Trending Assets

Top investors this month

Trending Assets

Top investors this month

$BABA Part 2

So here are my thoughts about BABA's recent earnings release, expectations for the future and price targets. I know that Chinese stocks can incite strong sentiment against them, but would still love to hear other people's thoughts.

Review of CY21 earnings

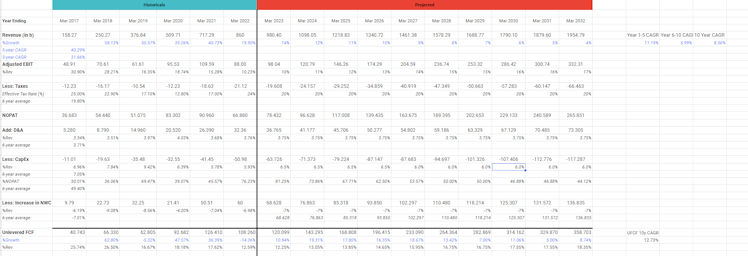

- BABA closed out CY21/TTM with 836.40B CNY (131.25B USD) of revenue at a 29.8% YoY growth rate.

- Operating Income / EBIT was 90.32B CNY and reported GAAP Net Income of 65.46B CNY.

- However, adjusting for one-time charges, we can add back 18.23B due to legal settlements, 25.14B due to goodwill impairment and 1.69B due to asset writedowns, giving us an Adjusted Net Income of 110.52B CNY (17.34B USD), which is a more accurate reflection of the earning power of the company for its shareholders.

- Operating and Net Income Margins come in at 10.80% and 13.21% respectively.

- My calculated free cash flow for BABA (which differs from the way they report) is 102.68B CNY. BABA excludes capex related to office campuses.

- BABA is sitting on roughly 355.30B CNY (55.5B USD) of net cash and short-term investments, and 476.3B CNY (~74.75B USD) in longer-term investments

- Overall, we get TTM trailing EV/EBIT, EV/Earnings and EV/FCF multiples of 15.72x, 12.84x and 13.82x as of 11 April 2022. These are huge discounts when compared to history and peers.

Valuation and Expectations: A Preface

Of course, multiple re-ratings happen for a reason. Just because a stock is cheap in terms of valuation doesn’t make it a good investment. One should definitely be wary of falling into the classic “value-trap”. Markets are more concerned about what happens in the future and move based on these expectations, because everything past and present is perfect information to all. Divergences in predictions of the future are what create markets.

Ultimately, current prices and valuations reflect expectations of future cash flows, while discounting them back to the present. Any factor that affects either of these two fundamental components will influence the stock price. For BABA, a variety of factors do justify a fall in its valuation: an abrupt slowdown in realised top-line growth; margin compression; uncertain competitive landscape; slowdown in China’s economy; unpredictable government regulation and intervention (that mandates a higher discount rate).

Each investor has their own personal answer to the important question: how justified is the fall in stock prices/valuation against a downward revision of expectations? Is there an overreaction, or is the market not pricing in enough? While being acutely aware of the risks, are potential rewards sufficient such that the risk-reward proposition warrants a position in our portfolio?

Revenue Growth Expectations

BABA realised a 3y revenue CAGR of ~35%. In the past two quarters, YoY growth was 17.8%. In the last quarter, barely 10%. Clearly, there has been a sharp slowdown in growth, and subsequently downward revision of future expectations. The company has attributed this to two main reasons: the current slowing macro landscape in China, and competition.

China’s GDP growth forecasts for the near-term have repeatedly been cut as it grapples with an enormous deleveraging in its real estate sector that has been unravelling over the past half a year-ish, a slower-than-expected global growth rebound and the latest Covid-related lockdowns and shutdowns. BABA has almost 1B users in China out of a population of 1.4B, thus its China commerce operations (which comprise the majority of its revenue) will move largely in tandem with the overall Chinese economy.

However, I would be wary of extrapolating the trends we see now into the long-term given temporary factors and still positive demographic undercurrents. China’s central bank has started easing its monetary policy and more is expected to come on the fiscal front. Coming out of Covid-related restrictions is a matter of when, not if. Once it reverses, comps will be easier and we may see a meaningful reacceleration. All this is on top of a continued migration of its population from the lower to the middle class, providing a strong base for GDP growth for at least the next 5-10 years to come.

Of course, tail-risks will include that the full impact of the real-estate deleveraging has yet to be seen, with much longer-term detrimental impacts. I’m not an economist, thus I’m well aware that further commentary is not possible. For now, this is my current outlook.

Still, my expectations of BABA’s growth have been revised downwards, standing at 14-15% for the year ahead. I will definitely be paying attention to the next earnings release (especially because the financials will be more detailed since it is their annual report) and news from China for more colour regarding what to expect for the year ahead and beyond.

Amidst competition, let me justify why I believe BABA can still achieve meaningful top-line growth. First, the higher its market share, the easier it will be for it to be lost. With relatively low fixed costs/barriers to entry in e-commerce and low customer loyalty, it's only natural that BABA would have gone from ~70% market share to ~50% over the past few years as new players emerge. Now that that is past, further attrition of the same rate is less likely as BABA continues to still be the biggest e-commerce ecosystem, benefitting from network effects and internal synergies. Barring niche situations, I think it is reasonable to assume that the first place Chinese merchants and consumers, whether they are looking to sell or buy, would turn to are BABA’s businesses (Taobao, Tmall).

Referring to my previous post, BABA has differentiated offerings for customers across all markets, be it value to premium, as well as providing multiple convenient fulfilment options. Moving forward, competition for merchants and customers will be about who can provide the most analytics, insights, and fulfilment capabilities for merchants to sell more and deliver smoothly; and the most seamless, intuitive, worry-free, engaging experience for customers to find and get what they want for cheap (or even better, discover things that they did not know they would want). I don’t see why BABA will be unable to do so for the Chinese consumers and merchants they have served over the past 20 years.

There are still more avenues to add marginal growth for a market that is largely mature. The e-commerce market is not homogenous — different categories of goods have different e-commerce penetration rates, think apparel/cosmetics vs household furnishings/Fast Moving Consumer Goods (FMCG, like groceries, fresh produce, toiletries). BABA’s “New Retail” concept acknowledges that some goods are preferred to be purchased or looked at offline, thus setting up businesses like Freshhippo or acquiring hypermarket retailer Sun Art. It aims to blur the lines between online and offline, integrating technology, automation and online features within the offline shopping experience to create a more convenient and smooth process for the customer from product discovery to delivery.

Furthermore, more untapped potential lies in rural China. BABA has recognised that this is the last segment of China’s population to be acquired and introduced into their ecosystem. They have been heavily investing in this space with their two latest apps: Taobao Deals and Taocaicai. As written in my previous post, Taobao Deals is targeted towards price-sensitive customers in rural China by offering them the cheapest, while maintaining quality and value, products directly from manufacturers; while Taocaicai is a community group buying platform that tackles the traditionally difficult venture of groceries and fresh produce e-commerce. Thus far, the results have been encouraging with strong user and order growth with improving unit economics. While these users bring in less revenue, BABA is playing the long game here because a decent proportion of these acquired users will move into the middle-class and gain more purchasing power, ultimately driving greater spend over the long term.

Taking a broader step back, e-commerce in China still has a runway to grow; internet penetration in China is roughly 73% in 2021. Beyond middle-class expansion, age demographics provide another tailwind as younger, tech-savvy generations born into the digital world continue to gain greater disposable income for e-commerce spending while replacing older generations where some may still be adverse. While it's a small tailwind, it still contributes a secular boost nonetheless.

I spent so long talking about how BABA can continue to maintain and grow its China commerce business, yet that won’t be the biggest growth driver (though it does serve as a stable base). Alibaba cloud will definitely be contributing the most to BABA’s future growth, as the cloud computing industry is riding on the secular, powerful force of digitalisation as more companies in non-tech industries recognise the value of cloud onboarding and as worldwide computing needs continue to increase. One can also expect Cainiao, its international e-commerce operations and local consumer services to contribute to its top-line growth.

Thus, I still believe that BABA can achieve about an 11% CAGR in the next 5 years; and 8.5% for the next 10 years (inclusive of the first 5 mentioned) for now. But of course, and once again, “When the facts change, I change my mind.”

Margins and the Bottom Line

Here is where it gets more exciting. BABA is an interesting company, a conglomerate, really. It’s an amalgamation of mature, profitable legacy businesses and new, fast-growing but cash-burning ventures.

Its overall operating margins come in at about 10-11%, while its adjusted EBITA margins for its China Commerce Operations in the last 9 months are 33%. When management attributes the large margin compression and fall in earnings in large part due to its “investment in new initiatives”, it is not an excuse.

While operating and net margins may remain depressed within the next year as a result, I believe from then on it is reasonable to expect a strong boost in margins as unit economics of newer initiatives continue to improve and as management scales back on the expenses (product development, marketing) that were needed to establish these new initiatives. Currently, Cloud and Cainiao bring in 2% and -2% in adjusted EBITA for the last 9 months respectively. Certainly, there is much room for overall margin expansion from these two units alone as they continue to mature, scale, and generate consistent profitability (whereas for International Commerce and Local Consumer Services I am not so optimistic).

As such, I expect operating margins to increase by 100 basis points each year from 2023 to 2026, which I believe to be rather conservative.

Another important component to BABA’s bottom-line is the performance of its investments, which including net cash, given it a portfolio of 831.6B CNY. A movement of 10% can nearly double or nearly erase its reported net earnings. Thus, its net margin has usually been much higher than its operating margin for the past three years as BABA continues to deploy its huge cash position into investments, with investment-related income accounting for a positive addition of more than 10%.

As written in my previous post, BABA’s poor bottom-line performance in the past few quarters has been bogged down by an exceptionally disastrous performance from Chinese financial markets. After such extreme fear, one can expect sentiments to recover and stabilise, if political concerns that have caused said fear in the first place subside, or as we have seen thus far, reverse.

Thus, we can expect bottom-line performance over the next year to be buoyed by relatively stronger investment returns (especially as compared to the previous year) if this base case does materialise. After accounting for other adjustments like taxes and minority interests, I expect adjusted net income margins (excluding one-off charges) to be about 400 basis points higher than operating margins over the next few years.

On that note about the “China risk”, I do acknowledge that investing in Chinese companies is inherently riskier, be it due to the VIE structure, or the unpredictability of the Chinese government. Geopolitical tensions are another possible flashpoint. While the Chinese government likes to throw its weight around and crackdown on businesses to demonstrate its might (as with all the rhetoric we witnessed last year), I believe fundamentally, they do recognise the importance of businesses like BABA to its economy, how it has driven much growth, and how Chinese companies have benefitted from foreign capital. They would want to avoid clamping down and stifling such businesses too hard, and any show of might will be temporary and without long-standing impacts (if they deem it important to their economy and society, unlike the for-profit online tutoring). It will also work to allow foreign capital and investment to continue flowing in and thus, as we have seen, cooperate to prevent the delisting of its companies. But once again, all of these will be subservient to other priorities like maintaining its political power or asserting its sovereignty (Taiwan). All in all, one has to be aware of and account for the elevated inherent risk.

Price Targets

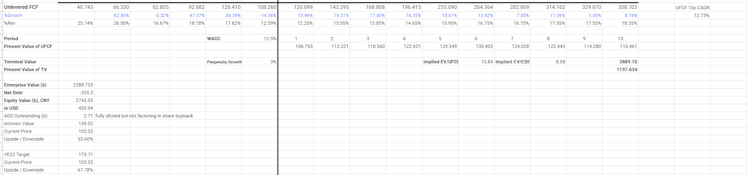

Based on this DCF (unlevered free cash flow), the year-end target is $173.74 USD, a 67.81% upside from a price of $103.53USD as of writing. Most of the parameters have been explained by all the bunch I’ve written above. I believe that a discount rate of 12.5% incorporates the elevated China-related risk, a higher US 10Y as the risk-free rate, and tighter financial conditions while slightly offset by BABA being a mature, stable and profitable company. Note that net debt does not account for long-term investments and stakes in other companies.

In conclusion, while factoring in poorer fundamentals, given the tailwinds BABA is riding on, I believe that BABA can offer strong returns at its current price.

Already have an account?