Trending Assets

Top investors this month

Trending Assets

Top investors this month

Reckitt: Brands, Transformation and Future Potential

The below is an extract of the latest write-up released in our newsletter. In this write-up, we cover $RBGLY.

For the full write-up you can click here --> Reckitt: Brands, Transformation and Future Potential

If you enjoy this memo, make sure that you subscribe to our newsletter. You can always join as a free subscriber, spend some time evaluating our work and decide later if you want to jump in.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Background

Reckitt Benckiser is a United Kingdom-based company listed on the London Stock Exchange since 1999, following the merger Reckitt & Colman and Benckiser NV. With a mission to "improve the hygiene, health, and nutrition of people across the globe", Reckitt has accumulated over two centuries of history, shaping its evolution into a prominent player in the consumer goods industry.

RB boasts a diverse and comprehensive brand portfolio, featuring some of the most trusted and recognizable names worldwide. These household brands include among others, Lysol, Vanish, Harpic, Finish, Air Wick, Dettol, Nurofen, Strepsils, Durex, and Enfamil.

Source: Reckitt Presentation at Consumer Analyst Group of New York Conference (CAGNY) 2022

Over the years RB has been growing through a combination of organic initiatives and strategic acquisitions. While many of these endeavors have contributed positively to the Company's expansion and market presence, it's important to note that not all acquisitions have proven equally beneficial for shareholder value. A notable example is the acquisition of Mead Johnson Nutrition (“MJN”) in 2017 for £13B, which led to material impairments for RB.

Global presence

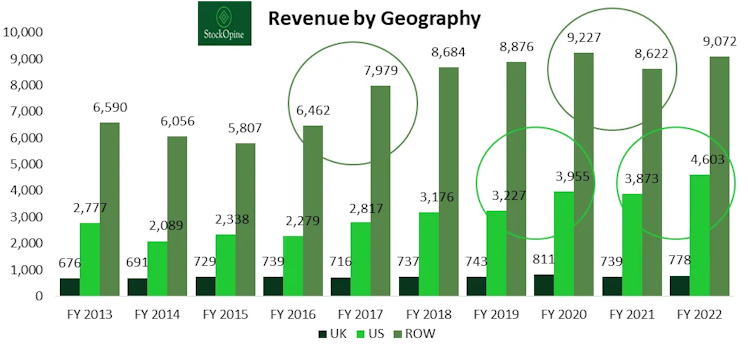

Historically, the Company reported revenues categorized by geography, primarily consisting of the UK, US, and All Other Countries (ROW). As of FY22, US contributed 32% of the total revenue, the UK accounted for 5%, and the All Other Countries comprised a significant majority at 63%.

Over the period FY13 to FY22, US had the highest growth reporting 5.8% CAGR, while ROW and UK had a CAGR of 3.6% and 1.6%, respectively.

Source: Koyfin (affiliate link with a 15% discount), StockOpine analysis

The volatility depicted in geographic revenues was influenced among others by the following factors:

- 2017: The acquisition of Mead Johnson Nutrition significantly increased revenues from "All Other Countries", as Mead Johnson had a substantial presence in Asia.

- 2020: Heightened demand for disinfectant products during the COVID-19 pandemic drove strong performance in the US market. Brands like Lysol and Dettol experienced exceptional growth, with combined revenue exceeding £3B in 2022.

- 2021: The sale of Infant Formula and Child Nutrition ("IFCN") business in China negatively impacted ROW revenues.

- 2022: Reckitt Benckiser gained market share in the nutrition segment in the US following a product recall by Abbott, contributing to revenue growth.

In 2023, the Company changed its reporting to North America, Europe/AZN and Developing Markets with revenues evenly distributed showcasing a well-diversified geographic reach.

Segments

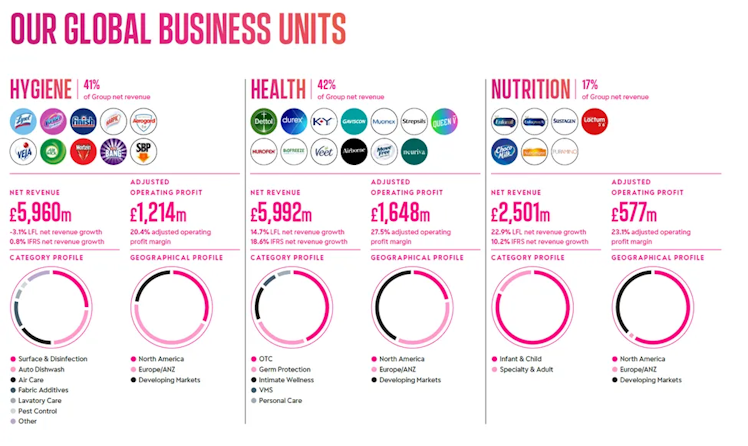

The Company operates under three reporting segments, namely, Hygiene, Health and Nutrition accounting for 41%, 42% and 17% of net 2022 sales, respectively.

Source: Reckitt Benckiser Annual Report 2022

Hygiene - Segment Overview

With £6.1B in revenues as of the latest twelve months ending (LTM) June 2023, brands in the Hygiene segment are broken into 6 core categories; Surface & Disinfection, Auto Dishwashing, Air Care, Fabric Additives, Lavatory Care and Pest Control. These core categories collectively contribute to over 80% of the segment's revenues.

Among the core categories, Surface & Disinfection, Auto Dish, and Air Care are the largest, each generating annual sales exceeding £1 billion. Fabric Care, Lavatory Care, and Pest Control, while smaller in comparison, each contribute between one-quarter of a billion and three-quarters of a billion GBP in retail sales.

The current standout performers in the segment include Finish (Auto Dish) and Harpic (Lavatory Care), both achieving double-digit growth in H1 2023. Harpic's remarkable success is particularly notable in India, where it has been present for over 30 years and now claims to have 78% market share.

--END OF EXTRACT-- That's just a glimpse

Hope you enjoyed this extract! If you did, consider signing-up and/or share it with friends. Your support will be appreciated.

📢 The rest of the write-up covers in detail the performance of each segment**, Management, Industry, Financials,** Competitive Advantages, Opportunities, Risks and Valuation.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Disclaimer: The content of our newsletter is not a trading or investment advice and we do not provide any personal investment advice tailored to the needs of any recipient. The information provided should not be considered as a specific advice on the merits of any investment decision.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

What do you think of Reckitt?

0%Solid investment idea ✅

100%Just ok ❌

1 VotesPoll ended on: 9/30/2023

Already have an account?