coal is our treasure,” says Dr Joanna Maćkowiak-Pandera, the boss of Forum Energii, an energy transition think tank.

- Limited new supply: Two years ago, the government struck a deal with the coal union limiting new mine development and phasing out coal by 2049 in exchange for an agreement ensuring all miners got new jobs before closures. The country has 31 mines producing 54mt of hard coal annually, almost all of which is used locally.

Opportunities

- In-bloc exports: An EU-wide ban on Russian coal means imports to the bloc from other countries have surged—mostly South African. If Polish diggers increase production, exports to other EU countries could increase their top lines. The Dutch, Germans, Danes, French, and Italians are upping coal imports.

- Priority supplier: Bogdanka is the key supplier of Enea, the company’s two-thirds majority shareholder and Poland’s second largest electricity producer. With a looming energy crisis, Enea will sell more energy to rich neighbours, boosting their top line and feeding through to higher coal demand.

- Mining licenses: Besides Bogdanka, the company has three other licenses (expiring in 2046, ‘46 and ‘65) for mining coal across the Lublin Basin, covering 2,000mt of extra coal resource. If developed, these will provide more than 9mt per year of additional production.

Catalysts

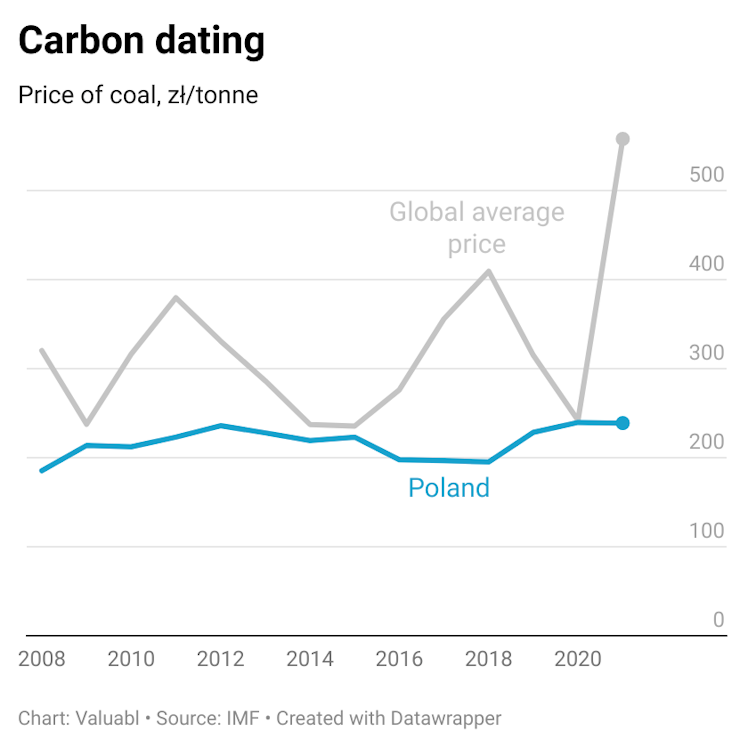

- Contract renegotiation: Supply contracts with Enea are renegotiated periodically, with coal prices set on historical averages. Current annexes cover 2022-'23 and will soon be negotiated for '24. Recent global coal price increases put upward pressure on prices.

- European Energy Summit: Bosses, politicians, and scientists will meet in the Netherlands in November to discuss the energy transition. By revealing the key role fossil fuels will play in the transition and EU dependence, future regulations will become more transparent, reducing uncertainty.

- Commodity inflation: If the prices of metals critical to renewable energy continue to rise, public and private investment in the energy transition will dwindle. Stretched public purses and rising interest rates make capital investment here less attractive, cementing coal's medium-term future.

Key risks

- Political power struggles: Poland’s refusal to close the Turow coal mine last year irked the EU. At COP26, Poland reversed its commitment to ban coal by 2030 within hours of inking the deal. Miffed global governing bodies, including the EU, might pressure or even sanction Poland to stop them digging and burning.

- Taxes: Polish companies pay a 19% tax rate, below the 21% average in Europe. Unlike in other wealthy countries, coal companies pay no additional taxes. If these change and Polish emitters are forced to pay up, this will erode cash flows.

- Russian aggression: If Ukraine falls, the Lublin voivodeship will share a border with hostile Belarussia and Ukrainian-Russia. However unlikely this seems now, an emboldened Russia could look to annex more land.

Valuation

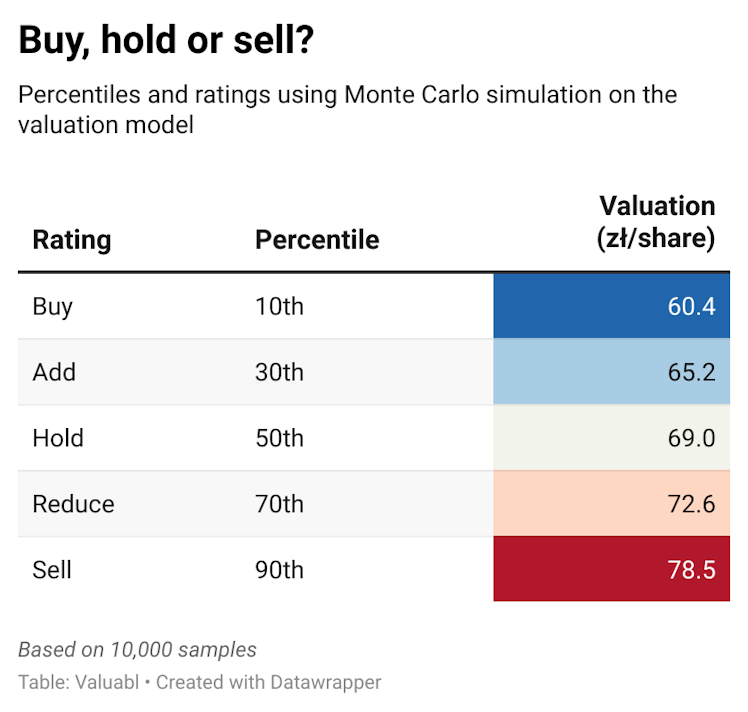

Coal miners are in lawmakers' cross-hairs and have a limited shelf life. Despite the Polish government banning Russian coal, they will find a way to get supply, mostly from local sources. The market will stabilise over the next few years, with prices and profits normalising. But the Paris accord means that Polish coal mining will be gone by 2049, and any resources left after that are worthless.

- Model

- Value/share: zł60-79

- IRR (excl. cash): 15.2%

docs.google.com

LWB (September 15, 2022) - Google Drive

Already have an account?