Trending Assets

Top investors this month

Trending Assets

Top investors this month

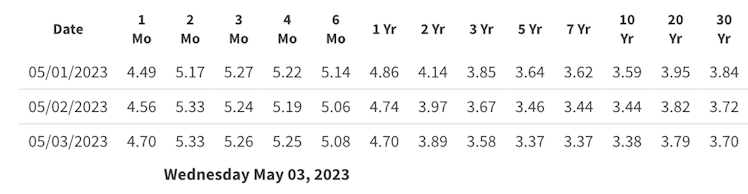

U.S. Bank Failures & Downward Trending Par Rates

Source: Federal Reserve

In light of another pending U.S. bank failure, in $PACW it’s worth examining the cause & outlook. A lender’s business model is to borrow short-term and invest long-term, allowing it to take advantage of higher risk premiums on LT debt. Since the start of last year, the yield curve’s inversion has resulted in many banks flipping their models and investing short-term to exploit yields on the shorter end. However, the spread between ST investments and funding costs is quite low, and unfortunately, banks with smaller market shares have not been able to keep funding costs at bay, which has led to failures.

What’s ahead? Much of the same until the Federal Reserve slashes interest rates. At the moment, they think they can keep rates high because of the belief that bail-in contingencies and other post-2008 created tools will prevent widespread systemic risk.

Already have an account?