Trending Assets

Top investors this month

Trending Assets

Top investors this month

Evergrande officially defaults today

But wait, there's not going to be total collapse. The headline was totally clickbait.

I'd written a couple of days ago that they had bonds coming due on 06 Dec, which was an extended deadline. They obviously couldn't pay that so now Fitch is the first rating agency to call it a "restricted default". (Here's the link to the Fitch Report)

What's Next

However, restructuring talks are on. Agents and bankers have already been appointed and the debt will be restructured.

The problem with debts of this quantum is that everyone takes a haircut / write down across the board. No one gets 100% of their money back, least of all the shareholders.

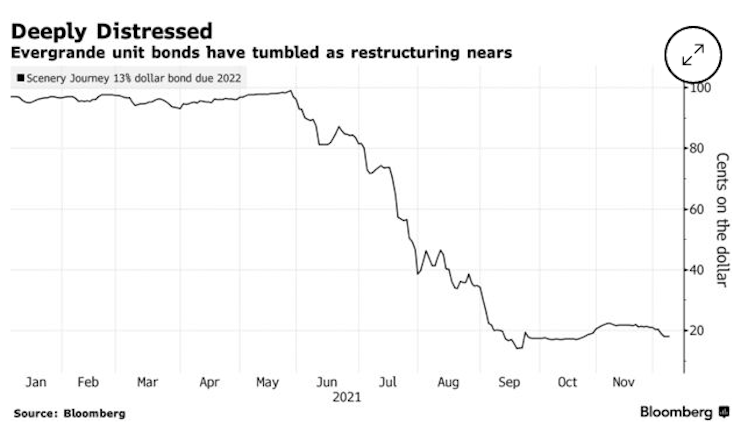

The bonds are already trading at about 20 cents to the dollar, i.e., 20% of their value.

Post recovery process, they may see this increase another 10 - 15 cents, which is usually the case in such situations. Depending on what can be sold off / liquidated / restructured, this may very well be 5c.

Government Intervention

What's interesting now though is that government officials are taking seats on a new risk management committee.

I've never seen this. Usually, the government only steps in once the mess is cleaned up, at least to a certain extent. They may even look to take over but, only once the debt holders are "managed".

The central bank on Monday released $188B of liquidity into the financial system in a bid to offset anxiety stemming from Evergrande’s debt crisis.

Evergrande approached government lenders for a loan as a stop-gap solution and I won't be surprised if they get approval now that there's extra liquidity in the system.

All signs point to the Government hoping to contain this situation rather than just let them fall.

Final Thoughts

We'll see how things unfold but, in my opinion there will a pseudo bail out but of course not to the tune of 100%.

Other smaller developers have also gone into default (Sunshine & Kaisa) and this will only get worse, if they don't support Evergrande, who is the biggest.

Fitch Ratings

Fitch Downgrades Evergrande and Subsidiaries, Hengda and Tianji, to Restricted Default

Fitch Ratings-Hong Kong-09 December 2021: LEAD PARAGRAPH

Fitch Ratings has downgraded to 'RD' (Restricted Default), from 'C', the Long-Term Foreign-Curr

Already have an account?