Trending Assets

Top investors this month

Trending Assets

Top investors this month

February Portfolio Review - Roth IRA

Following up with my Taxable review yesterday, here's my Roth IRA review for February. A little more action here this month as I continue my bi-weekly contributions.

Without further ado, the summary:

Portfolio Value

January '23 Month End: $9,133.84

February '23 Month End: $9,242.40

Value Difference: +$108.56

Performance: -3.46% (excluding contributions)

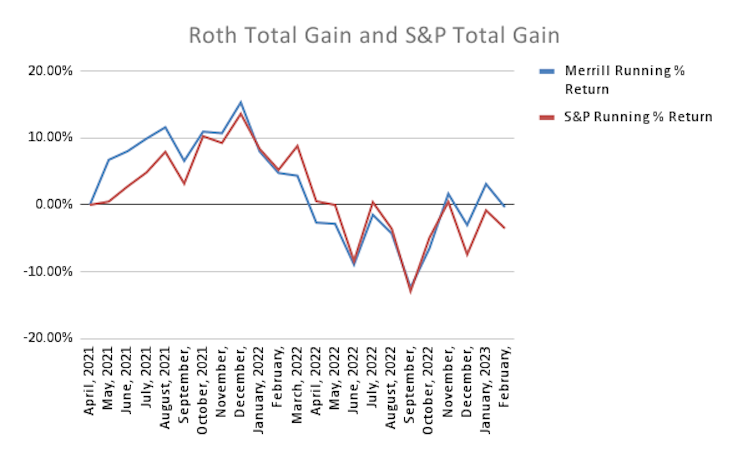

Portfolio vs S&P

January '23 S&P Month End: $4,076.60

February '23 S&P Month End: $3,970.15

S&P % Difference: -2.61%

% Difference Portfolio vs S&P: -0.85% (excluding contributions)

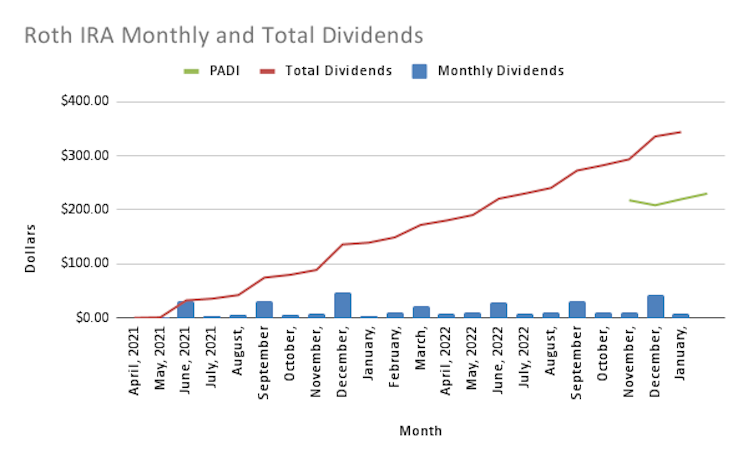

Dividends

February '23: $9.82

February '22: $11.33

% Difference: +15.4%

PADI: $219.71 to $230.12 (+4.7%)

Contributions

$425

Transactions

Buys

2/6

$CARR - 1 share at $46.29

$KMB - 1 share at $131.25

2/7

$EMB - 0.0152 shares via dividend reinvestment

2/10

$CARR - 0.0506 shares via dividend reinvestment

2/13

$KMB - 1 share at $129.33

2/21

$KMB - 1 share at $126.62

Sells

None

Top 5 Positions

- $VTI - 10.5% (-0.6%)

- $KMB - 10.5% (New to Top 5)

- $SBUX - 10.0% (-0.2%)

- $VNQ - 8.9% (-0.9%)

- $VIG - 8.0% (-0.4%)

Top 5 Total: 47.9% (+0.8%)

Summary & Commentary

Staying committed to routine contributions really makes these reviews a little more exciting. Continuing to introduce new capital increase my buying opportunities and allows me to continue building my portfolio toward my end goal.

The goal of my portfolio construction is to maintain balance according to my target allocations. I have been routinely adding to Kimberly-Clark over the month of February as it was tied for my highest rated holding but held the tie-breaker as the most underweight against target. This triggered me to continue to buy with each new influx of capital. $KMB grew from a Top 10 position all the way to 2nd largest holding in my portfolio.

I am a little more than half way to my target weighting of $KMB. As long as there are no major changes or surprises in March, I anticipate the month playing out mostly the same.

As always, I'd love to hear your thoughts or how your February wrapped up!

Already have an account?