Trending Assets

Top investors this month

Trending Assets

Top investors this month

Our Next Purchase is...PYPL

We just announced our fourth purchase: PayPal. This one comes from @brianferoldi. Here's is his reasoning...

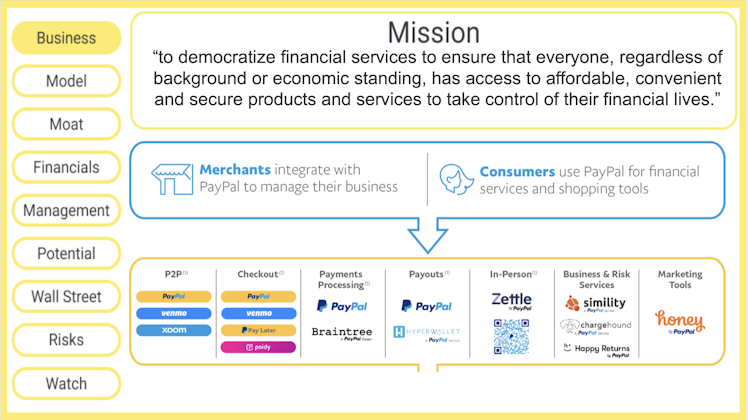

While it probably has the wordiest mission we've read in a while, everyone is pretty familiar with how using PayPal can make your financial life more manageable.

What's truly amazing is how little the company currently has to spend on sales and marketing -- giving it huge brand value

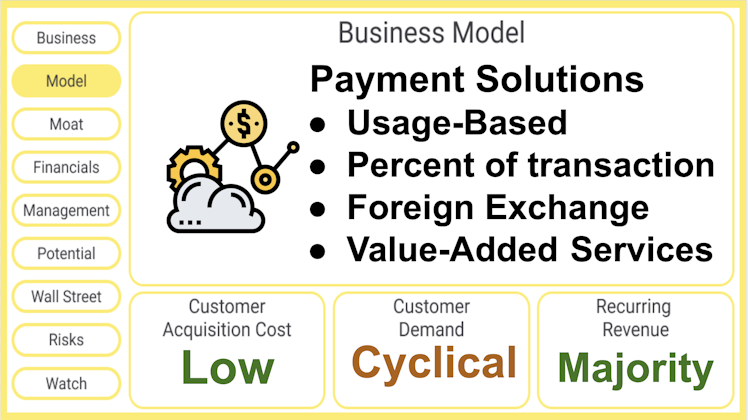

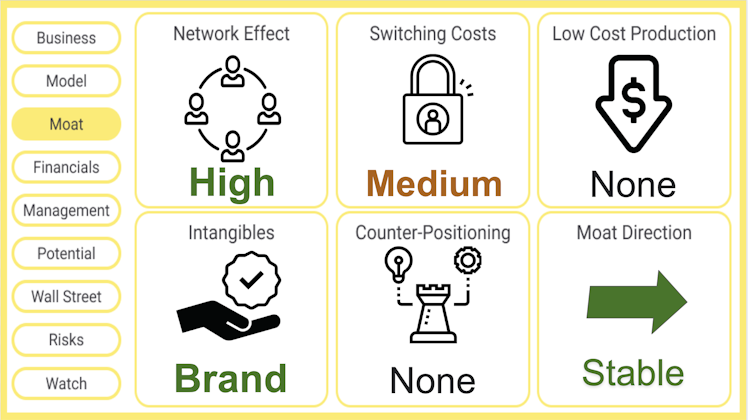

That brand value combines with strong network effects (by far the most accepted form of digital payment by merchants) and medium levels of switching costs to form the moat

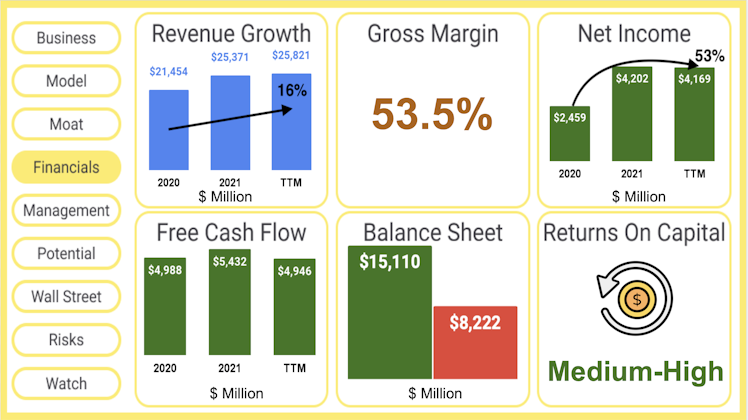

The growth may not look super impressive, but that's because these start in 2020 instead of 2019. Overall, there was understandable pull-forward because of the pandemic. but this is a cash generating machine either way.

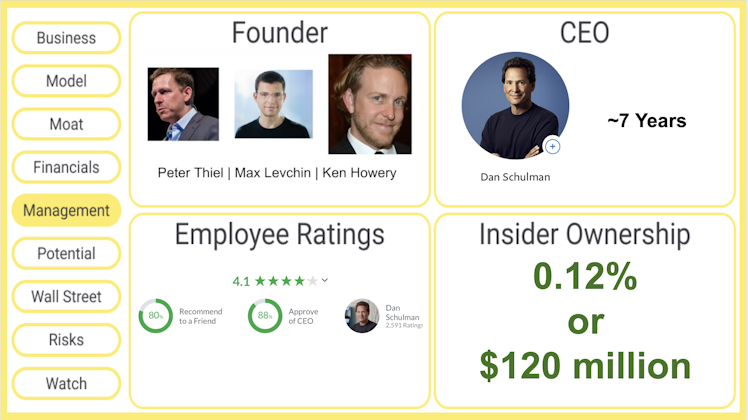

One area with mixed results: skin in the game. The "PayPal Mafia" is no longer around, but Dan Schulman gets rave reviews. The other downside: very low insider ownership.

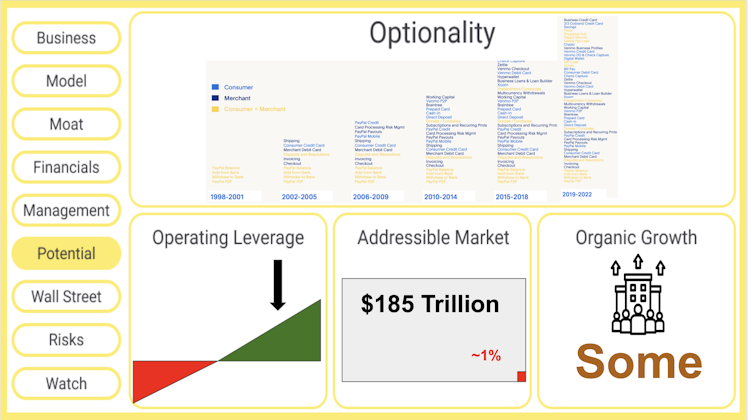

If you're looking for optionality, consider this: every one of those little words you can't read below is the launch of a new service or product over the past twenty years!

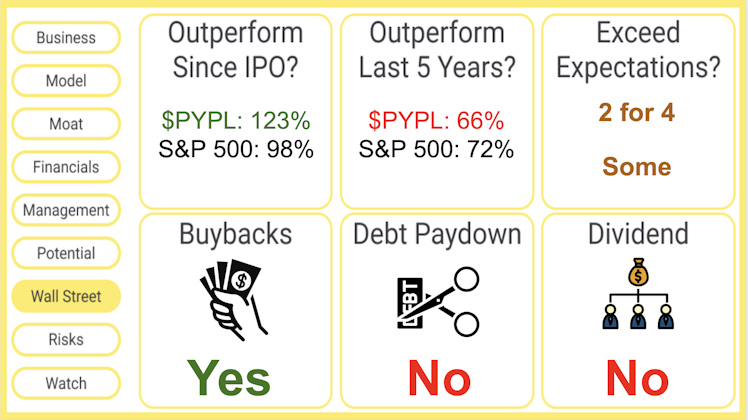

Here's a sign of the times -- and a major reversal: PYPL is actually UNDERPERFORMING over the past five years, and only slightly out-performing since coming public. We're betting on this trend not continuing.

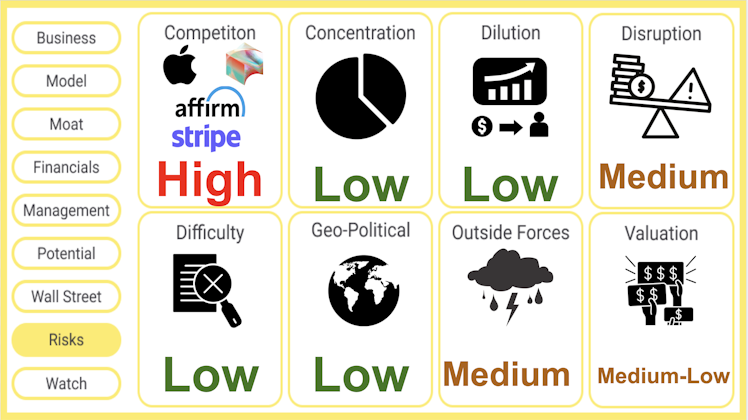

Competition is fierce, and cryptocurrency could disrupt the business model. But the valuation hasn't been this compelling in a long, long time.

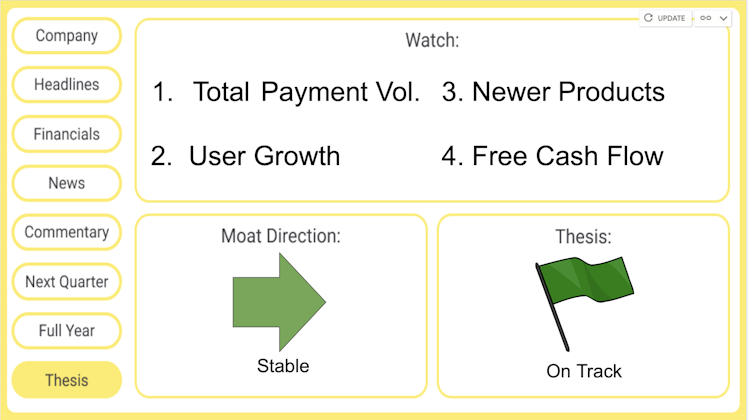

We'll keep a key eye on TPV and user Growth

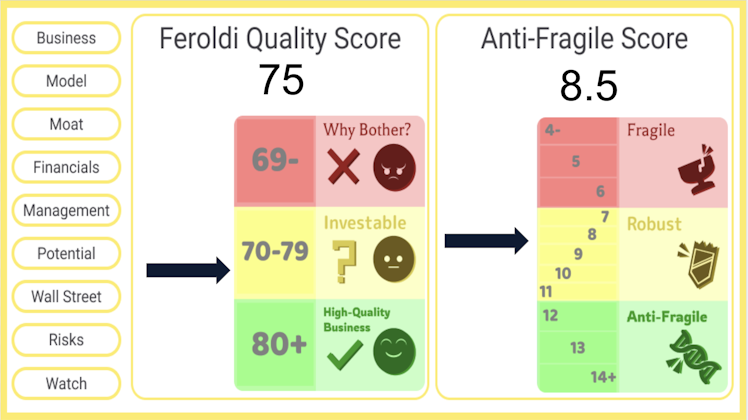

Overall, this scores much better on Brian Feroldi's scorecard than mine, but still very much in the investable range

What do you think?

PayPal is a...

64%Solid buy after its HUGE drop

35%A wait-and-see watch-lister

34 VotesPoll ended on: 5/16/2022

Already have an account?