Trending Assets

Top investors this month

Trending Assets

Top investors this month

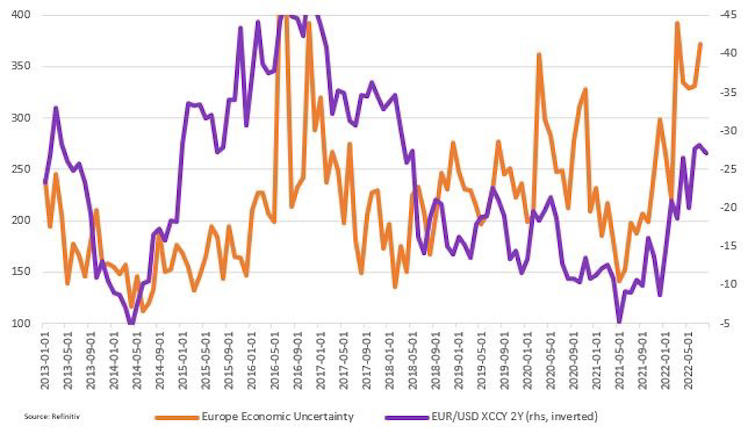

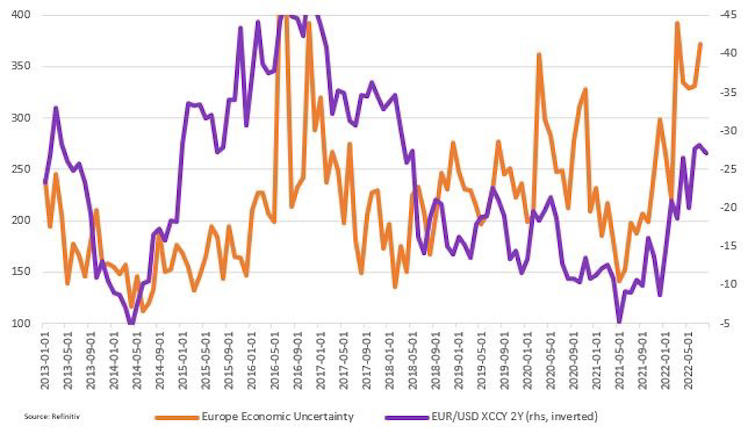

Economic Policy Uncertainty Europe

Economic policy becomes uncertain obviously this scares investors. The need to protect capital, and allocate capital efficiency within Europe begins to deteriorate. Other geopolitical can also start to effect the outlook of future economic policy. Right now Europe faces many uncertainties. Credit markets are deteriorating, CDS are rising rapidly, MMF stress, and dollar shortages are all effecting macroeconomic variables within Europe. Below is a chart of the 2y cross-currency basis swap against the economic policy uncertainty index for the region. As economic policy uncertainty rises the basis becomes more negative this is a signal to investors to flee EUR and USD. The negative basis can be both due to lack of liquidity (dollar shortage) and increases in counterparty risk thus making the basis more negative. As liquidity conditions tighten globally that basis could move more negative, as EPU index starts to move higher.

Already have an account?