Trending Assets

Top investors this month

Trending Assets

Top investors this month

TA Opinion: Mounting Evidence of a Technical Recovery

I've been watching the market over the last few days with great interest. These are the moments when the battle between the bulls and the bears gets most interesting because we've been sitting at a key inflection point. So far, the evidence from a technical analysis perspective is favouring the bull case. We're not out of the woods yet, but the good news is that the bears have been unable to wrestle control.

Let's look at the chart evidence:

(Hmm ... not sure why the graphic didn't maximise on upload, you may have to click in to expand)

We're seeing a convergence of bullish features:

- 3 consecutive closes above the resistance trend line that has proven to be a very stubborn obstacle in the past.

- An index trading above the long-term 200-Day simple moving average

- A shorter-term, faster moving 50-Day SMA rising to close the gap on the 200-Day SMA. If we continue hold these levels or trade even higher, the 50-Day SMA will eventually cross above the 200-Day SMA to form a golden cross. This is a bullish signal which adds to the corroborating evidence a technical recovery is underway

- Today's candlestick had a long tail showing an area of price rejection, notably below the resistance trend line. This price rejection below the trend line is important and could signal a change in polarity (what was once resistance now becomes a line of support). If we go to the day chart, we can see the session started with the bears firmly in control, but as the day progressed, willing buyers stepped in to lead the recovery. This kind of resilience is always a good sign.

I'm hopeful future macro news won't be worse than the market expects and we either consolidate at these levels or rise further from here. If the market rises higher, then market confidence will continue to grow and active fund managers will be compelled to deploy any sideline cash or rebalance their asset allocations to a "risk on" stance for fear of missing out on the market recovery. Active institutional funds have a tendency to herd because they can't afford to lag behind their peers too much.

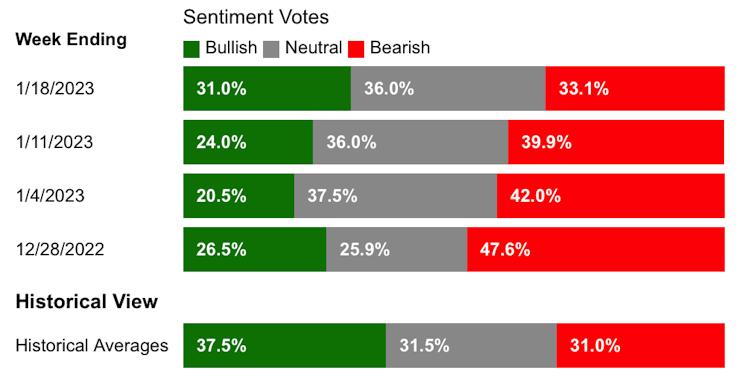

I'll be interested to see the results of the AAII sentiment survey for this week. Bullish sentiment was still well under historical averages last week. I'm sure most AAII members will have seen improvements to their portfolios (as we have). Things are a little less painful, and that's usually good enough to drive better sentiment.

There will be more interesting days ahead as the battle between the bulls and the bears rages on. If you're a long term investor in wealth accumulation mode, continue to stick to your process and keep on investing. A impending market recovery should only affect the degree of how happy you are when you look at your portfolio :).

Already have an account?