Check out my latest report on

$TXN Run by a great management team that has a laser focus on long term value to shareholders by targeting effective free cash flow per share growth and a plan to return 100% to shareholders with dividends and share repurchases.

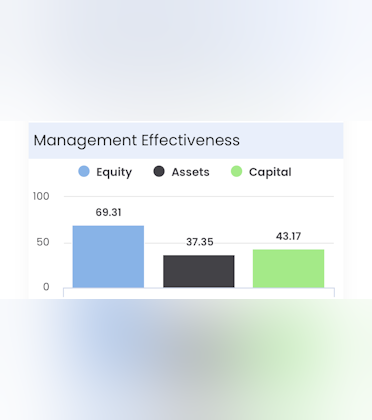

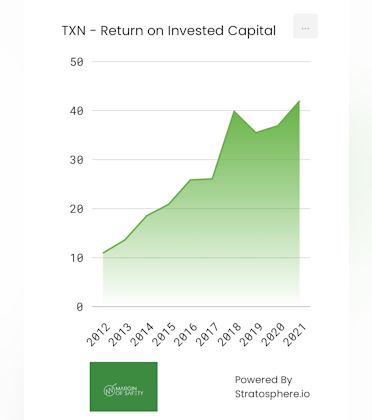

Margins and returns on capital have been improving steadily for over a decade as they increase their efforts to manufacture more on the cost advantaged 300 mm wafer. Billions in capex will be spent going forward on this very thing.

They enjoy a slow moving tech with long lifecycles for their products - years and in some cases decades.

They offer 80,000 products to over 100,000 customers and are currently trying to get closer to those customers in an effort get repeat business and understand the future needs.

The business has risks as well, the largest in my opinion is the 55% of sales from China.

Check it out for more…[paywall with free trial and 25% off for a year offer available inside]