CPG brands lose market share to private labels as consumers focus on the price tag

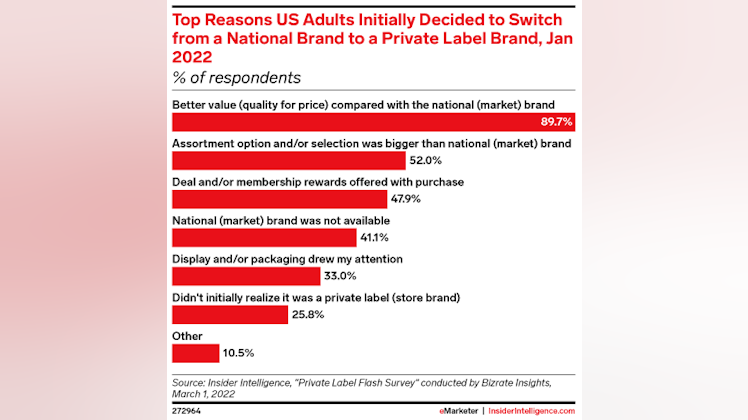

The trend: As more shoppers prioritize value over name recognition by choosing private label brands, national consumer packaged goods (CPG) brands are looking to boost their appeal without lowering prices.

How we got here: As production and distribution costs began rising, CPG companies adopted a number of tactics to protect their margins, opening the door for private label brands to steal market share.

- Many passed on cost increases to the consumer by raising prices, as Coca-Cola, Kimberly-Clark, and Tyson Foods have done.

- Brands have also reduced the frequency of promotions and the level of discounts.

- Many CPG manufacturers have cut the number of SKUs they offer to focus on their most profitable items.

The rise of private label: High gas and food prices coupled with changing consumer perceptions of private label products enabled store-owned brands to thrive. At the same time, retailers are doubling down on private labels to increase revenues and keep shelves stocked.

- In Q1 2022, sales of store-owned brands rose 6.5%, compared with a 5.2% increase in national brand sales, per data from IRI.

- Nearly 80% of US adults reported either purchasing or being willing to purchase private label apparel, pantry, personal care, and other goods, per our Private Label Flash Survey conducted by Bizrate Insights in January 2022.

- Retailers like Walmart and Target are bringing on premium designers to boost appeal for private label apparel brands.

Changing tactics: As shoppers dip into their savings to cope with higher prices, companies need to appeal to consumers in different ways.

- “This is when CPG companies with market brands (like Tide) have to double down on their features and benefits—why are they better than the value option?” said Suzy Davidkhanian, eMarketer principal analyst at Insider Intelligence. Highlighting attributes such as efficacy and reduced environmental impact can help.

- Davidkhanian also notes that CPG brands “should lean into the categories consumers are less likely to switch,” such as pet food or beauty products, to reduce the threat from private label brands.

Looking ahead: The Consumer Brands Association, a CPG trade group, warned in May that “price increases are now an unavoidable outcome” for the industry. As more people are forced to cut costs wherever they can, private labels’ market power will continue to grow.

- On the other hand, name brands have an opportunity to target more affluent shoppers who haven’t yet slowed their spending—provided they don’t irritate them by resorting to shrinkflation (shrinking product sizes while maintaining or even raising prices).

EMARKETER

The luxury retail market shows no signs of fading

US consumers can’t get enough of luxury retail: While Walmart and Target struggle, LVMH and Burberry benefit as affluent customers ramp up their spending.

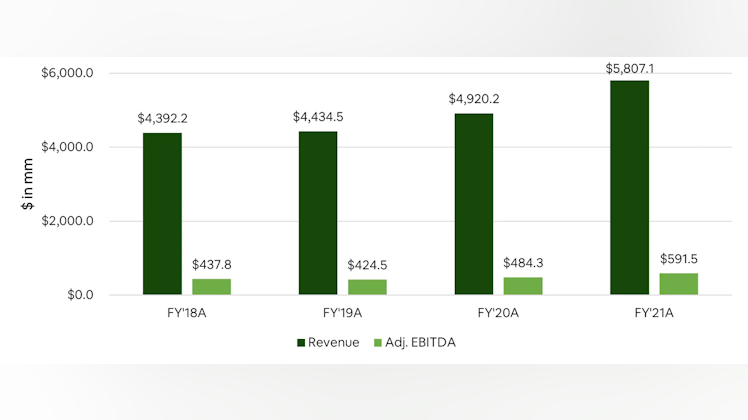

Is $THS the best way to bet on the rise in private label?