What if Commonstock had more anonymous profiles?

This question comes out of sheer curiosity. Let me explain the logic ..

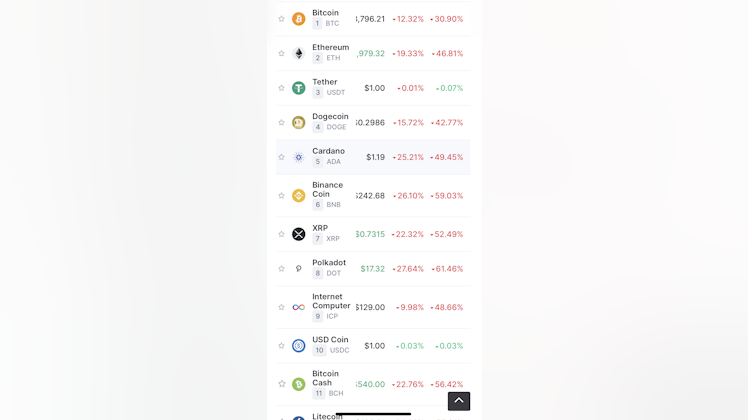

Love it or hate it, web3/crypto is pushing boundaries of what financial transparency is. Never before has such a large number of people been comfortable with totally exposing their entire investment history. But many, if not most, do it anonymously. Although you don’t know who the ape-avatared person on twitter really is, you 100% know how well they’ve picked what crypto/NFTs to buy. That's enough to know if they're BS or worth listening to.

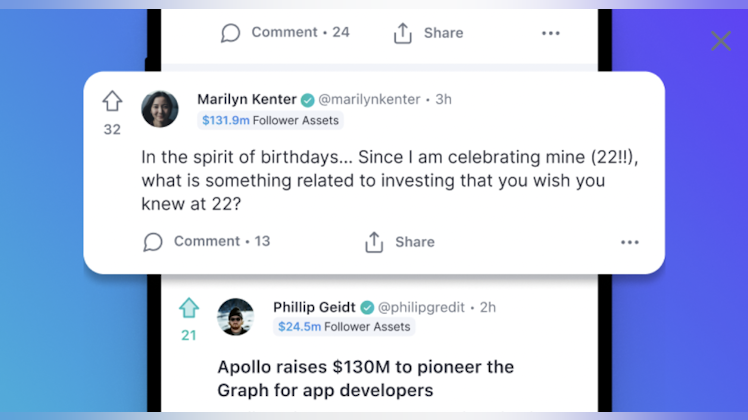

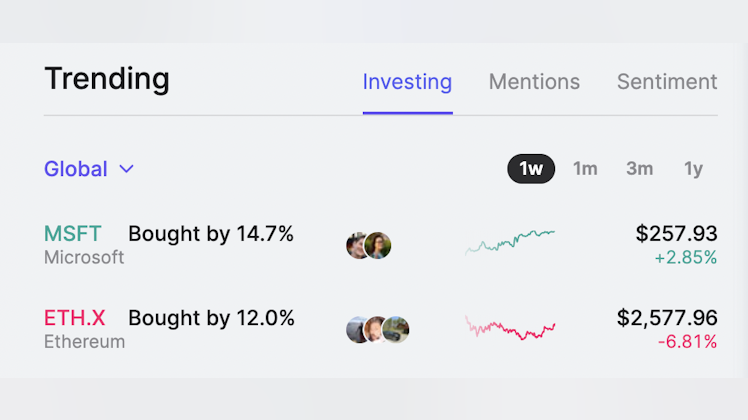

Commonstock is without a doubt the closest thing traditional finance has to web3. It brings transparency to traditional financial in a way no one has ever done before. It has made people comfortable exposing their trading history. And it’s done so while staying neutral (e.g. it’s not trying to compete with existing brokerages - it embraces them). That's made it lightyears ahead of unverified screenshots on WallStreetBets and far more objective than sites like Public whose ultimate goal is to compete with other brokerages.

That led me to wonder… while Commonstock has been very aligned with web3 psychology when it comes to being transparent about trading history, anonymity in traditional finance has largely been unexplored. On CS, you have to reveal (for the most part) who you really are (“doxxing” yourself in web3 parlance). Even if that’s not a requirement, it’s the vibe.

But what if it wasn’t? How would you feel if the portfolio you were tracking was a totally anonymous identity. If you knew that CS guaranteed the trading history was verified and accurate, would it matter? Or would you be hesitant to trust it without a real identity tied to it?

I'm genuinely curious, and would love the community's thoughts on it.

Disclosure: I'm a Commonstock shareholder, former employee, and big fan of the team and platform.

Would more people share portfolios on Commonstock if it was anonymous?

70%Yes

29%No

44 VotesPoll ended on: 5/8/2022

Would more people share portfolios if they were anon? I think, yes. It’s ‘easier’ to do so, to be able to hide behind anonymity. Perhaps, also easier to express one’s self without judgement.

Would it make me value the person/data/insights less? No.

Should Commonstock be exclusively anon? I don’t believe so.

So to answer your question, i think the answer is ‘yes’, people would share more but i think it should always remain optional and deserves more nuance. As innovative as Web3 has been, the dark side of anonymity has also been pretty evident.