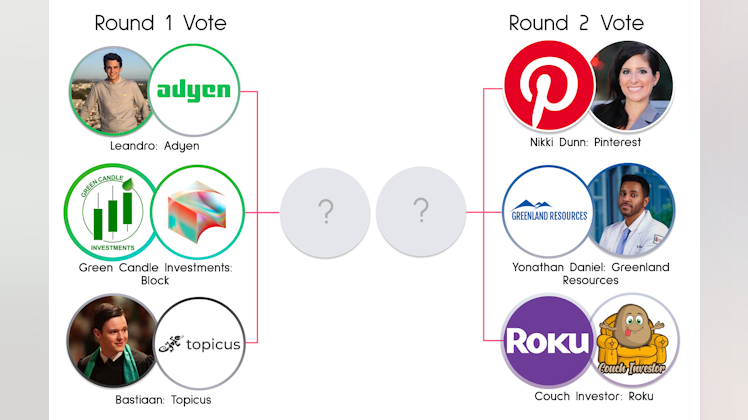

Block stock pitch (SQ) by Brandon

@greencandleit gave a great pitch for $SQ — which also have their investor day today.

You can watch the pitch HERE or read below ⤵

Block has various avenues of their business:

- They have Cash App, which is peer-to-peer. You can buy and sell stocks and Bitcoin and remove them off the platform too.

- They started developing Bitcoin mining hardware where they partnered with Blockworks.

- They are the biggest client for Intel's Bitcoin mining ASIC chip.

- They have Tidal music streaming service.

- They purchased after Afterpay earlier this year, and they also own Weebly, a web hosting service.

As far as Square goes, they own about 25% of the digital payments market share through 2021. Digital payments are obviously increasing drastically since the COVID-19 pandemic in 2020.

They have the payment rails not only for businesses to accept payments of all kinds, but they also have it for consumers with Cash App. And I think a big aspect of this that they're improving is that they've integrated the Lightning Network, which is essentially a Layer 2 technology on top of Bitcoin that allows them to almost undercut the visa and Mastercard fees that they transact and get for merchants.

When a lot of small businesses are going to be hurting with their underlying costs that 3% fee that they get on every transaction can be eliminated and could be a big point of sale for onboarding new merchants.

Cash App is a big aspect of their business as well. It allows people to move Bitcoin and stocks off the platform, which makes it more user-friendly.

They had $43 million worth of profit in their Bitcoin transaction.

And over the past two years, that's a revenue growth of 138% and profit growth of 155%. So not only is sending cash peer-to-peer with no banking fees a big sell, a lot of people already have this on their phone. And if they want to buy and sell stocks and get into investing, it's an easy way to already onboard people who have this application already on their phone.

They recently purchased Afterpay as well. If merchants need to buy and sell some products in order to help with sales they can do that through Afterpay, and they have the ability to do that and be the middleman and Square can be on all sides of that transaction, whether it's through Cash App payment, Square receiving the final payment, and Afterpay in the middle.

And then they're also developing in-home Bitcoin mining. They're using Tesla's solar power battery to create in-home miners. Bitcoin mining is a $16.7 billion in revenue market.

And there's not really any big players in there right now. Square will be one of the biggest players developing these giant Bitcoin miners.

And then last but not least. Jack Dorsey is now going full-time at Block, which he previously was sharing that time with Twitter.

And, since he's left Twitter there's been a lot of big moves being made in Block. First from changing the name then to partnering with Blockworks, becoming Intel's largest async chip client, developing a fully green Bitcoin miner, and then also the acquisition of Afterpay all in just six months.

With all that it's a bright outlook for Block and a lot of things on the horizon.

X (formerly Twitter)

Nathan Worden (@NathanWorden) on X

Block does a lot more than just digital payments. Brandon breaks down the investment thesis for $SQ

@Greencandleit

That’s the kind of big picture common sense analysis that is refreshing. Not a single useless acronym🤣I almost bought in last week. Lot of their numbers look great.