Despite physical retail’s resurgence, malls’ relevance diminishes

The trend: Despite the recovery of brick-and-mortar retail, malls—especially lower-tier ones—are struggling to stay relevant. While high-end developers like Simon Property Group command premium prices for square footage, class B, C, and D mall operators find it difficult to attract tenants and shoppers.

The haves: Simon continues to thrive. The developer raised its full-year guidance thanks to higher occupancy rates and rent increases, per its Q3 earnings report. The company has not seen any signs of pullback in store openings or renewals as retailers continue to invest in brick-and-mortar retail.

- Q3 net operating income for its domestic properties rose 2.3% year-over-year (YoY).

- Occupancy rates at the end of September stood at 94.5%, growing 1.7% YoY.

- Base minimum rents per square foot also grew 1.7%, to $54.80.

But Simon’s acquisition of a 50% stake in mixed-use developer Jamestown suggests the company is looking for ways to diversify its portfolio and reduce its reliance on enclosed malls.

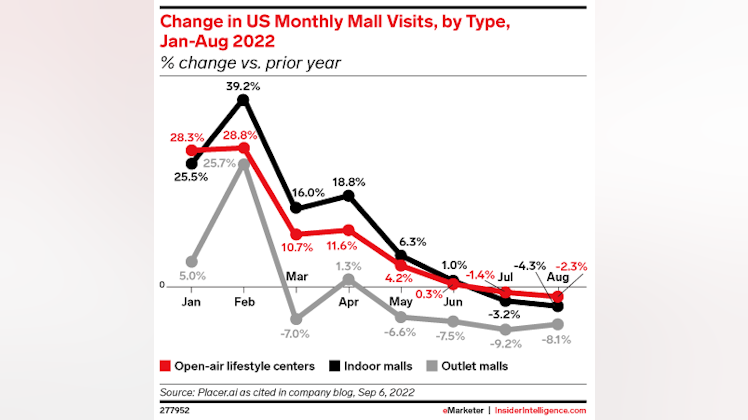

The have-nots: Mall traffic remains well below where it was pre-pandemic. In particular, outlet malls’ recovery has been much slower than indoor and open-air malls—a sign that even the prospect of scoring a deal is no longer enough to attract visitors.

- September traffic to indoor malls was 0.9% below where it was during the same month in 2019, according to Placer.ai. Traffic to outlet malls ticked down by 4.5%.

- The retail availability rate at malls has risen by 90 basis points over the past five years, largely because of an exodus from Class B and C properties, per CBRE.

- With department stores like Macy’s and Nordstrom looking beyond malls for growth, lower-tier operators will find it even more difficult to attract tenants without a big-name anchor.

The bigger picture: While CEO David Simon believes Simon’s strong performance should “put an end to the so-called negative mall narrative,” the situation is more complex. Simon’s focus on upscale malls means the developer has been a prime beneficiary of seemingly insatiable demand for luxury goods, making its properties more attractive to prospective tenants. Even so, its occupancy rate is lower than it was before the pandemic, per Hoya Capital.

- The number of malls has also fallen precipitously, from roughly 1,000 in 2021 to 750 today, according to Nick Egelanian, president of retail advisory company SiteWorks.

- Egelanian expects that number to drop to 150 over the next decade as online shopping gains popularity and department stores become less relevant.

While Simon may be correct in saying that its malls are thriving, the reality is that overall, malls are no longer as integral to the retail landscape as they once were. Instead, many have been transformed into leisure centers, office complexes, or even apartment buildings as developers try desperately to find new ways of drawing people in.

EMARKETER

Bloomingdale’s store closure demonstrates why malls need to evolve

Malls need to change: As department stores right-size and shift to smaller formats, mall operators need new types of businesses to drive people to their shopping centers.