Trending Assets

Top investors this month

Trending Assets

Top investors this month

China's Economic Slowdown

Economic numbers out of China are not looking so hot.

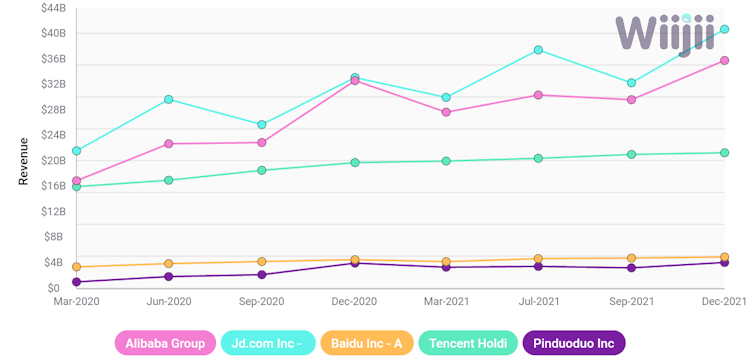

Chinese stocks have had a rough year as the economy remains heavily impacted by the pandemic. Let's look at the individual companies and see if their fundamentals are being affected in the same way. In this case, let's look at Tencent, Alibaba, JD, PDD, and Bidu.

If you want to look into the economic data a bit further, this is a good place to start.

Despite these economic pressures, it appears these stocks have been able to grow their revenue steadily over the last two years.

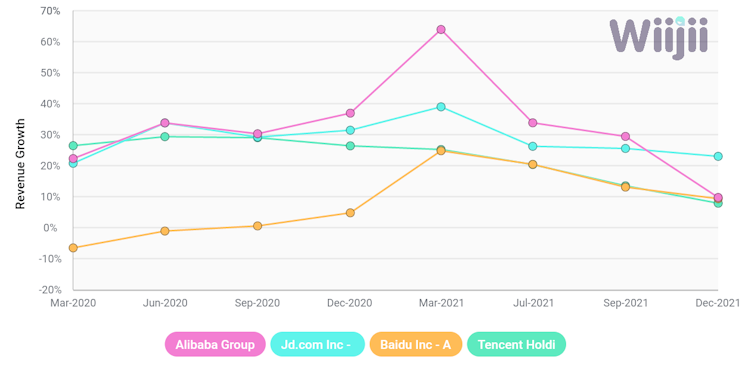

Unfortunately, this growth is beginning to slow as sequential revenue growth has dropped in each of the last 3 quarters. Sequential revenue growth can be a good indicator of how stable a company's growth rate is. Seeing declining growth quarter over quarter could signal more slowing to come.

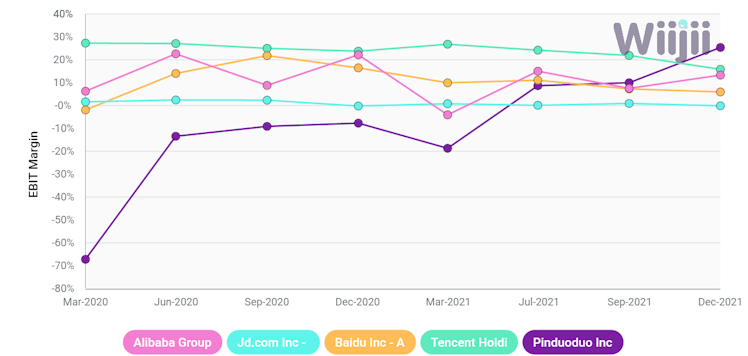

Additionally, margins have dropped for 3 out of these five stocks. Only, Alibaba and Pinduoduo have seen margin expansion. Revenue growth with declining margins can be a sign of competitive weakness or a slowing economy. This is because it means a company is lowering prices or facing higher input costs.

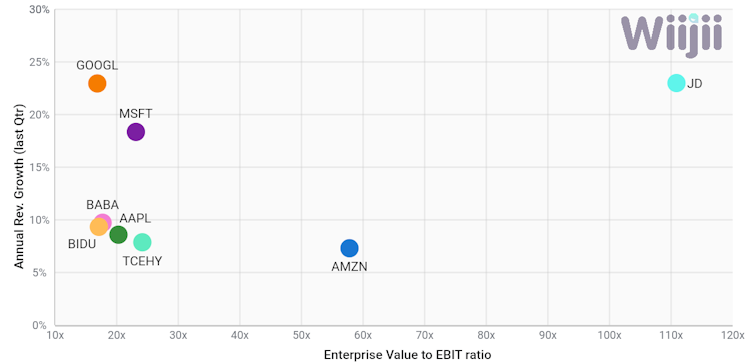

But what about the US? An important thing to analyze is the opportunity cost associated with purchasing these shares instead of shares in US tech companies. When comparing these two groups of stocks it becomes clear they have similar valuations although US stocks are experiencing higher growth rates.

As an investor, it is important to analyze the opportunity costs, valuation, and future prospects before taking a position. What do you think about these Chinese tech stocks? Are they undervalued, or do they have more room to fall?

viz.wiijii.co

OG_TITLE

OG_DESC

Already have an account?