Trending Assets

Top investors this month

Trending Assets

Top investors this month

$ZM - Is growth zooming out?

Markets says that it does as the stock is trending down since $ZM reported its results. The below presents our analysis for Q3'FY23 results that was published in our substack.

If you enjoy this type of analysis, please share our work and subscribe to our newsletter to receive similar posts directly to your inbox.

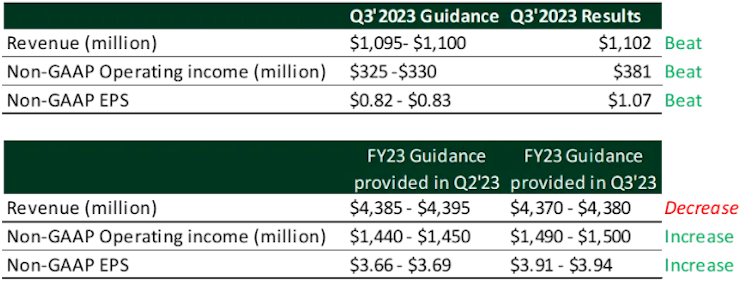

Results Vs Guidance

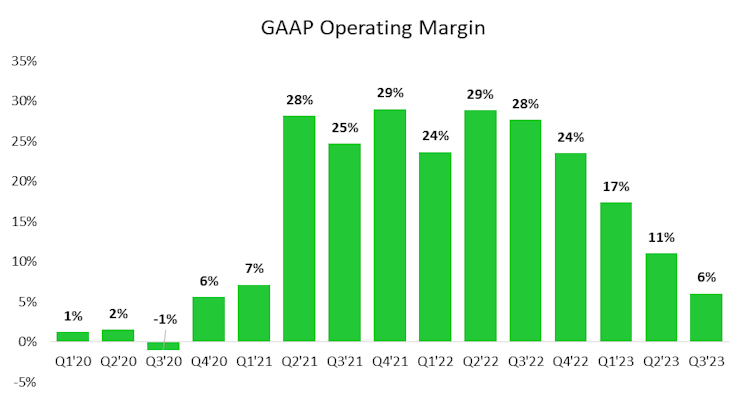

Despite beating guidance for Q3’FY23, the 2nd consecutive reduction in revenue guidance (justified by FX pressure) for fiscal 2023 as well as the material drop in GAAP operating income from $290.9M (margin of 27.7%) in Q3’22 to $66.5M (margin of 6.0%) in Q3’23, driven by a disproportionate increase in stock-based compensation (157%) seem to be the key drivers of this drop.

Eric S. Yuan, Founder, and CEO “In Q3, we drove revenue above guidance with continued momentum in Enterprise. In addition, our non-GAAP operating income came in meaningfully higher than our outlook, setting us up to finish the year with full-year revenue growth, strong GAAP and non-GAAP profitability, and free cash flow that we expect to be at the high end of our range of $1 billion to $1.15 billion.”

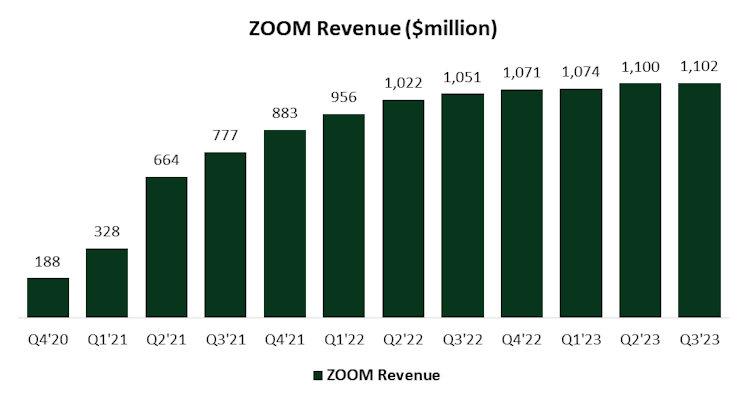

Revenue

Source: Zoom 10Q filings, StockOpine analysis

- Revenue up 5% year-over-year (“y/y”) to $1,102 million. Revenue growth was driven by the increase in enterprise revenue (up 20%) and partly offset by the decrease in revenue from the online business (down 10%).

- Americas region showed an increase of 11%, whereas EMEA and APAC declined by 9% and 3%, respectively. As per management, the drop in EMEA region was driven by Online, FX impact and Russia-Ukraine war and APAC region was impacted from strong dollar. Nonetheless, over the call it was indicated that “one of the biggest areas of opportunity is international partner expansion.”

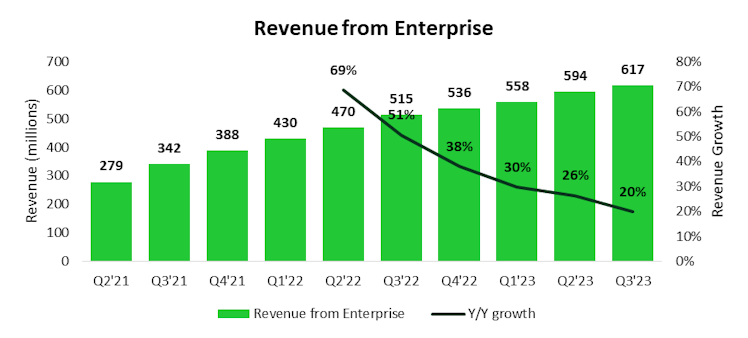

Enterprise Customers

- Revenue from Enterprise customers grew 20% y/y and represented 56% of total revenue, up from 49% in Q3‘22. Revenue from Enterprise customers is expected to be the chunk of total revenue over time.

“The continued strength of our enterprise growth is a testament to how the value proposition of our platform resonates with customers even in tougher economic environments.” Eric Yuan, Founder and CEO

- The FY’23 outlook for Enterprise assumes a low to mid-twenties growth and assuming a yearly 23% growth, Q4’23 growth will decelerate to c. 18% y/y (2% compared to Q3’23).

Source: Zoom 10Q filings, StockOpine analysis

- The growth in the number of Enterprise customers slowed down to 14% y/y compared to 18% in prior quarter, reaching approximately 209,300.

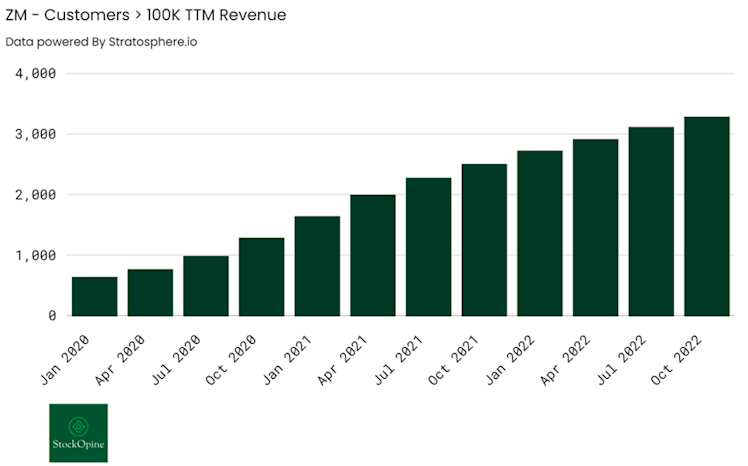

- Customers contributing more than $100,000 in trailing 12 months increased by 31% reaching 3,286. These customers represented 27% of revenue, up from 22% in Q3‘22.

Source: Stratosphere.io

- Trailing 12-month net dollar expansion rate for Enterprise customers was 117%, down from 120% in Q2’23.

Kelly Steckelberg, CFO “I want to highlight, especially in the enterprise renewals remain very, very strong. We were actually slightly ahead of our internal forecast for Q3. So we continue to see -- we've talked about many metrics, growth and expansion in the enterprise.”

Zoom Phone

Kelly Steckelberg, CFO “We also added 9 customers in Q3 that have purchased over 10,000 seats and that brings us to a total of 64 customers in that category. So I think it shows continued strength, especially in the up market even in these challenging economic times.”

No additional color was provided on the number of seats which exceeded 4m in prior quarter.

Contact Center

Eric Yuan, Founder, CEO “And I think that's a future big revenue driver for us, especially customer like CCaaS and UC together, right, and with a much better experience and also the total ownership of costs also much better.”

Across the call, we noted that the focus was not on a single product but rather expanding the full platform so instead of just Phone, Meetings or Chat, teams are focusing on Zoom One which captures those functions and on Contact Center and Zoom IQ for Sales.

Kelly Steckelberg, CFO “So for all the reasons we've been talking about in terms of retention, flexibility for organizations to reduce vendors, the cost savings, the total cost of ownership that they see by having that combined, that for all of those reasons, that's really becoming the focus of our enterprise sales organization.”

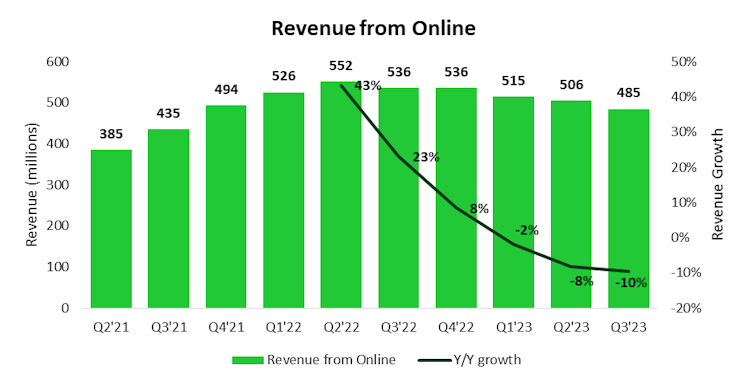

Online Business

- Revenue from online business was down 10% y/y and down 4% quarter-over-quarter (“q/q”) in Q3’FY23, thus the signs of stabilization we observed in the prior quarter may not be justified.

- The FY’23 outlook for Online Business of c.8% decline, translates to a 12% decline y/y and 3% q/q for Q4’23.

Despite this, Kelly Steckelberg, CFO commented that the initiatives for free-to-pay conversion are still in process and added that “we expect online to stabilize from a dollar perspective in Q2 of next year. And based on our most recent forecast, that is still the case.”

Source: Zoom 10Q filings, StockOpine analysis

- On a rather positive note, the recent metric introduced, Online Average Monthly Churn shows a mild improvement from 3.6% in prior 2 quarters to 3.1% in the current quarter.

Profitability

- Gross profit margin was 75% (79.5% non-GAAP) compared to 74% (76% non-GAAP) in Q3’22. Non-GAAP gross margin is expected to be around 79% for FY’23.

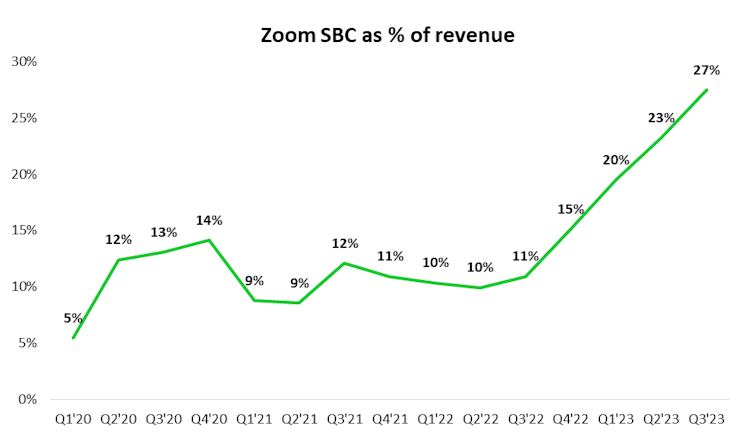

- Non-GAAP operating income of $380.9 million compared to $411.3 million in prior year, and non-GAAP operating income margin of 34.6% compared to 39.1% in prior year. Non-GAAP operating income does not include Stock Based Compensation (“SBC”) which in the case of Zoom is accelerating and increasing shareholder dilution.

Source: Zoom 10Q filings, StockOpine analysis

The exponential increase in SBC is due to supplemental grant program / retention measures to compensate employees who initially received Restricted Stock Units (“RSUs”) when the stock was in the range of $300-400s and as they vest over the same period as the underlying grants, the current level of SBC is expected to continue for few years.

Kelly Steckelberg, CFO “once the stock stabilizes, then you will see less impact from that or less need for additional grants. So we're hoping that we're at that place and that you're going to not see additional supplemental grant in that same level. But until we get past probably another year's worth, we might have some more.”

Although this might make sense to drive investments in new products, the 17.8M RSUs granted in 9M FY’23 compared to 3.2M for FY’22 are extreme. 27% over revenue is a significant dilution to shareholders and it’s not sustainable without a relevant increase in revenues.

- GAAP operating income of $66.5 million compared to $290.9 million in prior year, and GAAP operating income margin of 6.0% compared to 27.7% in Q3’22.

Source: Zoom 10Q filings, StockOpine analysis

- The growth in operating expenses was exponential compared to revenue (5%) with R&D up 99%, S&M up 46% and G&A up 46%. These were driven by SBC whereas R&D was also driven by “investments in expanding Zoom’s product portfolio and delivering on our customers’ evolving needs” and Sales & Marketing because “We continue to invest judiciously in sales capacity and channel partner expansion.”

Financial position, Share buybacks and Cash flows

- Cash and marketable securities as at 31 Oct 2022 are $5.2 billion with zero debt.

- Free cash flow of $273 million (25% of revenue) compared to $375 million in Q3’22 (36% of revenue). FCF does not include the impact of SBC and if included the margin turns negative for a 2nd consecutive quarter.

- The company purchased $565 million of stock, representing 7.0 million shares, implying an average cost of $81 per share. Of the $1 billion share buy-back announced in Feb 2022 only $9.2 million remain available.

- Management expects FCF of $1B to $1.15B for FY’23 (margin of 24.6% for mid-guidance). If tax legislation 174 for capitalization of R&D is not repealed or deferred, FCF will end up being lower. Effectively, there will be no option to deduct R&D in the year but rather amortize over 5 years thus tax saving will be much lower.

Concluding remarks

Q3’23 was not satisfactory despite beating guidance. The reduced profitability, the accelerated decline in online business, the abnormally high SBC which exceeds FCF and the 2nd consecutive reduction in FY’23 revenue guidance, far outweigh the double-digit growth observed in Enterprise.

As indicated on previous earnings reviews a lot depends on the future performance of ‘new’ products (Zoom Phone, Zoom contact center, Zoom IQ etc.) relative to the investments undertaken, the continued growth of Enterprise and the stabilization of Online business.

Disclaimer: The content of our newsletter is not a trading or investment advice and we do not provide any personal investment advice tailored to the needs of any recipient. The information provided should not be considered as a specific advice on the merits of any investment decision. This post may contain affiliate links, which means that we might get a commission if you decide to sign-up using any of these links. No extra cost is charged to you. Full disclaimer

stockopine.substack.com

About - StockOpine’s Newsletter

We focus on quality companies, providing high-quality fundamental research and stock ideas. Click to read StockOpine’s Newsletter, a Substack publication with thousands of subscribers.

Already have an account?