Trending Assets

Top investors this month

Trending Assets

Top investors this month

Fair price for great business

My entry for the buy the dip competition is, as the company’s CEO puts it, “the most important tech company you’ve never heard of.”

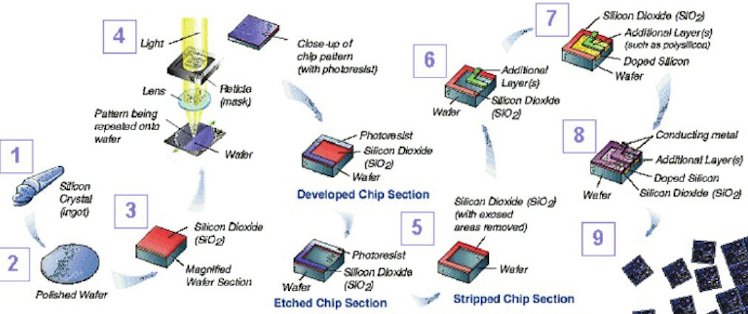

$ASML is the maker of DUV (direct ultraviolet lithography) and EUV (extreme ultraviolet lithography) machines. To make a semiconductor wafer many steps (involving multiple companies at each) are involved. In short…

Silicon wafer production

-made by - Shin Etsu, Sumco, Global Wafers

Photoresist coating

-Fuji, Dow Chemical, JSR Corp

Lithography

-ASML

Etch

-Lam research, Oxford instruments, SEMES

Ionization and Packaging

-Applied Materials, Wiliot, Ayar labs

These steps are used to construct wafers at a foundry

-TSMC, Global Foundries, SMIC, Samsung

Who uses software to design wafers/semiconductors from

-Cadence design and synopsis

Then Intel, NVDA, AMD, apple, etc assemble these wafers into chips that power our world

Notice only one of these steps has one name next to it. And that’s lighography. That’s bc they are the only company that has EUV. A few companies can make DUV machines (older gen machines) but only ASML has the ability to make EUV. So every time you read about a chip less than 10nm in size, they had to use ASML EUV lithography machines. Period. And that my friends is a technological monopoly.

And monopolies are great business to own. Just ask John D Rockefeller. But bc ASMLs monopoly is based on a technological advantage. “ASML's machine drops thousands of evenly spaced, microscopic droplets of [molten] tin, then hits them twice each with a powerful laser. The collision produces an ultraviolet light with a wavelength thousands of times narrower than a human hair.“ They don’t have to suppress competition or employ anti-competitor tactics to maintain their advantage. Which gives them low risk of antitrust lawsuits.

Bc of their new found monopoly in EUV, ASML has pricing power allowing them to over take AMAT as the most expensive step in the semiconductor manufacturing process. ASML has increased its percent of global capex in the semiconductor industry from 18% in 2018 to 22.8% in 2020.

This has nothing to do with the business moat but it was too cool to leave out. ASML has to use clean rooms to operate their lithography tools in. If the smallest spec of dust gets on a wafer it can ruin the chip. The air inside is 10,000 cleaner than outside air.

Okay. Back to business. If TSMC went out of business we’d still assemble chips from Samsung or Global Foundries. If Intel went belly up, we’d use AMD processors. If Oxford Instruments went away Lam Research would still allow for wafer etching. If ASML went away in a snap, we’d all have to go back to iPhone X of 2018 and 4 year old computers. This would be the end to Moore’s law.

That’s why I had this mug made. So every morning I can drink coffee thinking about my ownership in ASML and how without them Moore’s law, which is the doubling of transistor density on a chip every 2 years would end. This “law” has been held true since 1975.

Motley fool podcasts like to ask us the deserted island question. What company would you feel comfortable holding for 5 years if you couldn’t check the price or sell while on a deserted island. My answer would be ASML, every time. Hard to beat owning a moat that if it went away would send all technology backwards to the last decade.

Which brings me to my next point which is the current semiconductor shortage. GM has 95k cars finished but waiting on chips. Apple cut guidance by 10 million units due to the chip shortage. This demand has caused product backlog for ASML to double yoy to 26 billion.

ASML has a 5 year CAGR 19% revenue growth and 31% EPS growth.

More notably since EUV launch in 2019, gross margins improved 45.9% to 52.7% and operating margins 27.1% to 35.1%. This is due to better margins on EUV machines due to pricing power! Bc… you guessed it, it’s a monopoly!

They are steadily increasing their dividend while maintaining a low payout ratio at around 25%. They have 900 mil net cash on the balance sheet.

ROE is a mouth watering 46%. Among the lowest capex/net income ratios in semiconductor industry at 15% which leaves more free cash for buybacks. As opposed to

TSM 126% or Intel 83% capex/net income.

ASML bought back 6% of shares since 2017

But really ramped up over last 12 months, buying back around 1% a quarter (1.8-2.9 bil each quarter) which reduced count by 3.6% in last 12 months alone!

Historical PE range since EUV launched is 23-62. Currently at at PE of 31 which is the same low it traded at during March 2020 and a price to FCF of 14. With all of this you have a company that’s likely to beat the market in the short and long term.

Risk

SMIC is the largest Chinese foundry which can currently buy ASML DUV lithography but is barred from purchasing EUV. Current pressure to block DUV too. If blocked DUV in addition to EUV this would be a headwind.

And that’s it. Barring zombies, solar flares causing an EM pulse or nuclear winter there aren’t many risks to ASML.

This risk is a double edge sword however. The political uncertainty between the West and Asia has also lead to the US wanting to build out its semiconductor industry to not rely on Samsung or TSMC to build its chips. They granted billions to Intel to become a foundry and 22.8% of Intels capex to make these foundries will go to ASML.

Here’s hoping to the next 20 years of Moore’s law thanks to ASML with me as a shareholder.

Good luck everyone in the competition!

Already have an account?