Trending Assets

Top investors this month

Trending Assets

Top investors this month

Buy the Block? $SQ

Overview

Block was founded by Twitter's CEO Jack Dorsey who stepped down from Twitter in November of 2021 which means he can spend a lot more time focusing on Block. Speaking of Block, Square changed its name to Block shortly after Jack Dorsey stepped down from Twitter. The name change has been a total disaster to say the least. Timing couldn't have been worse for a company to rebrand as Block for Blockchain when Crypto had an absolute horrible year. At least we got some good jokes, right? Well, Block was probably not laughing since revenue got crushed due to the fall in price of Bitcoin.

This wouldn't be a "buy the dip" contest if I didn't write about a stock down over 70% since 1 year ago. Block is down 73.88% since 1 year ago.

Valuation? Deep Dip Territory

Price / Sales (TTM) 1.86 5 year average 7.77 % Diff to 5 year average -76.06%

Should I end my article here? That is not a typo 1.86 for fricken Square!

Price / Book (TTM) 2.13 5 year average 27.29 % Diff to 5 year average -92.18%

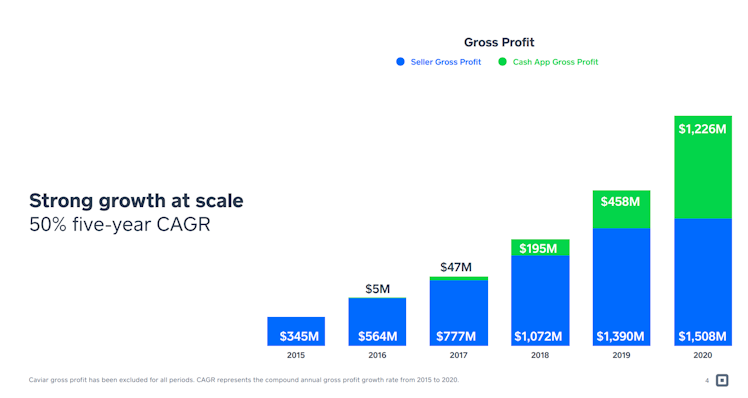

This relatively low valuation isn't due to Block's business being busted or growth rate slowing. It's more indicative of the general macro environment towards growth stocks. In this particular situation, it is unwarranted. Look below at the 5-year CAGR on Block's Growth Profit!

Okay, Cash App basically saved Block's ass...but isn't that what makes a great company? The optionality to take cash and grow it even when the existing cash generator starts to mature.

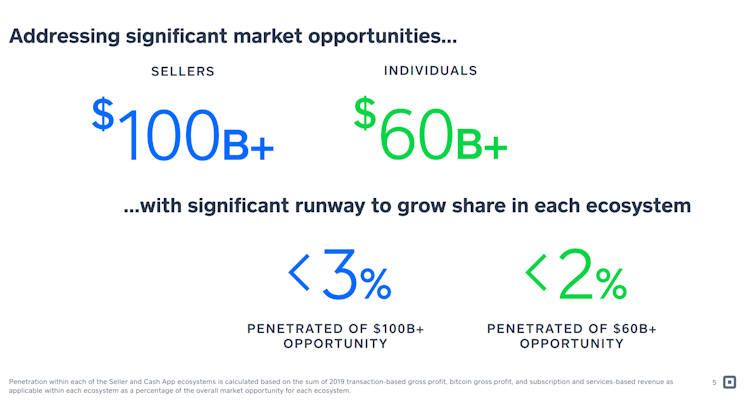

Put together these two amazing businesses, you get a fintech company with the ability to go after an expanding addressable market.

Cash App has over $60B revenue opportunity today plus Cash App is rolling out new products and use cases and in the long-term going into new markets.

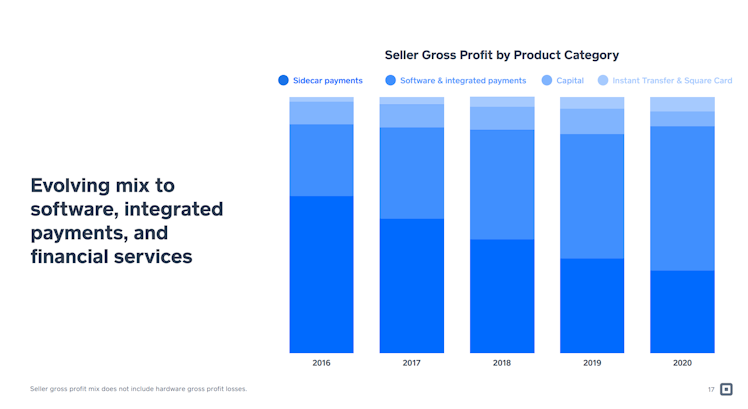

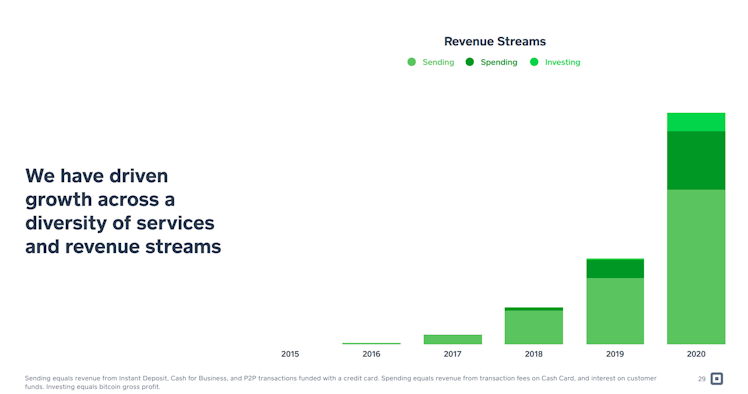

Every year Block's revenue is coming from an increasingly diversified mix of sources. This creates less risk that any one revenue source will the the primary driver of future returns.

Square

Cash App

Competition

To say they have some strong competitors would be an understatement. Good news is all of fintech has been clobbered by the market downturn. Maybe someone else will write a post about one of the above mentioned companies.

Afterpay

Square completed the aquisition of Afterpay in 2022 for $29 billion. Afterpay is a buy now pay later provider which has helped Square expand to over 13,000 merchants. I'm not a huge fan of aquisitions that cost almost a quarter of your total market cap, but I thought this made sense as long as buy now pay later doesn't turn out to be another fad in the fintech world. With other companies such as $AFRM having great success in this space, I think in hindsight it was a fairly smart move.

Negatives

Don't be fooled by Block's free cash flow. Most of it can be directly tied to SBC. SBC was $608 million in 2021 and levered free cash flow was $684 million.

Block looks pretty overvalued compared to Fiserv and PayPal. Block will really need to expand into its different growth areas to make their higher valuation worth the price.

Disclosure

I own 1 share of $SQ

Already have an account?